Our CIOs with expertise in Manufacturing IT & AI consulting know that these companies generate enormous volumes of data through production lines, supply chains, quality control systems, and increasingly IoT-enabled equipment. Yet the sector is often constrained by legacy systems, long investment cycles, and complex operational environments. While stabilization and optimization are progressing rapidly, monetization is uneven. Some firms are turning predictive analytics and AI into revenue streams, while others are still struggling with foundational integration.

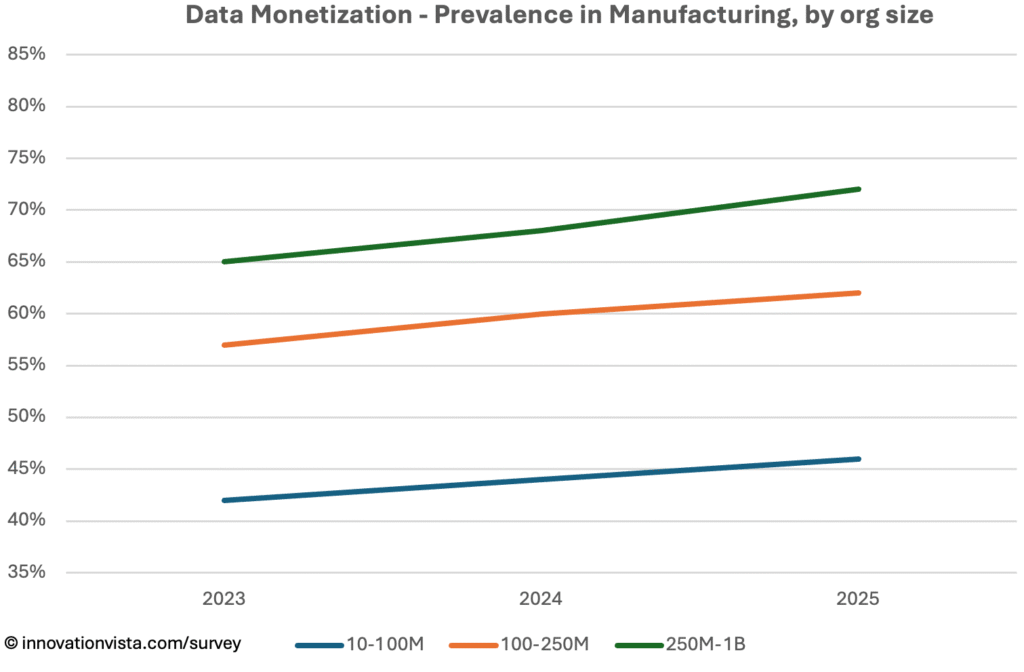

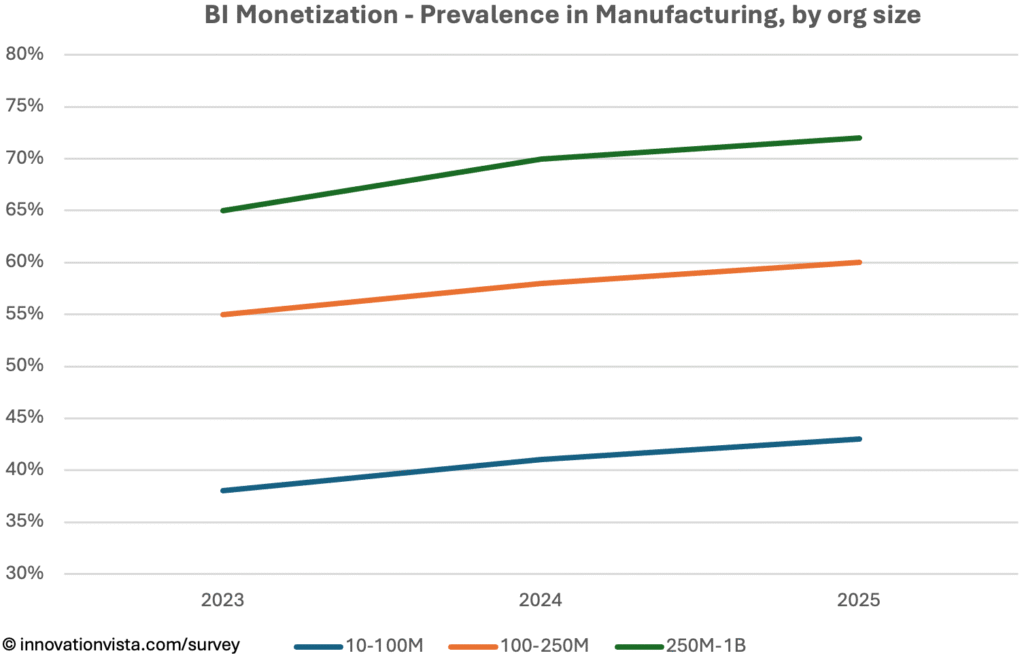

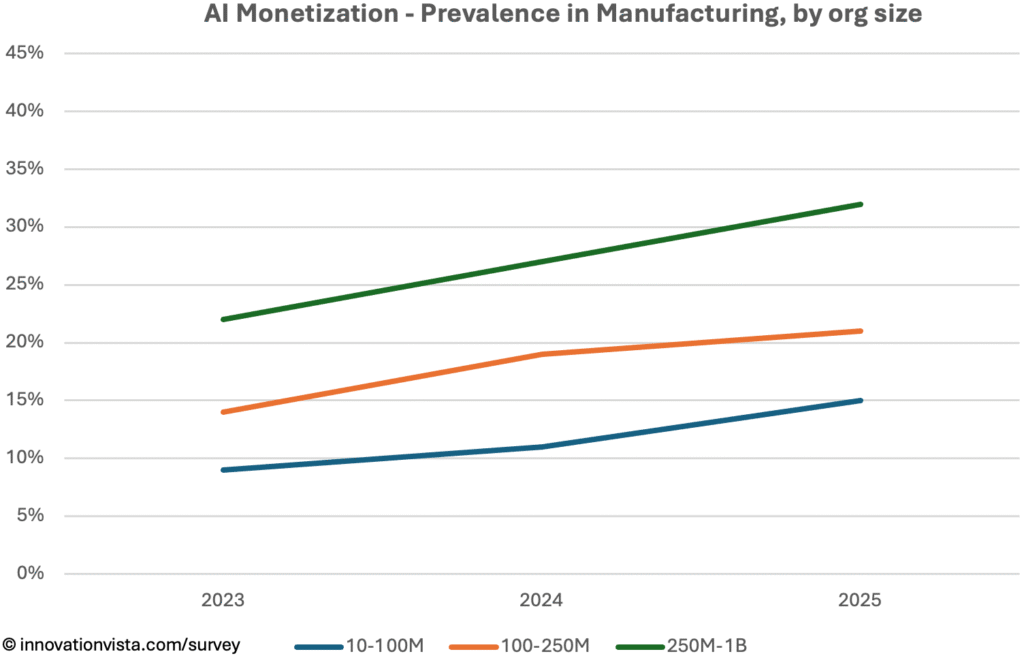

The recent update to our Mid-market Analytics Maturity Survey provides a three-year view (2023–2025) of how Manufacturing companies are evolving across Data, Business Intelligence (BI), and Artificial Intelligence (AI). The results show near-universal stabilization and optimization by 2025, but wide variance in monetization across size bands.

Data Maturity in Manufacturing

Criteria

- Stabilized: central warehouse/lake with scheduled ETL and a starter data dictionary.

- Optimized: daily refresh, catalog + glossary, and first MDM domain.

- Monetized: enterprise-wide MDM, data products shared across functions, measurable ROI.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 83 / 50 / 23 | 99 / 86 / 42 | 100 / 98 / 57 | 100 / 100 / 65 | 100 / 100 / 73 |

| 2024 | 86 / 53 / 24 | 100 / 88 / 44 | 100 / 100 / 60 | 100 / 100 / 68 | 100 / 100 / 78 |

| 2025 | 89 / 56 / 25 | 100 / 91 / 46 | 100 / 100 / 62 | 100 / 100 / 72 | 100 / 100 / 82 |

!nsights: Stabilization and optimization are nearly universal by 2025, with monetization catching up more slowly. In $10–$100M firms, only 46% monetize Data, compared to 72% in $250M–$1B companies. Larger manufacturers increasingly monetize by turning data into predictive supply chain visibility and selling insights across their partner ecosystems.

BI Maturity in Manufacturing

Criteria

- Stabilized: dashboards in place, weekly refresh, initial instrumentation.

- Optimized: governed semantic layer, KPI catalog with owners, data literacy programs.

- Monetized: predictive analytics, scenario planning, automated responses embedded in workflows.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 79 / 42 / 18 | 97 / 82 / 38 | 100 / 98 / 55 | 100 / 100 / 65 | 100 / 100 / 75 |

| 2024 | 82 / 44 / 19 | 98 / 85 / 41 | 100 / 99 / 58 | 100 / 100 / 70 | 100 / 100 / 80 |

| 2025 | 84 / 47 / 20 | 99 / 88 / 43 | 100 / 99 / 60 | 100 / 100 / 72 | 100 / 100 / 82 |

!nsights: BI is widely stabilized and optimized across Manufacturing by 2025. Monetization remains lower than in sectors like Retail or Financial Services – just 43% of $10–$100M firms monetize BI – but larger firms are progressing, with monetization rates above 70%. Common use cases include production quality analytics, predictive maintenance reporting, and supply chain optimization dashboards.

AI Maturity in Manufacturing

Criteria

- Stabilized: pilots and early deployments, prompt libraries, basic guardrails.

- Optimized: MLOps practices, model registries, evaluation frameworks, monitoring.

- Monetized: production AI delivering ROI – fine-tuned models, measurable revenue &/or cost impact.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 40 / 18 / 6 | 48 / 25 / 9 | 62 / 34 / 14 | 80 / 52 / 22 | 95 / 73 / 36 |

| 2024 | 46 / 25 / 7 | 57 / 32 / 11 | 70 / 44 / 19 | 85 / 63 / 27 | 97 / 86 / 41 |

| 2025 | 55 / 31 / 10 | 66 / 39 / 15 | 78 / 53 / 21 | 92 / 73 / 32 | 99 / 93 / 50 |

!nsights: AI is the area of fastest progress for Manufacturing. Stabilization rates climbed to 66% in $10–$100M firms and 92% in $250M–$1B companies by 2025. Monetization, however, is uneven; only 15% of smaller mid-market firms monetize AI, compared to 32% of larger ones. Top use cases include predictive maintenance, defect detection, robotics optimization, and supply chain forecasting.

Manufacturing Compared to Other Industries

- Ahead in stabilization: Manufacturing matches or exceeds mid-market averages in Data and BI stabilization and optimization.

- Behind leaders in monetization: Monetization rates trail Financial Services, Insurance, and Retail by 10–15 points.

- High potential in AI: The sector’s rapid growth in AI pilots and optimization suggests monetization could scale quickly once production ROI cases (like predictive maintenance and defect reduction) are fully embedded.

Company Spotlight: Monetizing Supply Chain Visibility

One mid-market contract manufacturer shows how Manufacturing firms can move beyond optimization into true monetization. Traditionally, the company focused on delivering components to larger OEMs, competing primarily on cost, quality, and delivery speed.

The journey began with stabilization. The firm integrated ERP, procurement, and logistics data into a centralized platform, creating a reliable foundation for monitoring supplier performance, order status, and lead times.

Optimization followed as the company deployed BI dashboards. Managers could now track supplier reliability, predict bottlenecks, and measure production efficiency with far greater accuracy. These dashboards gave internal teams the ability to act proactively, reducing delays and improving margins.

The breakthrough came when the firm embedded this intelligence into its client relationships. Rather than treating visibility as an internal tool, the company created a premium client-facing portal that gave customers real-time insights into order status, delivery forecasts, and supplier risks. Access to this portal became part of higher-value contracts, with fees tied to the assurance of transparency and predictability.

This move turned analytics into a product. Customers pay not just for manufactured components but for the intelligence that reduces their risk and improves their planning. For the manufacturer, monetization came in the form of stronger margins, stickier contracts, and an enhanced reputation as a partner offering reliability, not just capacity.

This example demonstrates how a Manufacturing firm can move through the full maturity spectrum – stabilizing systems, optimizing processes, and monetizing insights – by embedding intelligence directly into its customer value proposition.

Strategic Implications for Manufacturing CXOs

For Manufacturing leaders, the path is clear: stabilization and optimization are now expected; monetization is the competitive battleground.

Key opportunities include:

- Predictive maintenance and quality analytics to reduce downtime and waste.

- AI-powered robotics and process automation to improve throughput.

- Supply chain visibility platforms that not only optimize internal operations but can be sold as premium services to partners.

Firms that monetize these capabilities will command better margins, reduce operational risk, and strengthen their position in increasingly digital supply chains. Those that remain optimized-only risk being commoditized by competitors who can offer data-backed performance guarantees.