Our experience in Entertainment & Media IT & AI consulting informs us companies have been among the earliest adopters of advanced data and AI capabilities. With direct-to-consumer models, advertising-driven revenues, and massive libraries of digital content, these firms are under constant pressure to innovate. Unlike more traditional sectors, Entertainment & Media companies have long recognized that data is their product, and that insight is shaping what content is created, how it’s distributed, and how it’s monetized.

The recent update to our Mid-market Analytics Maturity Survey provides a three-year view (2023–2025) of how Entertainment & Media firms have progressed across Data, Business Intelligence (BI), and Artificial Intelligence (AI). The results show the sector consistently leading the mid-market in optimization and monetization, making it one of the benchmark industries for others to measure against.

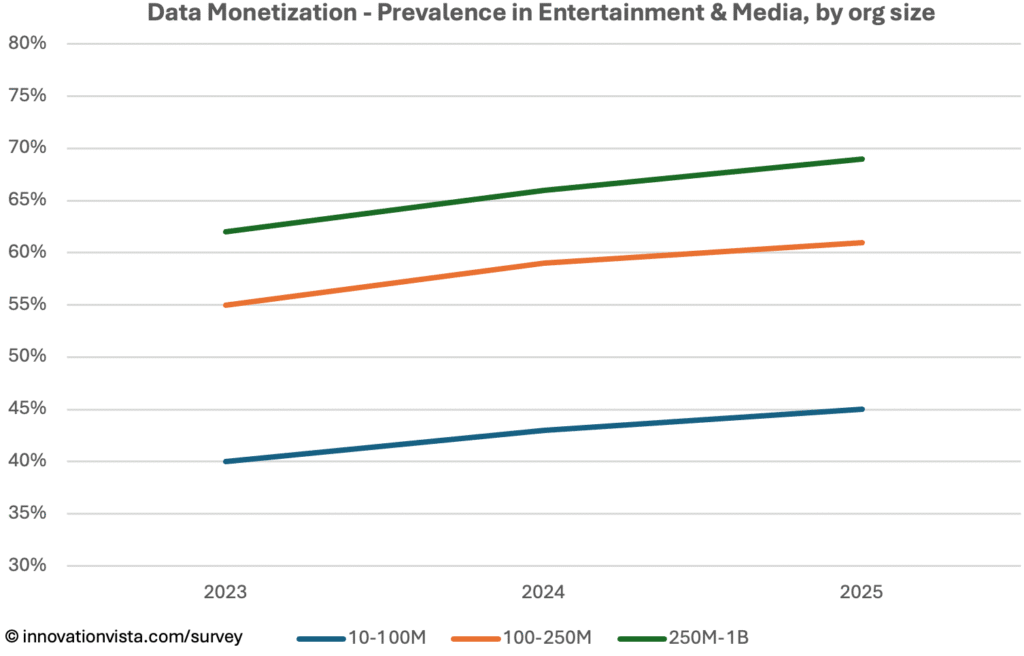

Data Maturity in Entertainment & Media

Criteria

- Stabilized: central warehouse/lake with scheduled ETL and a starter data dictionary.

- Optimized: daily refresh, catalog + glossary, and first MDM domain.

- Monetized: enterprise-wide MDM, data products shared across functions, measurable ROI.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 80 / 42 / 20 | 97 / 80 / 40 | 100 / 96 / 55 | 100 / 100 / 62 | 100 / 100 / 72 |

| 2024 | 82 / 44 / 21 | 98 / 83 / 43 | 100 / 98 / 59 | 100 / 100 / 66 | 100 / 100 / 76 |

| 2025 | 84 / 47 / 22 | 99 / 86 / 45 | 100 / 99 / 61 | 100 / 100 / 69 | 100 / 100 / 79 |

!nsights: Entertainment & Media firms are nearly universal in data stabilization and optimization by 2025. Monetization levels are high compared to the mid-market average – over 45% in $10–$100M companies and exceeding 70% in $1B+ enterprises. This reflects how the industry increasingly monetizes audience data, streaming consumption patterns, and advertising analytics.

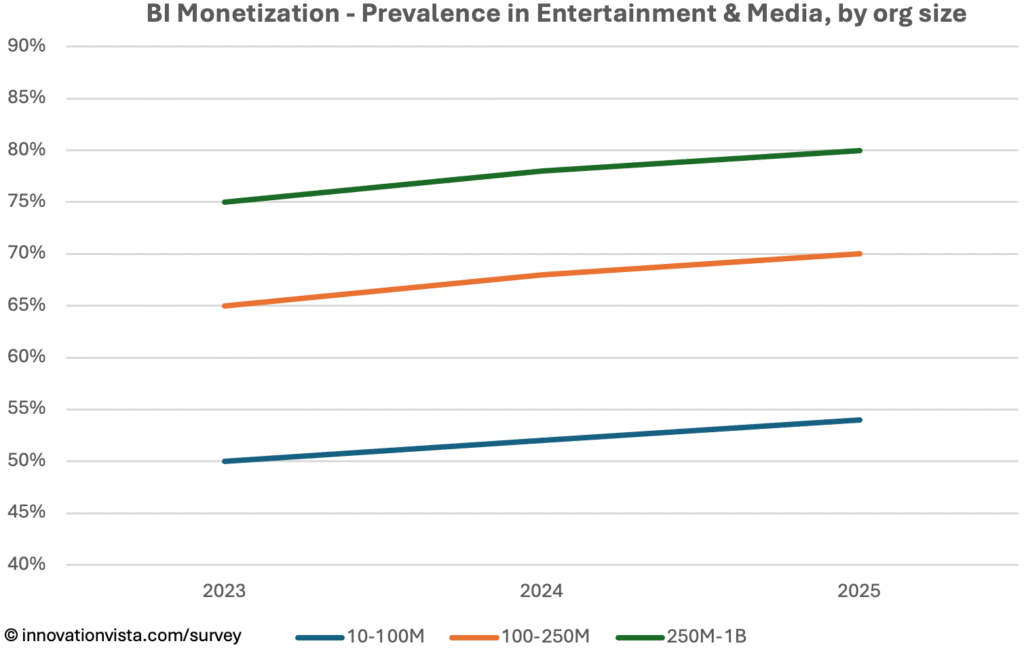

BI Maturity in Entertainment & Media

Criteria

- Stabilized: dashboards in place, weekly refresh, initial instrumentation.

- Optimized: governed semantic layer, KPI catalog with owners, data literacy programs.

- Monetized: predictive analytics, scenario planning, automated responses embedded in workflows.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 89 / 62 / 28 | 100 / 92 / 50 | 100 / 100 / 65 | 100 / 100 / 75 | 100 / 100 / 85 |

| 2024 | 92 / 64 / 30 | 100 / 94 / 52 | 100 / 100 / 68 | 100 / 100 / 78 | 100 / 100 / 88 |

| 2025 | 93 / 67 / 31 | 100 / 96 / 54 | 100 / 100 / 70 | 100 / 100 / 80 | 100 / 100 / 90 |

!nsights: BI is a clear strength in Entertainment & Media. Monetization sits at 54% in $10–$100M firms and climbs to 80–90% in larger companies, far above most industries. The sector demonstrates how BI can move beyond internal dashboards to power advertising pricing, content commissioning, and personalized user experiences.

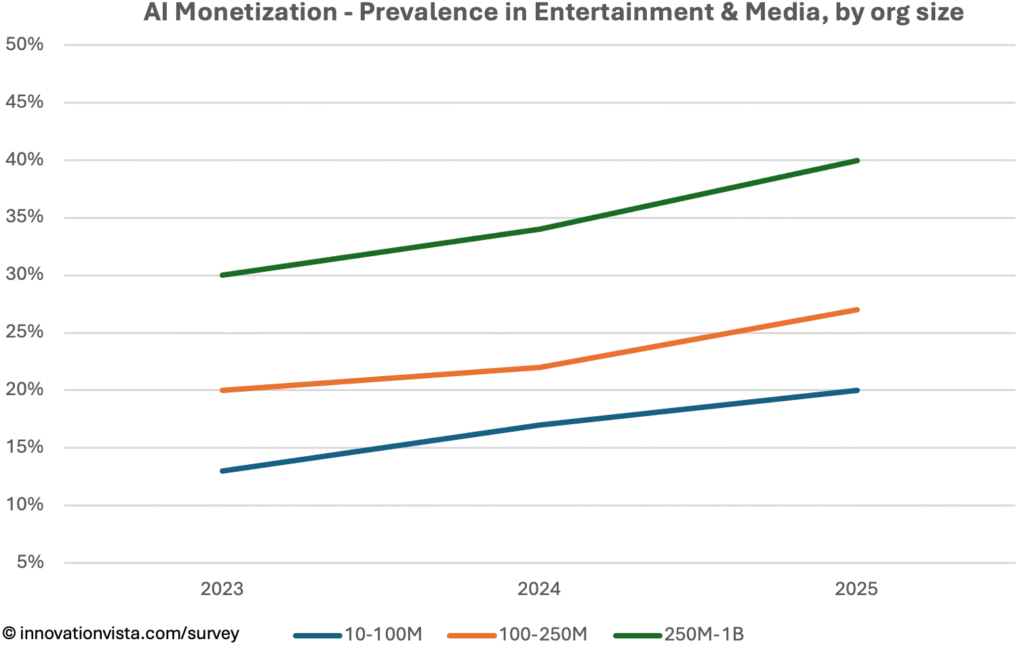

AI Maturity in Entertainment & Media

Criteria

- Stabilized: pilots and early deployments, prompt libraries, basic guardrails.

- Optimized: MLOps practices, model registries, evaluation frameworks, monitoring.

- Monetized: production AI delivering ROI – fine-tuned models, measurable revenue &/or cost impact.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 49 / 26 / 9 | 59 / 33 / 13 | 71 / 47 / 20 | 88 / 66 / 30 | 98 / 85 / 45 |

| 2024 | 54 / 31 / 11 | 64 / 39 / 17 | 76 / 52 / 22 | 90 / 70 / 34 | 98 / 91 / 50 |

| 2025 | 62 / 38 / 14 | 73 / 47 / 20 | 84 / 61 / 27 | 95 / 80 / 40 | 100 / 96 / 60 |

!nsights: AI is the most dynamic growth area. Stabilization is now nearly universal in the mid-market, with 47% of $10–$100M firms optimized and 20% monetized. Larger firms are much further ahead: monetization reaches 40% in $250M–$1B companies and 60% in $1B+ enterprises. The industry is leading in applying AI for recommendation engines, automated editing, content generation, and targeted advertising, all driving clear ROI outcomes.

Entertainment & Media Compared to Other Industries

- Consistent leader: The sector ranks among the top three in every maturity category across 2023–2025.

- Ahead in monetization: Both BI and AI monetization are well above mid-market averages, reflecting an industry where insights and personalization directly drive revenue.

- Benchmark for others: Entertainment & Media stands as the model for how mid-market organizations can monetize technology, turning analytics and AI into customer-facing products and services.

Company Spotlight: Personalization as Product

One mid-sized streaming platform illustrates how Entertainment & Media firms can turn analytics and AI into their core business model. Originally operating with a traditional subscription approach, the company began by stabilizing its data infrastructure: consolidating viewing behavior, subscription history, device usage, and churn metrics into a unified warehouse.

With this stabilized foundation, the firm optimized by building advanced dashboards for internal teams. Content producers gained visibility into which shows drive the most engagement; marketers tracked trial conversions, retention curves, and churn signals; and executives measured ROI on content investments.

The real breakthrough came with monetization. The platform embedded AI into its user experience, creating personalized recommendation engines, dynamic user interfaces, and targeted subscription offers. Instead of being a support tool, intelligence became the customer-facing product. Viewers now expect the platform to surface the right show at the right time, and premium tiers offer enhanced personalization and ad-free experiences.

Revenue growth is directly tied to these capabilities. Churn reduction, increased hours streamed per subscriber, and higher uptake of premium plans have all been attributed to the platform’s AI-driven personalization. What began as back-office analytics has become the differentiator customers pay for – providing proof that in Entertainment & Media, monetization is no longer optional but a competitive necessity.

Strategic Implications for Entertainment & Media CXOs

For Entertainment & Media leaders, the imperative is to maintain pace at the frontier. Stabilization and optimization are already assumed; the question is how far monetization can be pushed. Companies that innovate fastest in personalization, dynamic pricing, and AI-driven content creation will capture disproportionate market share.

The real opportunity is to continue moving analytics from the back office into the product itself, making intelligence not just a support function, but the experience customers are buying.