Private Equity IT & AI Consulting

Proven IT Leaders with Track Records in the Private Equity Space

Experienced Private Equity Tech Consultants Driving Value & Strategy

Private Equity groups, Venture Capital and Hedge Funds are powerful drivers of growth in our economy — unique in their focus on speed, value creation, and return on investment. In this sector, technology strategy must be shaped by very different priorities than in traditional businesses, including exit timelines, constraints on capex/opex, and the constant need to strengthen competitive positioning.

Through our flagship Contract CIO+® tech leadership service and our foundational CIO IQ® IT & AI Advisory offering, Innovation Vista delivers independent vendor-neutral IT & AI strategy to the Private Equity industry. Our consultants have not only deep technical expertise but also direct experience guiding IT in private equity environments. We understand where general best practices apply — and where they fall short in the face of PE-specific dynamics such as aggressive growth targets, post-merger integration, and portfolio company transformations.

Unlike firms that assign consultants without industry context, our experts have led IT due diligence, M&A oversight, and portfolio advisory in private equity settings. With Contract CIO+®, the goal is more than stabilizing and optimizing technology; it’s aligning IT with your fund’s investment thesis, maximizing enterprise value, and supporting exits that outperform expectations.

State of Innovation in Private Equity

Our 2026 Summary of Innovation in the Private Equity sector

As deal flow accelerates and the “distribution drought” ends, 2026 will separate PE firms into two camps: those who talk about AI and those who have operationalized it to create competitive moats.

AI Moves from Pilot to Profit: LPs and buyers are no longer impressed by AI experiments. In 2026, valuations will reward portfolio companies that have successfully scaled AI to drive measurable EBITDA improvements and margin expansion.

The “Clean Data” Premium: As AI becomes standard in due diligence, assets with clean, governable data structures will command a premium. Conversely, “dirty data” will become a significant drag on exit valuations.

Cybersecurity as Value Preservation: With ransomware targeting mid-market portfolios, cybersecurity is no longer just IT hygiene—it is asset preservation. Buyers in 2026 will scrutinize cyber resilience more aggressively than ever before.

The Bolt-on & Roll-up Renaissance: Expect a surge in “buy-and-build” strategies where technology integration is the primary driver of synergy. The ability to rapidly merge IT platforms post-acquisition will be a defining factor in realized returns.

Interested in Leveraging Some of these Tech Capabilities? An Assessment Could Be Step 1.

Is your tech platform and organization ready to scale and advance? Many of our clients choose to start with an IT & AI Assessment and Recommendations report.

This is a high-leverage first step to gain actionable insights from our Private Equity/Venture Capital consulting team, validate your current IT and AI readiness, and discover how our expert collaboration can drive value for your organization’s future.

Business Leaders First - Then Tech Leaders

Our Unique Approach to Private Equity Tech Strategy

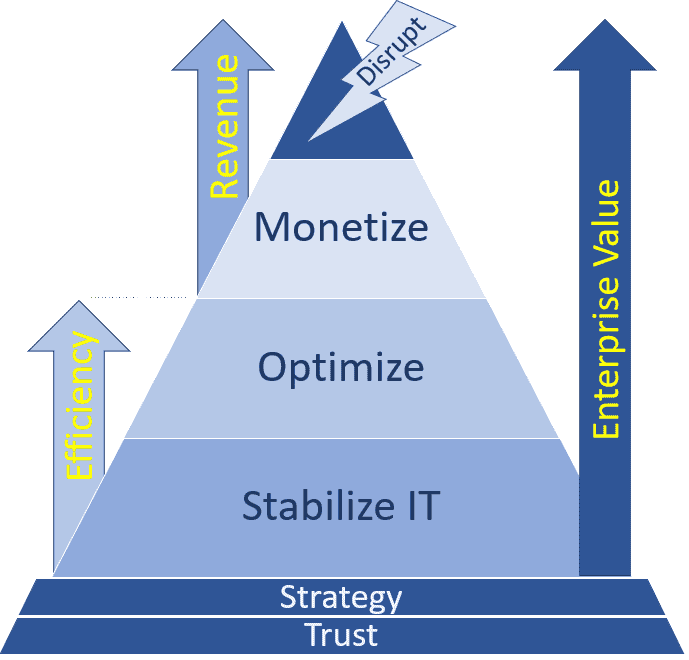

Like many consulting firms, we help private equity clients with Stabilizing IT platforms, securing networks, and Optimizing architecture, service levels, and budgets. Those steps are essential — but in PE, they’re only the beginning.

With Contract CIO+® and CIO IQ®, our approach starts by aligning technology with the investment thesis. Every fund and portfolio company has unique goals: accelerating a roll-up strategy, driving synergies in post-merger integration, or preparing for a profitable exit. The “right” IT strategy depends on where you are in the investment cycle, your capital constraints, and your exit timeline.

Where we add the most value is in Monetizing technology. Through our focus on helping clients Innovate Beyond Efficiency®, we identify ways for portfolio companies to leverage IT and data to grow top-line revenue — not just cut costs. That might mean enabling faster scaling in a roll-up, digitizing customer engagement for higher sales velocity, or creating capabilities that command a stronger valuation multiple at exit. For PE leaders, IT is not simply infrastructure — it’s a lever for enterprise value creation.

IT & AI Strategy for Your Private Equity Niche

Private Equity Functions Covered

- IT due diligence

- Hedge fund private enterprise investments

- PE rollup/individual acquisitions

- PE investments

- Mergers

- Enterprise turnarounds

- Post-merger integration

- Portfolio company advisory

- Downsizing advisory

Latest Private Equity Tech !nsights from Our Team:

Analytics Maturity in Private Equity · Analyzing our Mid-market Survey

Our experience providing Private Equity (PE) IT & AI strategy consulting confirms for us that these firms live and die by portfolio company performance. Increasingly, analytics maturity at the portfolio level determines not just operational efficiency but also valuation multiples at exit. PE owners are uniquely positioned to accelerate stabilization and optimization by pushing playbooks across their holdings. In truth, PE firms can be considered a significant uplift engine for Analytics in the mid-market as a whole. They would score higher on this survey, but they frequently sell or IPO high-maturity organizations, and acquire new companies at the lower end of the spectrum. Climbing the Analytics maturity curve is where a good portion of Private Equity’s gains in recent years