Our experience providing Private Equity (PE) IT & AI strategy consulting confirms for us that these firms live and die by portfolio company performance. Increasingly, analytics maturity at the portfolio level determines not just operational efficiency but also valuation multiples at exit. PE owners are uniquely positioned to accelerate stabilization and optimization by pushing playbooks across their holdings.

In truth, PE firms can be considered a significant uplift engine for Analytics in the mid-market as a whole. They would score higher on this survey, but they frequently sell or IPO high-maturity organizations, and acquire new companies at the lower end of the spectrum. Climbing the Analytics maturity curve is where a good portion of Private Equity’s gains in recent years have been generated.

The recent update to our Mid-market Analytics Maturity Survey provides a three-year lens (2023–2025) on how PE-owned companies are progressing across Data, Business Intelligence (BI), and Artificial Intelligence (AI). The results show faster adoption than the mid-market average, reflecting investor-driven pressure, but also significant spread between leaders and laggards inside portfolios.

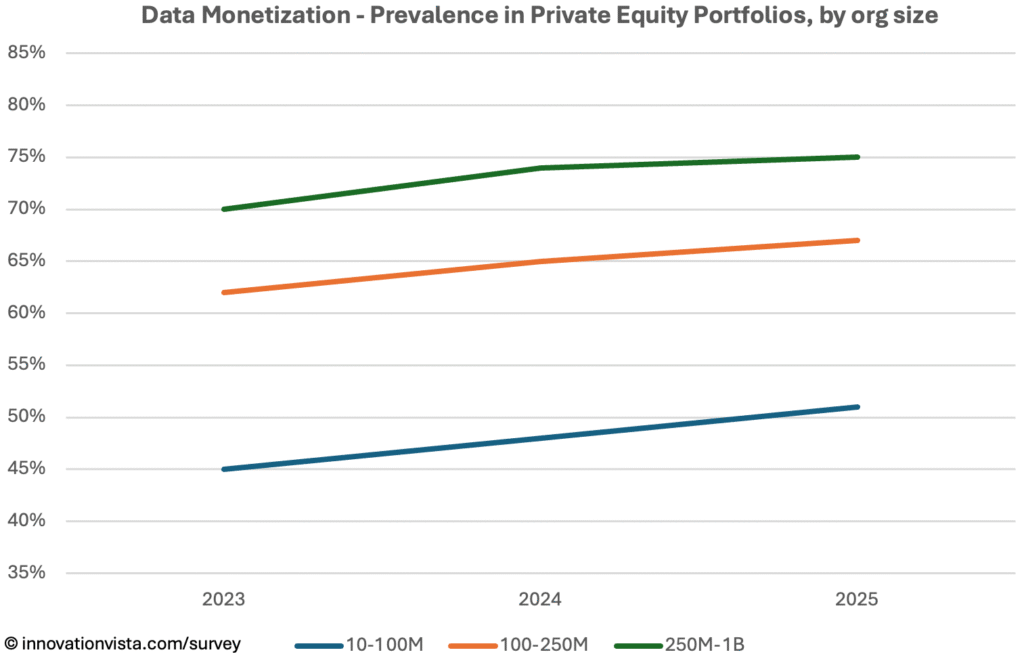

Data Maturity in Private Equity Portfolio companies

Criteria

- Stabilized: central warehouse/lake with scheduled ETL and a starter data dictionary.

- Optimized: daily refresh, catalog + glossary, and first MDM domain.

- Monetized: enterprise-wide MDM, data products shared across functions, measurable ROI.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 88 / 59 / 28 | 100 / 90 / 45 | 100 / 100 / 62 | 100 / 100 / 70 | 100 / 100 / 78 |

| 2024 | 90 / 61 / 28 | 100 / 92 / 48 | 100 / 100 / 65 | 100 / 100 / 74 | 100 / 100 / 83 |

| 2025 | 92 / 64 / 31 | 100 / 94 / 51 | 100 / 100 / 67 | 100 / 100 / 75 | 100 / 100 / 84 |

!nsights: Data maturity among PE port-co’s is strong across the board. By 2025, stabilization and optimization are essentially universal. Monetization is now climbing: 51% of $10–$100M port-co’s monetize data (vs. 44% mid-market average), reflecting PE influence in pushing operational data into strategic assets. Larger portfolio companies monetize at 75%+, underscoring how data maturity can directly raise exit valuations.

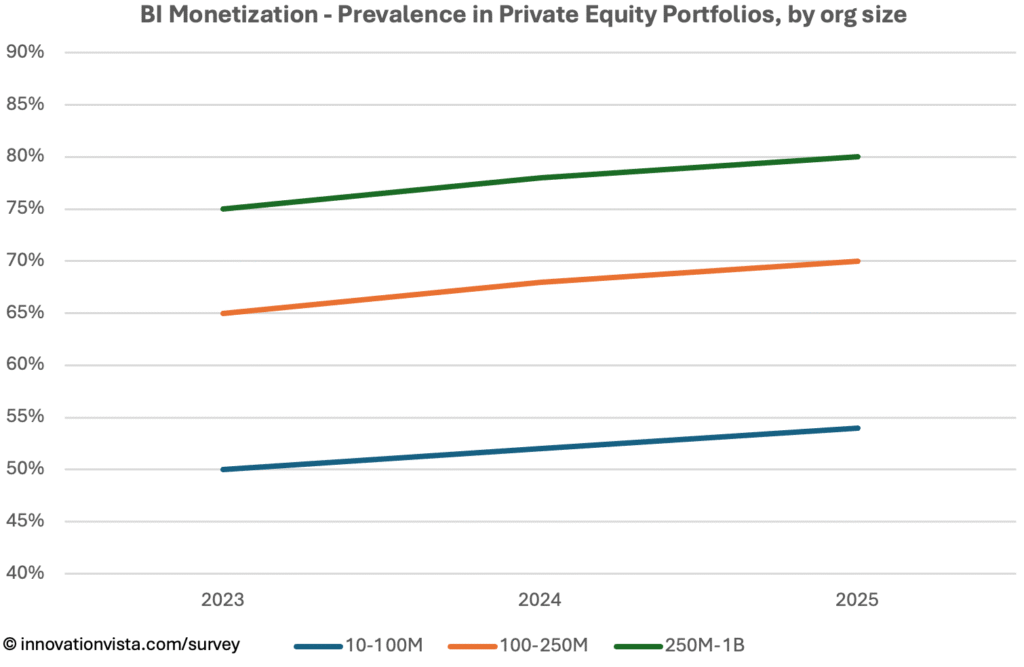

BI Maturity in Private Equity Portfolio companies

Criteria

- Stabilized: dashboards in place, weekly refresh, initial instrumentation.

- Optimized: governed semantic layer, KPI catalog with owners, data literacy programs.

- Monetized: predictive analytics, scenario planning, automated responses embedded in workflows.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 89 / 62 / 28 | 100 / 92 / 50 | 100 / 100 / 65 | 100 / 100 / 75 | 100 / 100 / 85 |

| 2024 | 92 / 64 / 30 | 100 / 94 / 52 | 100 / 100 / 68 | 100 / 100 / 78 | 100 / 100 / 88 |

| 2025 | 93 / 67 / 31 | 100 / 96 / 54 | 100 / 100 / 70 | 100 / 100 / 80 | 100 / 100 / 90 |

!nsights: BI is one of the clearest areas where PE ownership accelerates progress. By 2025, 54% of $10–$100M port-co’s monetize BI, embedding predictive dashboards into client reporting or pricing. Larger firms reach 80–90% monetization, reflecting standardized playbooks pushed by sponsors. The value is clear: BI maturity delivers faster decision-making and stronger EBITDA expansion.

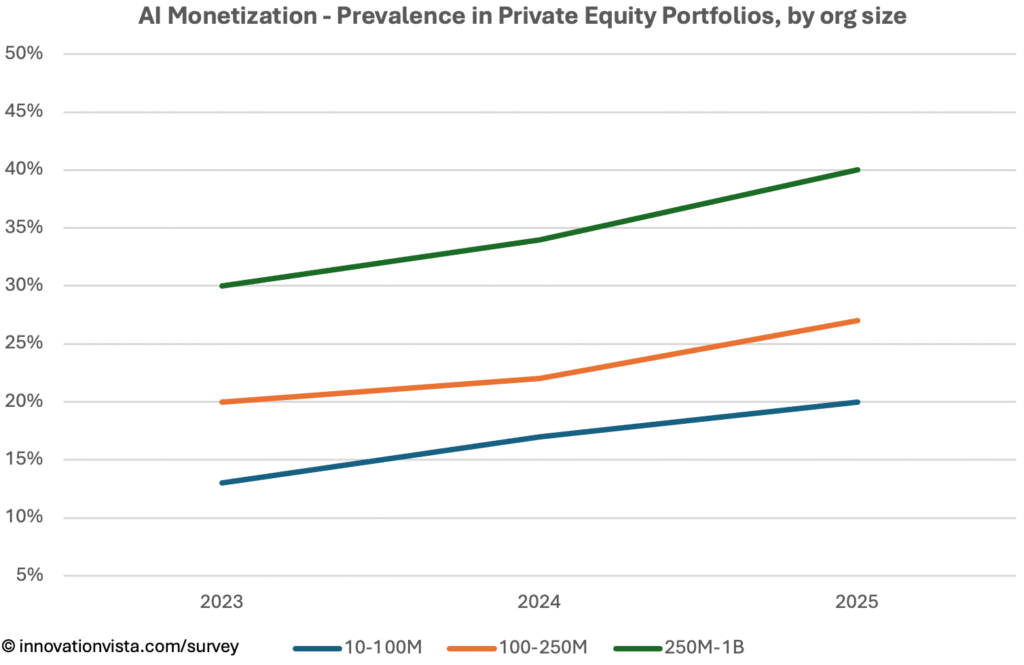

AI Maturity in Private Equity Portfolio companies

Criteria

- Stabilized: pilots and early deployments, prompt libraries, basic guardrails.

- Optimized: MLOps practices, model registries, evaluation frameworks, monitoring.

- Monetized: production AI delivering ROI—fine-tuned models, measurable revenue or cost impact.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 49 / 26 / 9 | 59 / 33 / 13 | 71 / 47 / 20 | 88 / 66 / 30 | 98 / 85 / 45 |

| 2024 | 54 / 31 / 11 | 64 / 39 / 17 | 76 / 52 / 22 | 90 / 70 / 34 | 98 / 91 / 50 |

| 2025 | 62 / 38 / 14 | 73 / 47 / 20 | 84 / 61 / 27 | 95 / 80 / 40 | 100 / 96 / 60 |

!nsights: AI is where PE port-co’s are separating into leaders and laggards. By 2025, 47% of $10–$100M companies have optimized AI pilots, but only 20% monetize them. Larger port-co’s are racing ahead: 40% of $250M–$1B companies monetize AI, often embedding it into products, pricing, or fraud prevention. PE firms that push their playbooks into AI monetization are likely to create the most enterprise value uplift at exit.

Private Equity Compared to Other Industries

- Ahead of the mid-market average: In all categories, PE port-co’s show faster monetization, reflecting sponsor-driven urgency.

- Closer to Financial Services in AI: AI adoption rates rival those of banks and insurers, though monetization still trails Retail and Entertainment.

- Laggard risk within portfolios: The spread between leaders and laggards inside portfolios is stark, with some companies still optimized-only while others monetize at scale.

Company Spotlight: Monetizing Product Intelligence

One portfolio company in the tech-enabled services space shows how private equity ownership can accelerate the leap from optimized analytics to monetization. The company, a mid-market B2B SaaS provider, had stabilized its foundation by centralizing customer usage data, billing records, and support interactions into a unified data warehouse.

Optimization followed with BI dashboards that tracked churn risk, annual recurring revenue growth, and feature adoption rates. Executives could finally see which features drove renewals, which segments were most profitable, and which customer behaviors predicted attrition. These insights improved internal decision-making and guided product roadmaps.

The monetization breakthrough came when AI was embedded directly into the product. Using models trained on historic usage and outcomes, the platform began recommending workflows, automating routine tasks, and suggesting upsell features to customers in real time. These capabilities became the cornerstone of new premium tiers, enabling the company to raise prices, expand customer lifetime value, and unlock new upsell revenue.

For the SaaS provider, analytics was no longer just a management tool — it was the product. Under PE ownership, the transformation from stabilized and optimized to monetized analytics not only improved top-line growth but also materially increased the company’s exit valuation by demonstrating differentiated, recurring revenue streams tied directly to intelligence.

Strategic Implications for Private Equity CXOs

For PE investors and portfolio company CXOs, the data confirms that analytics maturity is now a value-creation lever, not just an operational necessity.

Key opportunities include:

- Accelerating monetization: Sponsors should push portfolio companies to move beyond optimization, embedding monetized analytics into products, pricing, and customer engagement.

- Playbook scaling: Standardizing data and BI maturity across portfolios creates compounding effects in valuation.

- AI monetization as the next frontier: Early movers embedding AI in underwriting, dynamic pricing, or customer personalization are already generating competitive advantage and valuation uplift.

Port-co’s that remain stuck in “optimized only” risk underperforming at exit, while those that monetize analytics position themselves for higher multiples.