As we know well from our Aerospace IT & AI consulting, it is one of the most complex environments of the mid-market: capital-intensive, highly regulated, and safety-critical. The industry generates massive data volumes from sensors, IoT, and telemetry across aircraft and supply chains. This creates both opportunities and challenges: while data capture is abundant, integration and monetization are harder to achieve given long product cycles and risk-averse cultures.

The recent update to our Mid-market Analytics Maturity Survey provides a clear view of how Aerospace companies are maturing across Data, Business Intelligence (BI), and Artificial Intelligence (AI). They also reveal how the sector compares to mid-market averages and to leading industries like Financial Services and Retail.

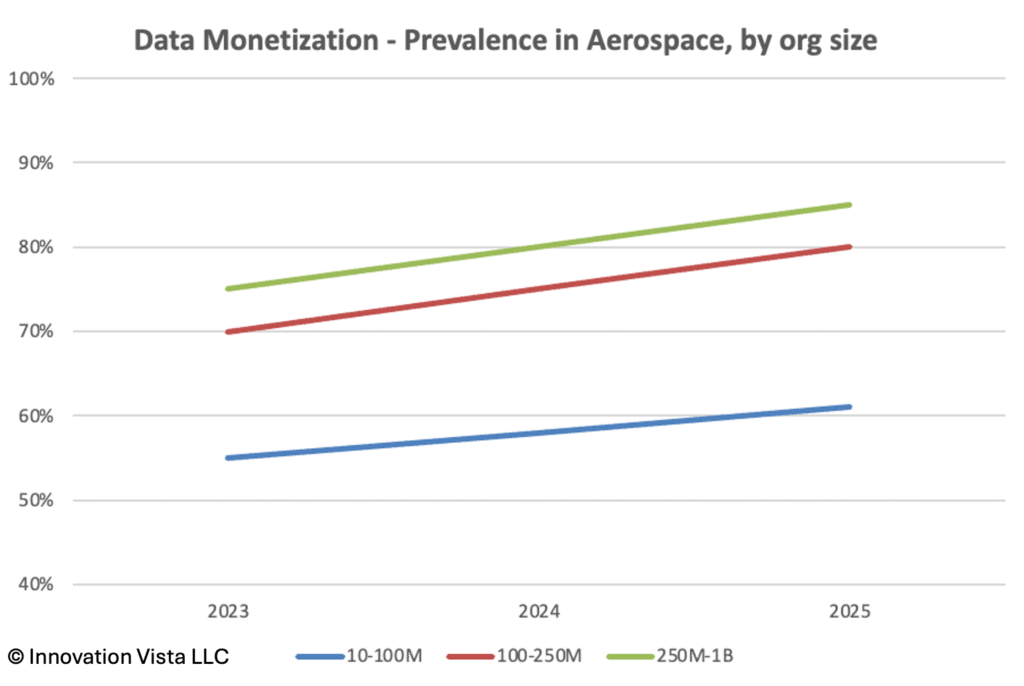

Data Maturity in Aerospace

Criteria

- Stabilized: central warehouse/lake with scheduled ETL and a starter data dictionary.

- Optimized: daily refresh, catalog + glossary, and first MDM domain.

- Monetized: enterprise-wide MDM, data products shared across functions, measurable ROI.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 88 / 59 / 28 | 100 / 90 / 55 | 100 / 100 / 70 | 100 / 100 / 75 | 100 / 100 / 80 |

| 2024 | 90 / 61 / 30 | 100 / 92 / 58 | 100 / 100 / 75 | 100 / 100 / 80 | 100 / 100 / 85 |

| 2025 | 92 / 64 / 32 | 100 / 94 / 61 | 100 / 100 / 80 | 100 / 100 / 85 | 100 / 100 / 90 |

!nsights: Aerospace data maturity was already strong in 2023, with stabilization nearly universal and optimization common. By 2025, optimization is complete across the mid-market, and monetization exceeds 60% in $10–$100M firms and 80–90% in larger firms. This positions Aerospace on par with leading industries in data integration and ROI.

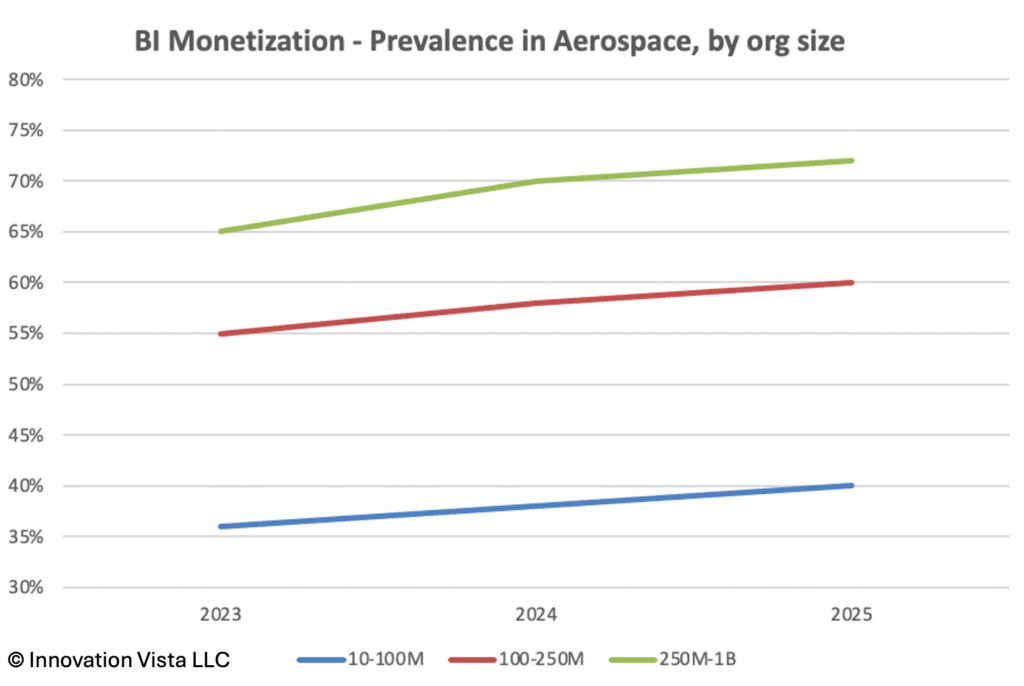

BI Maturity in Aerospace

Criteria

- Stabilized: dashboards in place, weekly refresh, initial instrumentation.

- Optimized: governed semantic layer, KPI catalog with owners, data literacy programs.

- Monetized: predictive analytics, scenario planning, automated responses embedded in workflows.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 81 / 47 / 20 | 99 / 85 / 36 | 100 / 98 / 55 | 100 / 100 / 65 | 100 / 100 / 75 |

| 2024 | 84 / 50 / 22 | 100 / 88 / 38 | 100 / 99 / 58 | 100 / 100 / 70 | 100 / 100 / 80 |

| 2025 | 87 / 53 / 22 | 100 / 91 / 40 | 100 / 99 / 60 | 100 / 100 / 72 | 100 / 100 / 82 |

!nsights: Aerospace BI was highly stabilized by 2023, but monetization rates lagged behind leaders. This year, monetization climbs into the 40%+ range in mid-market bands and exceeds 70% in $250M–$1B companies. While not as fast-moving as sectors like Retail or Financial Services, Aerospace BI adoption is steady, supported by strong regulatory and operational reporting requirements.

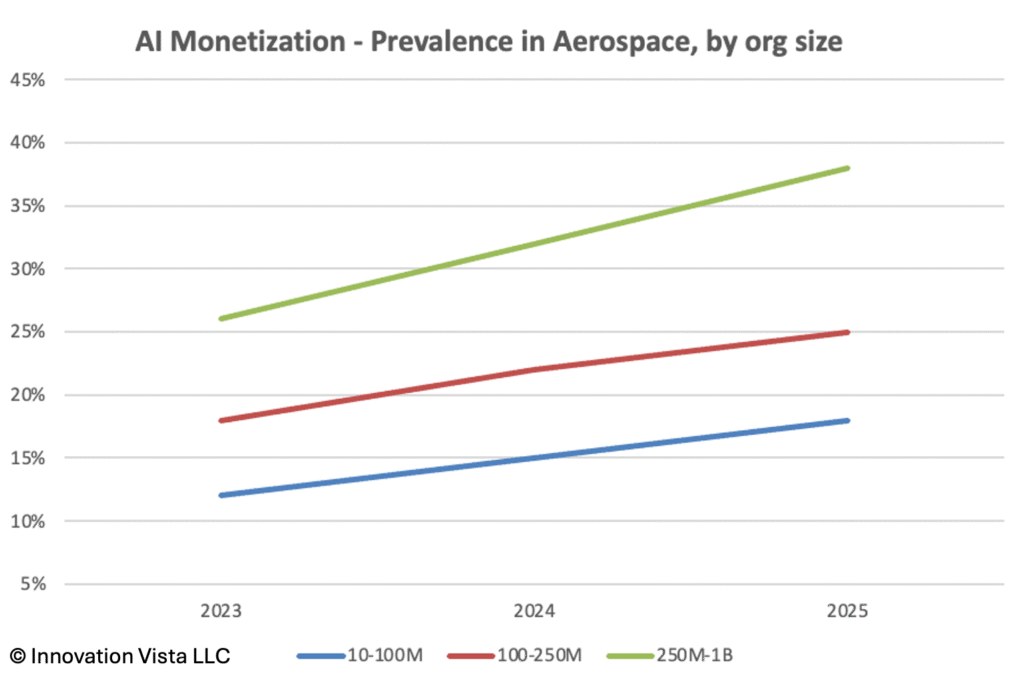

AI Maturity in Aerospace

Criteria

- Stabilized: pilots and early deployments, prompt libraries, basic guardrails.

- Optimized: MLOps practices, model registries, evaluation frameworks, monitoring.

- Monetized: production AI delivering ROI – fine-tuned models, measurable revenue &/or cost impact.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 44 / 21 / 7 | 52 / 28 / 12 | 66 / 37 / 18 | 82 / 57 / 26 | 96 / 80 / 40 |

| 2024 | 52 / 28 / 9 | 61 / 37 / 15 | 74 / 48 / 22 | 88 / 68 / 32 | 98 / 90 / 48 |

| 2025 | 60 / 35 / 12 | 70 / 45 / 18 | 82 / 58 / 25 | 94 / 78 / 38 | 99 / 95 / 55 |

!nsights: AI is the most dynamic frontier for Aerospace. Stabilization rose from 44% in <$10M firms in 2023 to 60% in 2025, while optimization nearly doubled. Monetization, though still lower than in consumer-facing sectors, has grown significantly, from 7% to 25% in $100–$250M companies. Leading use cases include predictive maintenance, digital twins, and supply chain optimization, though Aerospace still trails Retail and Entertainment in embedding AI into customer-facing products.

Aerospace Compared to Other Industries

- On par with leaders in Data and BI: Aerospace has kept pace with Financial Services, Insurance, and Utilities in achieving near-universal optimization, and also has shown strong monetization.

- Middle tier in AI: Aerospace outperforms Manufacturing and Agriculture/Food Service in AI adoption but trails customer-centric industries like Retail, Entertainment, and Financial Services, where monetization is already breaking 30–40%.

- Stronger than laggards: Aerospace is well ahead of Education, Real Estate, and Commercial Real Estate in every dimension, particularly in AI, where those sectors remain stuck in single-digit monetization.

Company Spotlight: Turning Maintenance into a Data Business

One mid-sized Aerospace maintenance provider has transformed its traditional repair and overhaul services into a data-driven business model. Historically, the company competed on turnaround time and cost. Today, it competes on predictive intelligence.

The foundation was laid by stabilizing vast amounts of flight and maintenance data, integrating telemetry from aircraft sensors with decades of service records. With this stabilized backbone, the firm then optimized by layering in analytics and AI models capable of predicting component wear and identifying anomalies long before they trigger downtime.

The monetization leap came when the company reshaped its contracts. Instead of billing per part or per hour, it now offers “availability-as-a-service,” guaranteeing uptime for customer fleets. Pricing is based on predictive models, and customers willingly pay a premium for reliability. The firm not only gains recurring revenue, but also locks in longer-term relationships by embedding intelligence into its offering.

This example shows how even a mid-market service provider can move from stabilized and optimized systems into monetization – turning IT and AI from back-office tools into the very product customers are buying. It is a blueprint for how Aerospace firms can Innovate Beyond Efficiency into growth.

Strategic Implications for Aerospace CXOs

For Aerospace leaders, stabilization and optimization are no longer differentiators; they are baseline expectations. The competitive battleground is monetization: firms that can turn their telemetry, IoT, and operational data into predictive, revenue-driving insights will capture disproportionate gains.

The most pressing opportunities are:

- Predictive maintenance: leveraging AI to reduce downtime and costs.

- Digital twins: monetizing simulation and design insights across the supply chain.

- AI-driven design and operations: embedding intelligence into workflows to shorten cycles and optimize performance.

CXOs who act now to monetize data and AI are positioning their organizations to lead not just within Aerospace, but also against adjacent industries that may encroach with digital-first business models.