Our consultants with experience in Tourism IT & AI consulting, whether in the context of travel agencies, tour operators, attractions, or regional destination managers, know well that these companies face unique pressures. Customer experience is paramount, margins are slim, and demand fluctuates dramatically with seasons and external shocks. Data and analytics – with AI to follow – offer the potential to improve forecasting, personalize offerings, and maximize yield management. Yet the industry’s maturity varies widely: digital-first platforms race ahead, while many mid-market operators remain at the early stages of monetization.

The recent update to our Mid-market Analytics Maturity Survey (2023–2025) shows steady progress in stabilization and optimization, with AI adoption gaining traction. Monetization is rising, particularly in larger mid-market firms that are embedding analytics into customer experiences and pricing models.

Data Maturity in Tourism

Criteria

- Stabilized: central warehouse/lake with scheduled ETL and a starter data dictionary.

- Optimized: daily refresh, catalog + glossary, and first MDM domain.

- Monetized: enterprise-wide MDM, data products shared across functions, measurable ROI.

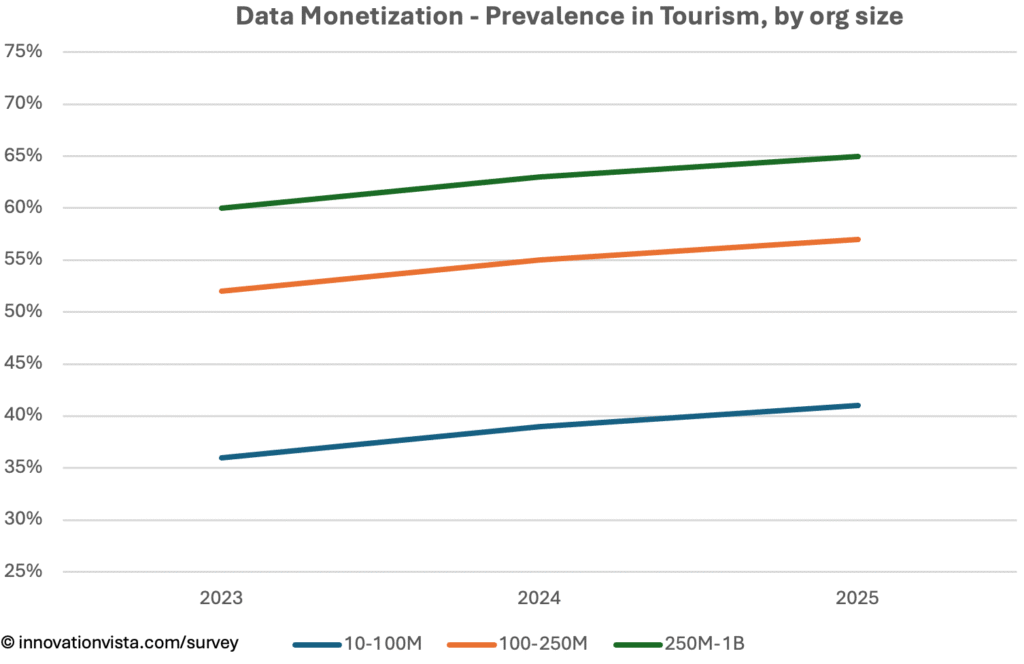

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 76 / 37 / 16 | 96 / 76 / 36 | 100 / 97 / 52 | 100 / 100 / 60 | 100 / 100 / 70 |

| 2024 | 78 / 40 / 17 | 98 / 79 / 39 | 100 / 98 / 55 | 100 / 100 / 63 | 100 / 100 / 73 |

| 2025 | 80 / 42 / 18 | 98 / 82 / 41 | 100 / 98 / 57 | 100 / 100 / 65 | 100 / 100 / 75 |

!nsights: By 2025, data stabilization and optimization are nearly universal in Tourism. Monetization is improving, but mid-market firms are behind leaders in other industries: 41% of $10–$100M firms monetize data versus 44–50% across the mid-market. Larger companies exceed 65% monetization, often using data to create predictive demand forecasts, bundled pricing, and customer segmentation services.

BI Maturity in Tourism

Criteria

- Stabilized: dashboards in place, weekly refresh, initial instrumentation.

- Optimized: governed semantic layer, KPI catalog with owners, data literacy programs.

- Monetized: predictive analytics, scenario planning, automated responses embedded in workflows.

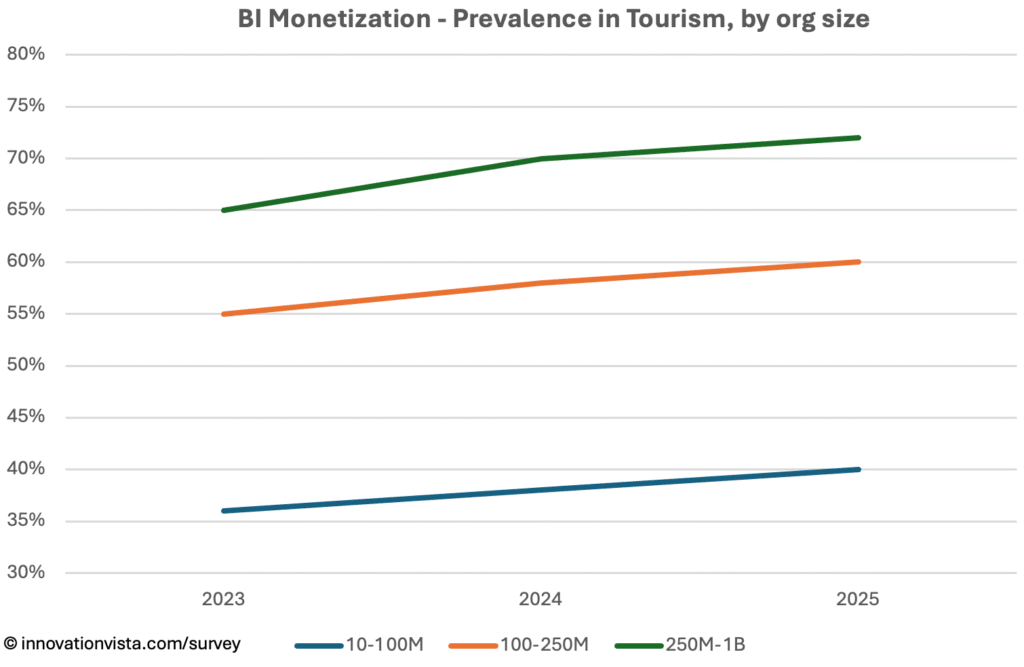

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 81 / 47 / 20 | 99 / 85 / 36 | 100 / 98 / 55 | 100 / 100 / 65 | 100 / 100 / 75 |

| 2024 | 84 / 50 / 22 | 100 / 88 / 38 | 100 / 99 / 58 | 100 / 100 / 70 | 100 / 100 / 80 |

| 2025 | 87 / 53 / 22 | 100 / 91 / 40 | 100 / 99 / 60 | 100 / 100 / 72 | 100 / 100 / 82 |

!nsights: BI is well established in Tourism, with near-universal stabilization and optimization by 2025. Monetization remains modest in smaller firms — just 40% of $10–$100M companies — but climbs above 70% in $250M–$1B organizations. Leaders monetize BI by embedding predictive pricing, customer journey analytics, and upsell dashboards directly into booking platforms.

AI Maturity in Tourism

Criteria

- Stabilized: pilots and early deployments, prompt libraries, basic guardrails.

- Optimized: MLOps practices, model registries, evaluation frameworks, monitoring.

- Monetized: production AI delivering ROI—fine-tuned models, measurable revenue or cost impact.

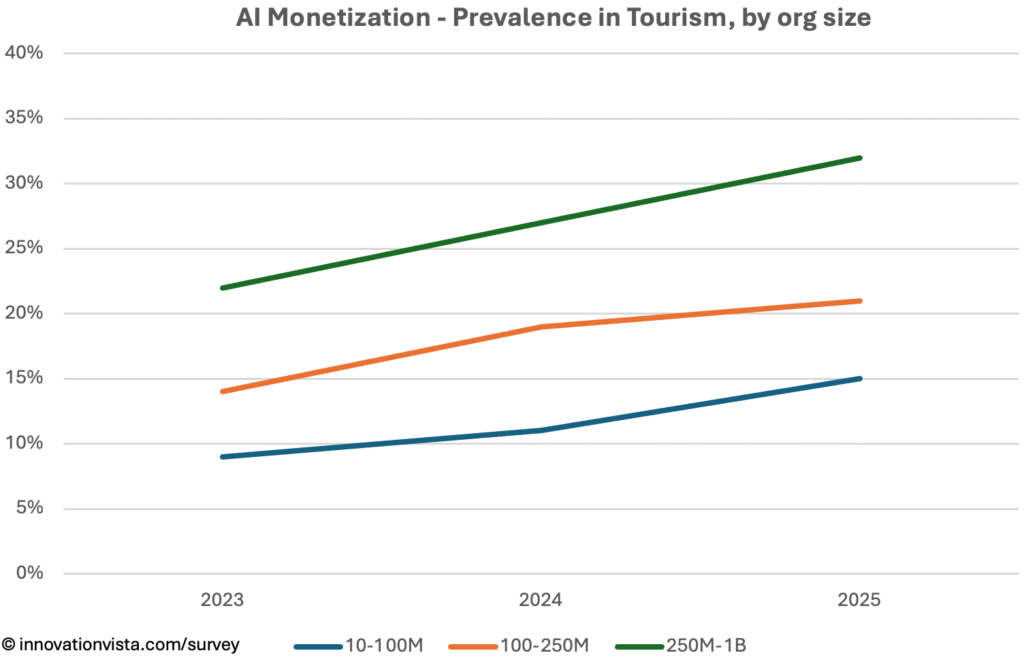

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 40 / 18 / 6 | 48 / 25 / 9 | 62 / 34 / 14 | 80 / 52 / 22 | 95 / 73 / 36 |

| 2024 | 46 / 25 / 7 | 57 / 32 / 11 | 70 / 44 / 19 | 85 / 63 / 27 | 97 / 86 / 41 |

| 2025 | 55 / 31 / 10 | 66 / 39 / 15 | 78 / 53 / 21 | 92 / 73 / 32 | 99 / 93 / 50 |

!nsights: AI adoption is accelerating in Tourism. By 2025, 39% of $10–$100M firms are optimized and 15% monetize, often through dynamic pricing engines and chatbots that upsell tours or travel services. Larger firms reach 32% monetization, with AI powering yield management, personalized recommendations, and real-time disruption handling. The sector is still behind Retail and Financial Services but catching up quickly.

Tourism Compared to Other Industries

- Similar to Agriculture & Food Service: Solid stabilization and optimization but lower monetization.

- Behind leaders like Retail and Financial Services: Monetization rates in BI and AI are 10–15 points lower.

- Closer to the middle of the pack: Tourism is not as far behind as Real Estate or Education, but still vulnerable to disruption by digital-native competitors.

Company Spotlight: Monetizing Experiences with Dynamic Pricing

One mid-market tour operator shows how Tourism firms can move from optimization to monetization by embedding analytics directly into their customer offerings. Historically, the company relied on static pricing for packages and limited visibility into which tours or experiences drove profitability.

The journey began with stabilization. The operator centralized booking histories, customer feedback, and itinerary data into a unified warehouse. This provided, for the first time, a consistent view of seasonality, demand patterns, and margin by product line.

Optimization followed through BI dashboards. Managers tracked occupancy rates, tour profitability, and seasonal peaks in real time. This helped them allocate guides, vehicles, and resources more efficiently, improving both customer satisfaction and margins.

The monetization breakthrough came with the rollout of AI-driven dynamic pricing and upsell engines. The system now adjusts package rates automatically based on real-time demand signals, while customers booking online receive personalized recommendations for add-ons such as premium excursions, local dining, or extended stays. These innovations created new revenue streams by monetizing intelligence — turning analytics from an internal planning tool into a direct driver of sales growth.

For the operator, the results have been transformative. Higher margins during peak demand, increased per-booking revenue through upsells, and greater customer satisfaction from personalized experiences all reinforce loyalty and competitiveness. This example demonstrates how Tourism firms can move from stabilized and optimized operations into monetization, using data and AI to turn travel into a smarter, higher-value business.

Strategic Implications for Tourism CXOs

For Tourism leaders, stabilization and optimization are no longer differentiators — they are expected. The real opportunity is monetization, particularly in AI.

Opportunities include:

- Dynamic pricing engines to capture more yield from fluctuating demand.

- AI-powered chatbots and personalization to improve upselling and cross-selling.

- Operational forecasting to optimize staffing, fleet utilization, and seasonal capacity.

- Customer journey analytics that translate into loyalty and repeat bookings.

Firms that monetize intelligence as part of the customer experience will strengthen margins and loyalty. Those that remain optimized-only risk being commoditized by digital-first players already embedding AI into every interaction.