We know well from our experience in Utilities IT & AI consulting — spanning telecom, electricity, water, and natural gas providers — sit at the intersection of public service and private enterprise. With heavy infrastructure, regulatory oversight, and essential service mandates, Utilities are required to maintain stability and reliability while increasingly pressured to modernize. Smart meters, grid IoT sensors, and customer experience platforms are generating more data than ever before. The challenge is not stabilization or optimization, which are nearly universal, but monetization: using analytics and AI to improve efficiency, sustainability, and customer engagement in measurable ways.

The recent update to our Mid-market Analytics Maturity Survey (2023–2025) shows Utilities consistently among the top sectors for data and BI maturity, with monetization steadily climbing and AI adoption advancing quickly.

Data Maturity in Utilities

Criteria

- Stabilized: central warehouse/lake with scheduled ETL and a starter data dictionary.

- Optimized: daily refresh, catalog + glossary, and first MDM domain.

- Monetized: enterprise-wide MDM, data products shared across functions, measurable ROI.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 90 / 63 / 29 | 100 / 92 / 48 | 100 / 100 / 65 | 100 / 100 / 72 | 100 / 100 / 80 |

| 2024 | 92 / 66 / 31 | 100 / 94 / 52 | 100 / 100 / 70 | 100 / 100 / 76 | 100 / 100 / 85 |

| 2025 | 94 / 69 / 33 | 100 / 96 / 55 | 100 / 100 / 72 | 100 / 100 / 80 | 100 / 100 / 88 |

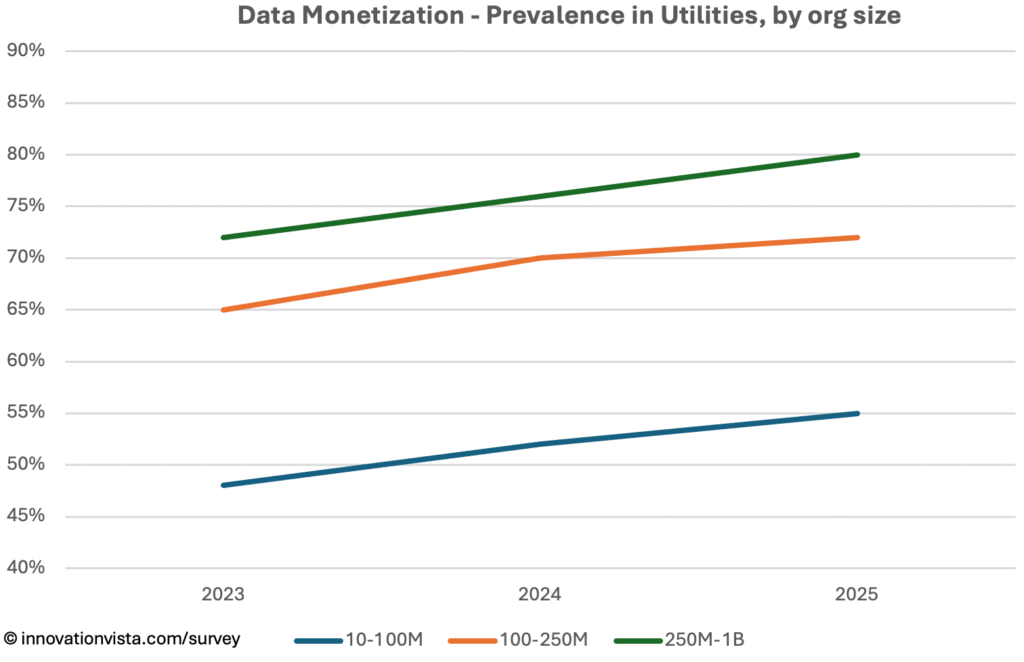

!nsights: Utilities demonstrate consistently high maturity across Data. Stabilization and optimization are universal by 2024, and monetization is climbing — 55% in $10–$100M companies by 2025 and 80% in $250M–$1B companies. Monetization comes through initiatives like smart meter analytics, predictive outage detection, and billing transparency tools that improve both efficiency and customer satisfaction.

BI Maturity in Utilities

Criteria

- Stabilized: dashboards in place, weekly refresh, initial instrumentation.

- Optimized: governed semantic layer, KPI catalog with owners, data literacy programs.

- Monetized: predictive analytics, scenario planning, automated responses embedded in workflows.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 84 / 52 / 22 | 99 / 88 / 42 | 100 / 99 / 57 | 100 / 100 / 68 | 100 / 100 / 78 |

| 2024 | 86 / 53 / 23 | 100 / 92 / 45 | 100 / 100 / 62 | 100 / 100 / 73 | 100 / 100 / 83 |

| 2025 | 89 / 56 / 23 | 100 / 92 / 47 | 100 / 100 / 64 | 100 / 100 / 76 | 100 / 100 / 86 |

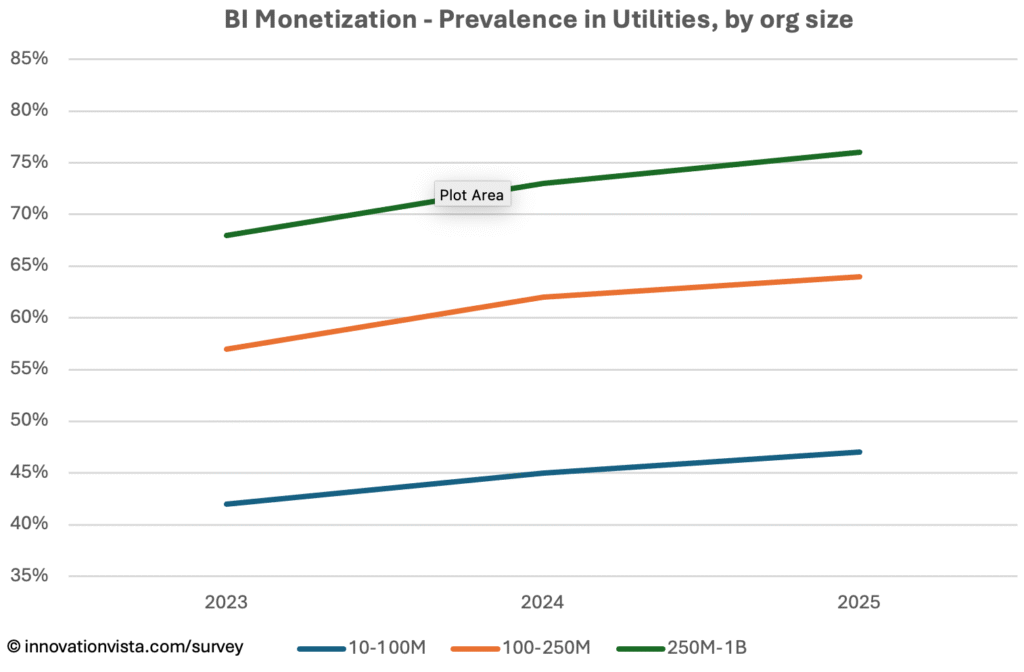

!nsights: BI maturity in Utilities is among the strongest of any sector. By 2025, monetization reaches 47% in $10–$100M firms and over 75% in larger mid-market companies. Predictive analytics for demand planning, outage forecasting, and regulatory compliance reporting are monetized both internally (operational efficiency) and externally (rate cases, customer-facing portals).

AI Maturity in Utilities

Criteria

- Stabilized: pilots and early deployments, prompt libraries, basic guardrails.

- Optimized: MLOps practices, model registries, evaluation frameworks, monitoring.

- Monetized: production AI delivering ROI – fine-tuned models, measurable revenue &/or cost impact.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 39 / 19 / 6 | 47 / 23 / 8 | 61 / 33 / 13 | 80 / 54 / 24 | 95 / 75 / 38 |

| 2024 | 44 / 23 / 7 | 54 / 30 / 10 | 67 / 41 / 18 | 83 / 60 / 28 | 96 / 85 / 42 |

| 2025 | 52 / 29 / 9 | 63 / 37 / 13 | 76 / 50 / 21 | 90 / 70 / 33 | 99 / 92 / 50 |

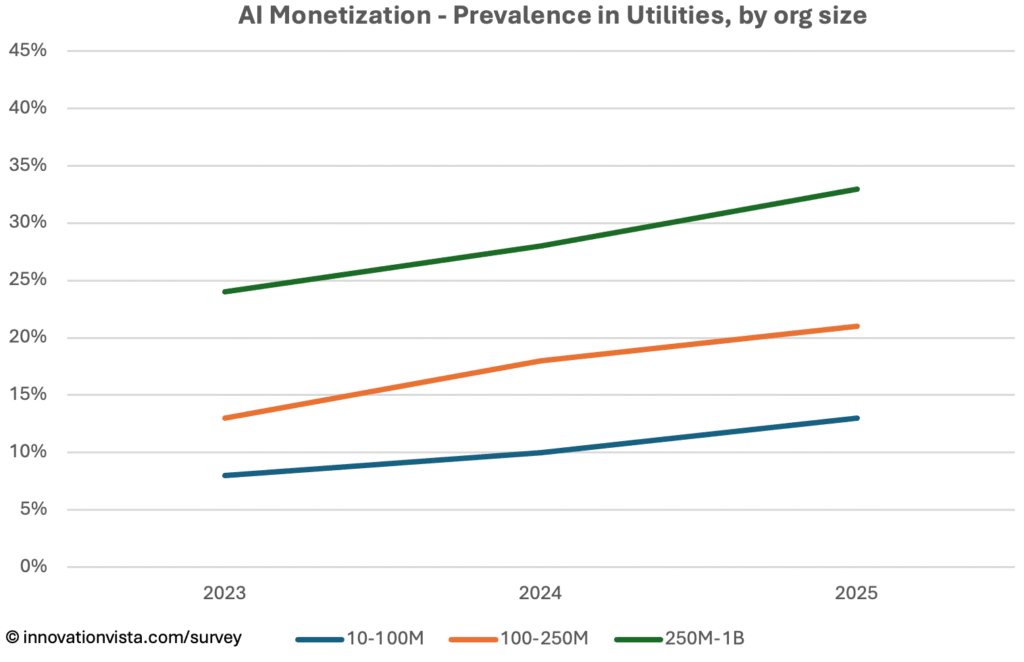

!nsights: AI adoption in Utilities is advancing rapidly, particularly at larger scale. By 2025, 37% of $10–$100M firms have optimized AI pilots, though only 13% monetize. Larger firms are further ahead: 33% of $250M–$1B utilities monetize AI by embedding predictive grid management, asset optimization, and customer service chatbots into operations. The sector is moving toward using AI not just for internal efficiency but also to improve resilience and sustainability.

Utilities Compared to Other Industries

- Ahead in Data & BI: Utilities consistently outpace mid-market averages, ranking alongside Financial Services and Insurance.

- Middle tier in AI monetization: Utilities outperform laggards like Education and Real Estate but trail leaders like Retail and Entertainment.

- Regulatory influence: Compliance requirements push optimization early, but also create hurdles for experimentation, slowing monetization for smaller firms.

Company Spotlight: Monetizing Reliability

One mid-market electric utility illustrates how analytics and AI can turn reliability into a monetized service. Historically, the company’s data was fragmented across smart meters, outage reports, and SCADA telemetry, limiting its ability to anticipate failures or optimize grid performance.

The journey began with stabilization. Leadership consolidated meter data, incident logs, and infrastructure telemetry into a unified warehouse. For the first time, the utility had an enterprise-wide view of consumption, outages, and grid health.

Optimization came next through BI dashboards that tracked real-time load, outage incidents, and regulatory compliance metrics. Managers could see emerging patterns and respond faster, while regulators received more transparent reporting. Predictive models began to highlight weak points in the grid, allowing maintenance to be scheduled before failures occurred.

The monetization breakthrough came when the utility began embedding these predictive capabilities into customer contracts. Large commercial and industrial customers were offered premium “assured reliability” packages, guaranteeing uptime backed by AI-driven predictive analytics. For customers, this reduced costly disruptions; for the utility, it transformed a compliance requirement into a source of recurring revenue.

By stabilizing, optimizing, and then monetizing its data, the utility shifted from being a commodity energy provider to a reliability partner. It demonstrates how Utilities can move beyond efficiency to sell intelligence as part of the service itself — aligning regulatory goals, customer expectations, and new revenue opportunities.

Strategic Implications for Utilities CXOs

For Utilities leaders, stabilization and optimization are givens. The opportunity is monetization — embedding intelligence into products, services, and customer relationships.

Key opportunities include:

- Smart grid optimization to reduce outages and improve sustainability.

- Predictive maintenance on transmission and distribution assets.

- Customer-facing analytics portals to provide transparency and build trust.

- AI-driven demand forecasting to optimize generation and purchasing.

Firms that monetize these capabilities will not only reduce costs but also strengthen regulatory positions and customer loyalty. Those that remain optimized-only risk being seen as slow-moving in an industry facing fast-rising expectations.