As we know well from our Agriculture & Food Service IT & AI consulting, this industry sits at the crossroads of tradition and innovation. Many companies in this sector are still rooted in manual operations and seasonal rhythms, while others are racing ahead with IoT sensors, supply chain visibility, and AI-driven demand forecasting. The diversity in maturity is striking.

The recent update to our Mid-market Analytics Maturity Survey provides a three-year lens (2023–2025) on how Agriculture & Food Service companies are evolving across Data, Business Intelligence (BI), and Artificial Intelligence (AI). The results highlight steady improvement in stabilization and optimization, but also underscore how far many firms still have to go in monetizing these capabilities.

Data Maturity in Agriculture & Food Service

Criteria

- Stabilized: central warehouse/lake with scheduled ETL and a starter data dictionary.

- Optimized: daily refresh, catalog + glossary, and first MDM domain.

- Monetized: enterprise-wide MDM, data products shared across functions, measurable ROI.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 74 / 33 / 14 | 96 / 72 / 34 | 100 / 95 / 50 | 100 / 100 / 55 | 100 / 100 / 65 |

| 2024 | 76 / 36 / 15 | 97 / 76 / 37 | 100 / 97 / 53 | 100 / 100 / 60 | 100 / 100 / 70 |

| 2025 | 78 / 39 / 17 | 98 / 80 / 40 | 100 / 98 / 55 | 100 / 100 / 65 | 100 / 100 / 75 |

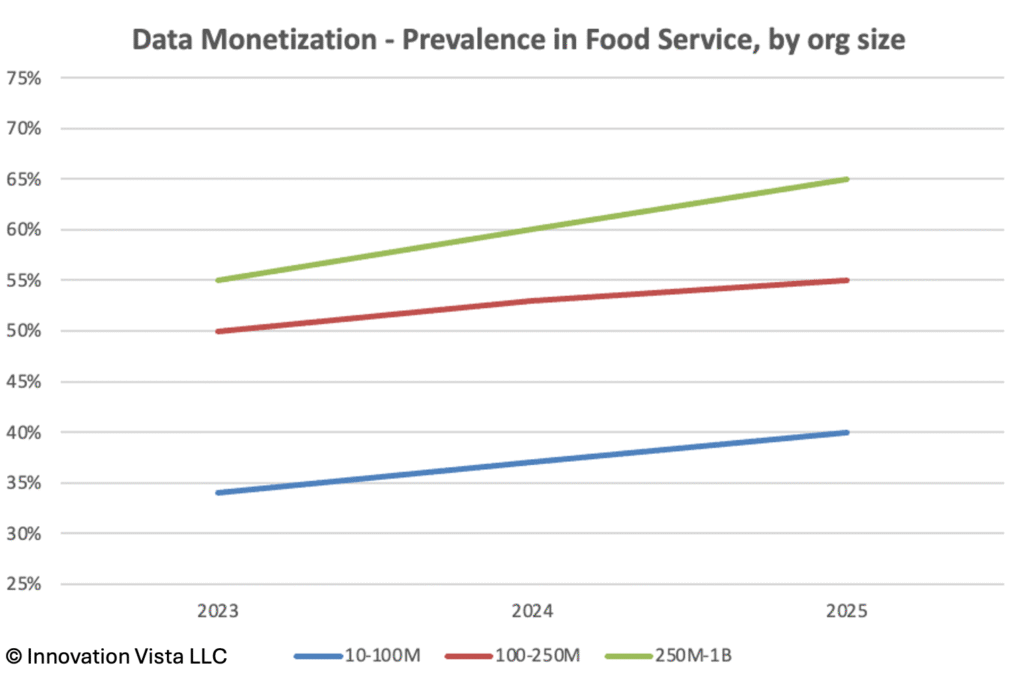

!nsights: Stabilization is nearly universal by 2024, and optimization is strong, but monetization lags behind the mid-market average. Even in 2025, monetization in $10–$100M firms is only 40%, compared to 44–50% across the mid-market. Larger companies are closing the gap, with monetization above 65% by $250M–$1B, but the spread between small and large remains significant.

BI Maturity in Agriculture & Food Service

Criteria

- Stabilized: dashboards in place, weekly refresh, initial instrumentation.

- Optimized: governed semantic layer, KPI catalog with owners, data literacy programs.

- Monetized: predictive analytics, scenario planning, automated responses embedded in workflows.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 68 / 30 / 12 | 95 / 70 / 32 | 100 / 93 / 48 | 100 / 100 / 58 | 100 / 100 / 67 |

| 2024 | 71 / 32 / 13 | 96 / 74 / 35 | 100 / 94 / 50 | 100 / 100 / 60 | 100 / 100 / 70 |

| 2025 | 74 / 33 / 14 | 97 / 77 / 37 | 100 / 96 / 52 | 100 / 100 / 63 | 100 / 100 / 73 |

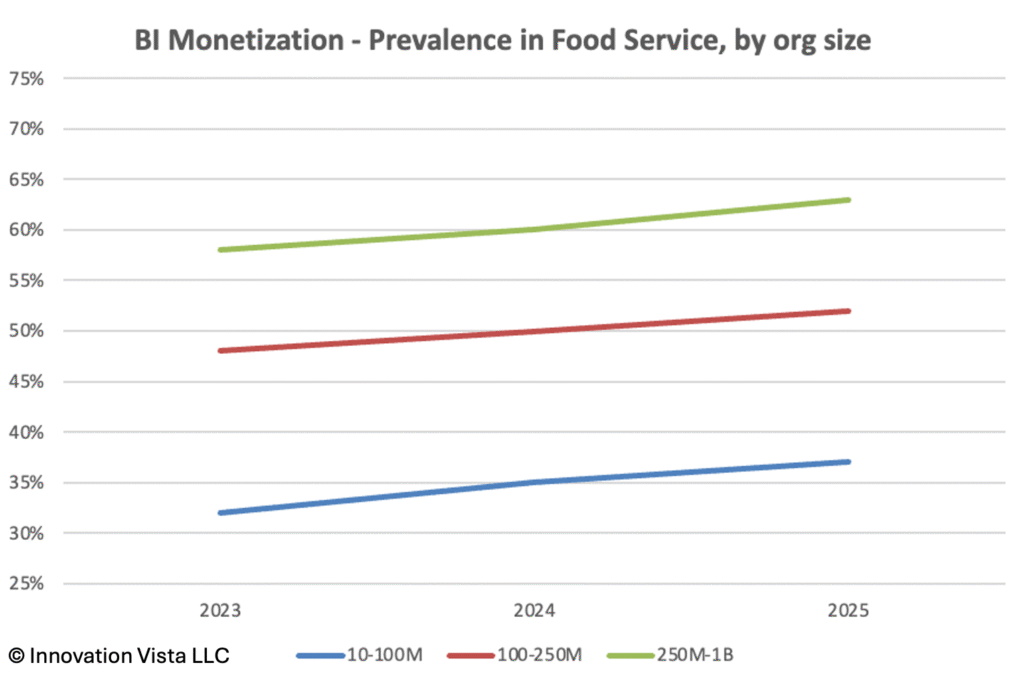

!nsights: BI adoption is strong, with stabilization nearly complete by 2023. Monetization, however, continues to trail the mid-market. By 2025, 37% of $10–$100M firms monetize BI, versus 42% across the mid-market. Larger firms are more competitive, with monetization rates exceeding 60% in $250M–$1B companies, but Agriculture & Food Service still trails leaders like Retail and Financial Services, where monetization is over 70%.

AI Maturity in Agriculture & Food Service

Criteria

- Stabilized: pilots and early deployments, prompt libraries, basic guardrails.

- Optimized: MLOps practices, model registries, evaluation frameworks, monitoring.

- Monetized: production AI delivering ROI—fine-tuned models, measurable revenue or cost impact.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 30 / 13 / 4 | 38 / 18 / 6 | 52 / 28 / 12 | 70 / 46 / 20 | 88 / 70 / 34 |

| 2024 | 38 / 18 / 6 | 46 / 24 / 8 | 60 / 34 / 14 | 78 / 52 / 24 | 94 / 79 / 40 |

| 2025 | 45 / 23 / 8 | 55 / 30 / 12 | 69 / 42 / 18 | 86 / 62 / 28 | 98 / 88 / 45 |

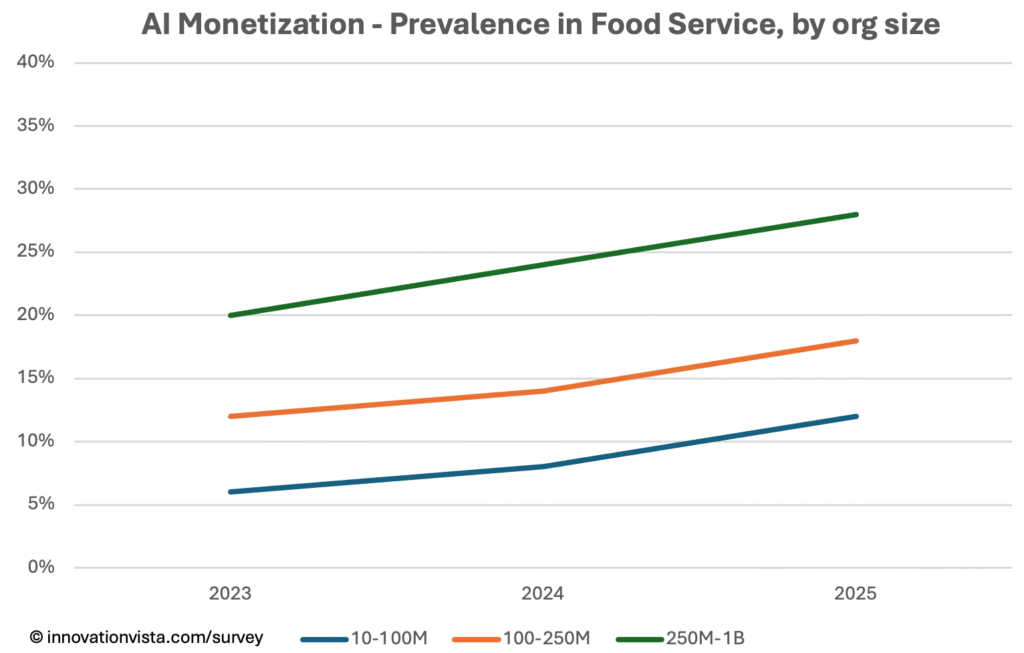

!nsights: AI remains the slowest-moving area for Agriculture & Food Service. Stabilization grows from 38% to 55% in $10–$100M firms over three years, showing more pilots and experimentation. Optimization improves, but monetization is still very limited—only 12% in $10–$100M companies by 2025. Larger firms perform better, monetizing at nearly 30% in $250M–$1B companies, but still trail the mid-market average of 35%.

Agriculture & Food Service Compared to Other Industries

- Behind leaders: Retail, Financial Services, and Insurance monetize both BI and AI at nearly double the rate of Agriculture & Food Service.

- Close to laggards: Agriculture & Food Service is slightly ahead of Education and Real Estate, but still closer to the bottom than the top.

- Improving in Data, trailing in AI: Strong optimization in Data, but AI monetization is the clear gap, leaving this sector at risk of disruption from digitally native entrants.

Company Spotlight: Innovation as a Business Model

One mid-sized player in the agriculture sector has built its entire model around the monetization of data and AI. Originally conceived as a digital network for farmers to share insights, the company quickly expanded into a platform that aggregates agronomic data, input pricing, and crop performance information from thousands of participants.

With this stabilized foundation of data, the firm optimized by layering analytics and AI on top. Its most visible innovation is a digital agronomy advisor that leverages both proprietary and public datasets to generate recommendations for crop protection, seed selection, and livestock health. This tool effectively transforms raw data into usable intelligence, delivered directly to growers at the point of decision.

The monetization layer comes from multiple streams. Farmers access advanced insights through subscription services; a digital marketplace for seeds, crop protection, and equipment creates transaction revenue; and financing tools use the company’s datasets to improve underwriting and risk assessment. In each case, the intelligence embedded in the platform directly creates new revenue opportunities rather than acting as an internal efficiency play alone.

This model illustrates what it looks like to fully traverse the maturity spectrum: stabilization through a comprehensive data backbone, optimization through applied analytics and AI, and monetization by embedding those capabilities into products and services customers are willing to pay for. It is a concrete example of how innovation can move beyond efficiency to become the growth engine of the business.

Strategic Implications for Agriculture & Food Service CXOs

For Agriculture & Food Service leaders, stabilization and optimization are no longer differentiators—they are expected. The competitive frontier is monetization.

The most immediate opportunities include:

- Demand forecasting with AI to reduce waste and improve margins.

- Predictive maintenance on equipment to avoid costly downtime.

- Digital supply chain visibility for resilience and efficiency.

- Consumer insights to drive pricing, promotion, and menu optimization.

Firms that push beyond optimization to monetization will unlock new efficiencies and growth, while those that remain stalled risk margin compression and disruption from more agile, technology-driven competitors.