Our experience in Insurance IT & AI consulting informs us that these companies have always been data-driven at their core, from underwriting and risk assessment to claims processing and fraud detection. The rise of digital-first insurers, usage-based products, and AI-driven risk models has only intensified the need to modernize data and analytics capabilities. At the same time, regulatory oversight creates pressure for rigorous optimization and transparency.

The recent update to our Mid-market Analytics Maturity Survey provides a three-year view (2023–2025) of how Insurance firms are progressing across Data, Business Intelligence (BI), and Artificial Intelligence (AI). The results confirm that Insurance sits alongside Financial Services as one of the most advanced sectors in the mid-market, particularly in monetizing AI through underwriting and fraud prevention.

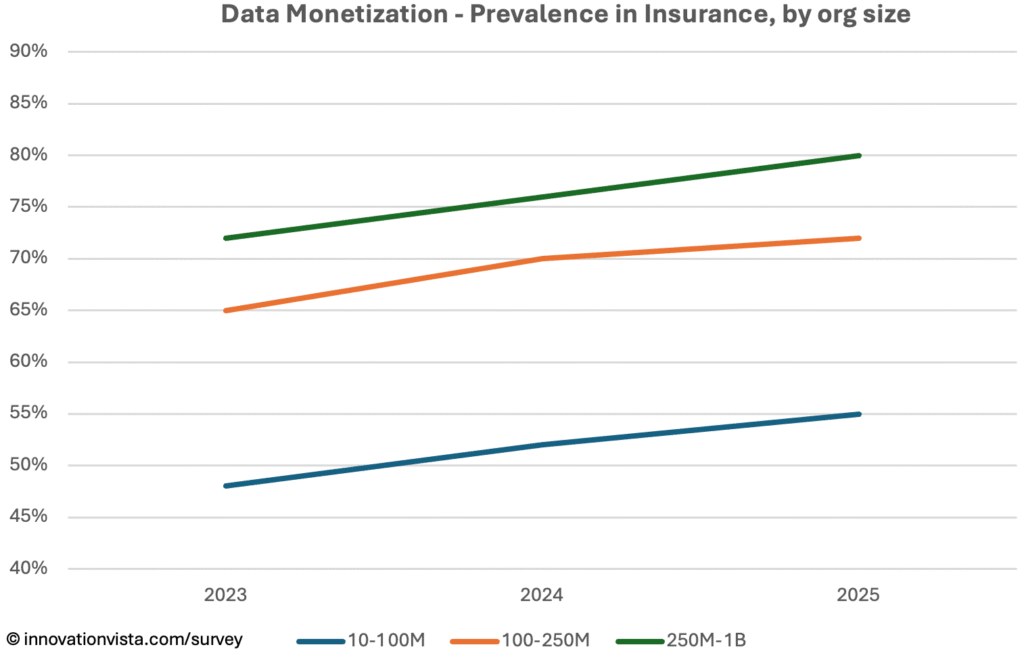

Data Maturity in Insurance

Criteria

- Stabilized: central warehouse/lake with scheduled ETL and a starter data dictionary.

- Optimized: daily refresh, catalog + glossary, and first MDM domain.

- Monetized: enterprise-wide MDM, data products shared across functions, measurable ROI.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 90 / 61 / 28 | 100 / 91 / 48 | 100 / 100 / 65 | 100 / 100 / 72 | 100 / 100 / 80 |

| 2024 | 92 / 64 / 31 | 100 / 94 / 52 | 100 / 100 / 70 | 100 / 100 / 76 | 100 / 100 / 85 |

| 2025 | 93 / 67 / 33 | 100 / 95 / 55 | 100 / 100 / 72 | 100 / 100 / 80 | 100 / 100 / 88 |

!nsights: Stabilization and optimization are universal across Insurance, but the monetization numbers are most revealing. Even $10–$100M firms monetize data at 55% by 2025, far ahead of the mid-market average. Larger firms exceed 80%, reflecting how insurers directly tie data models to premium pricing and claims outcomes.

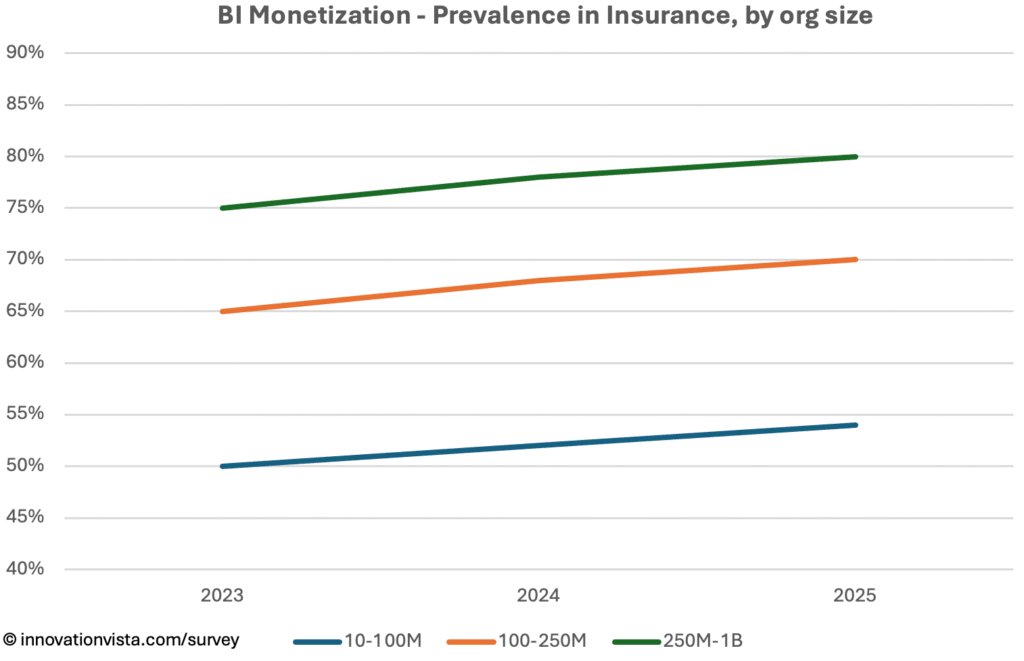

BI Maturity in Insurance

Criteria

- Stabilized: dashboards in place, weekly refresh, initial instrumentation.

- Optimized: governed semantic layer, KPI catalog with owners, data literacy programs.

- Monetized: predictive analytics, scenario planning, automated responses embedded in workflows.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 89 / 62 / 28 | 100 / 92 / 50 | 100 / 100 / 65 | 100 / 100 / 75 | 100 / 100 / 85 |

| 2024 | 92 / 64 / 30 | 100 / 94 / 52 | 100 / 100 / 68 | 100 / 100 / 78 | 100 / 100 / 88 |

| 2025 | 93 / 67 / 31 | 100 / 96 / 54 | 100 / 100 / 70 | 100 / 100 / 80 | 100 / 100 / 90 |

!nsights: BI in Insurance is nearly flawless by 2025, with optimization universal and monetization widespread. In $10–$100M firms, 54% monetize BI, embedding predictive models into pricing, claims forecasting, and portfolio monitoring. By $250M–$1B, monetization is at 80%, reflecting how BI has become not just operational but strategic.

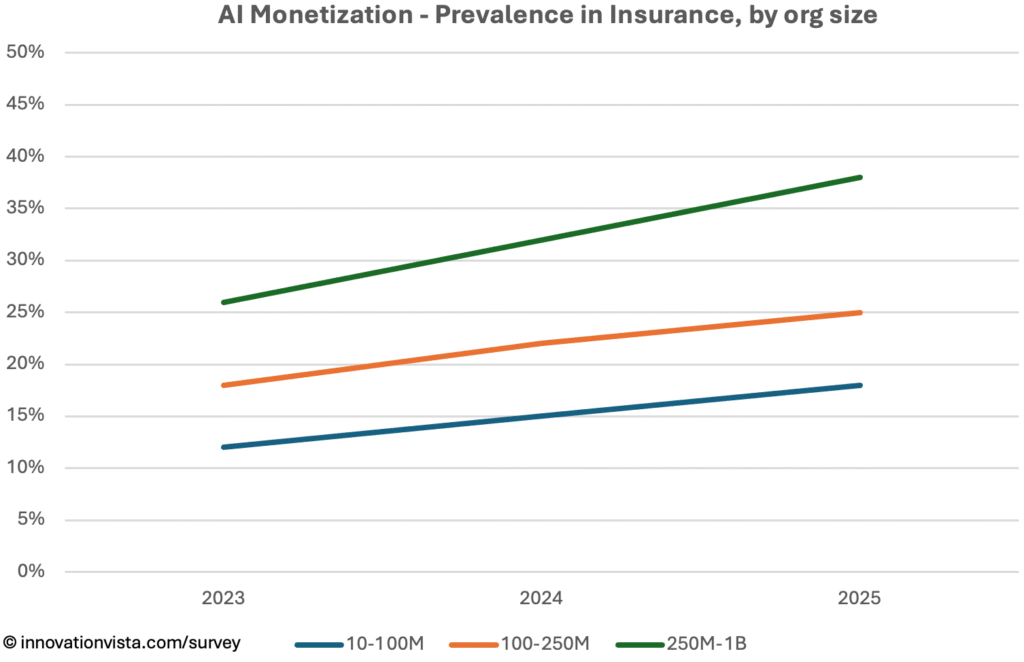

AI Maturity in Insurance

Criteria

- Stabilized: pilots and early deployments, prompt libraries, basic guardrails.

- Optimized: MLOps practices, model registries, evaluation frameworks, monitoring.

- Monetized: production AI delivering ROI – fine-tuned models, measurable revenue &/or cost impact.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 44 / 21 / 7 | 52 / 28 / 12 | 66 / 37 / 18 | 82 / 57 / 26 | 96 / 80 / 40 |

| 2024 | 52 / 28 / 9 | 61 / 37 / 15 | 74 / 48 / 22 | 88 / 68 / 32 | 98 / 90 / 48 |

| 2025 | 60 / 35 / 12 | 70 / 45 / 18 | 82 / 58 / 25 | 94 / 78 / 38 | 99 / 95 / 55 |

!nsights: Insurance has become one of the clear leaders in AI monetization. By 2025, 18% of $10–$100M insurers monetize AI, mainly through smarter underwriting, fraud prevention, and claims automation. Larger firms show monetization at 38–55%, making AI not just an efficiency tool but a core revenue driver.

Insurance Compared to Other Industries

- Alongside Financial Services: Insurance is among the most advanced in Data, BI, and AI, particularly in monetization.

- Ahead of average: Monetization rates are 10–15 points higher than the mid-market across all size bands.

- Clear leadership in AI use cases: Fraud detection and risk modeling put Insurance at the frontier, while laggards in Real Estate, CRE, and Education remain years behind.

Company Spotlight: Monetizing Underwriting Speed

One mid-sized life insurance and annuity provider shows how insurers can move from data stabilization to full monetization of AI. For decades, the company relied on traditional underwriting processes that involved lengthy questionnaires, manual risk assessment, and weeks of waiting for approvals.

The journey began with stabilization. The insurer consolidated decades of mortality tables, claims histories, and customer records into a single, unified data warehouse. This gave actuaries and underwriters a consistent foundation to work from, replacing fragmented systems and manual reconciliation.

Optimization came next. Predictive analytics and BI dashboards helped identify product gaps, customer churn risks, and agent productivity metrics. Managers could monitor the pipeline more effectively, while actuaries gained better insight into portfolio performance and capital exposure.

The monetization leap was transformational. By embedding AI directly into its underwriting workflows, the company cut approval times from weeks to minutes. Models now analyze health records, claims histories, and lifestyle data to deliver real-time risk assessments. Faster underwriting translates into higher conversion rates, increased policy sales, and improved customer experience. The insurer also leverages this speed to differentiate its brand in a crowded marketplace, offering a compelling value proposition to both customers and agents.

This example illustrates how a mid-market insurer can move through all three maturity stages – stabilized, optimized, and monetized – and how monetization in Insurance often comes through revenue acceleration rather than just cost savings. By making AI-enabled underwriting its competitive edge, the firm turned technology from a back-office function into a direct driver of growth.

Strategic Implications for Insurance CXOs

For Insurance leaders, the survey underscores that stabilization and optimization are no longer differentiators – they are expected. The competitive battleground is monetization. Firms that embed monetized analytics and AI into underwriting, claims, and fraud prevention are already widening the gap.

Opportunities include:

- Usage-based insurance models that monetize IoT and telematics data.

- Fraud prevention AI offered as premium features to clients and partner networks.

- Dynamic pricing engines that turn analytics into a direct driver of revenue.

- Customer experience personalization that links AI to retention and lifetime value.

Insurers that hesitate risk not only falling behind competitors but also missing the chance to redefine their value proposition around intelligence as a product.