Our experience in Logistics & Transportation tech consulting confirms that these firms sit at the heart of the supply chain, where efficiency is everything and margins are thin. Companies in this sector manage fleets, warehouses, and multimodal operations that generate massive volumes of data. With rising customer expectations for visibility and speed, technology maturity is becoming the difference between leaders and laggards.

The recent update to our Mid-market Analytics Maturity Survey provides a three-year lens (2023–2025) on how Logistics & Transportation firms are progressing across Data, Business Intelligence (BI), and Artificial Intelligence (AI). The findings show steady gains in data and BI monetization, and rapid growth in AI adoption, where predictive routing, maintenance, and real-time tracking are reshaping business models.

Data Maturity in Logistics & Transportation

Criteria

- Stabilized: central warehouse/lake with scheduled ETL and a starter data dictionary.

- Optimized: daily refresh, catalog + glossary, and first MDM domain.

- Monetized: enterprise-wide MDM, data products shared across functions, measurable ROI.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 88 / 59 / 27 | 100 / 90 / 45 | 100 / 100 / 62 | 100 / 100 / 70 | 100 / 100 / 78 |

| 2024 | 90 / 61 / 29 | 100 / 92 / 48 | 100 / 100 / 65 | 100 / 100 / 73 | 100 / 100 / 82 |

| 2025 | 92 / 64 / 31 | 100 / 94 / 51 | 100 / 100 / 67 | 100 / 100 / 75 | 100 / 100 / 84 |

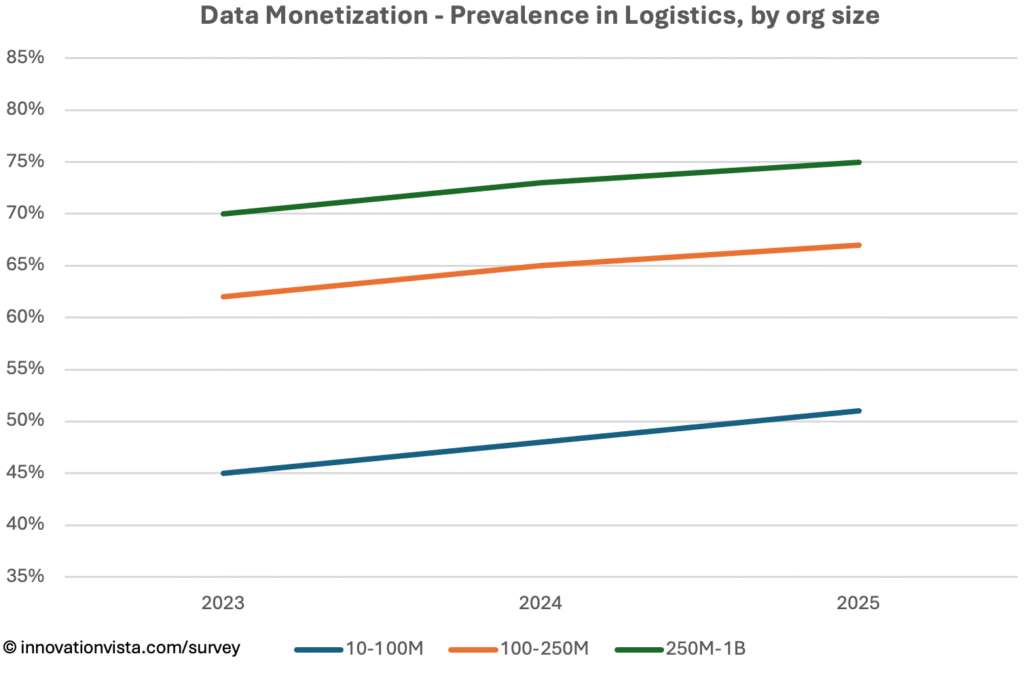

!nsights: Data maturity is nearly universal across Logistics & Transportation. By 2025, stabilization and optimization are complete in the mid-market, with monetization climbing to 51% in $10–$100M firms and 75% in $250M–$1B firms. Larger firms are beginning to treat data not just as an operational necessity but as a product, selling visibility and analytics services back to customers.

BI Maturity in Logistics & Transportation

Criteria

- Stabilized: dashboards in place, weekly refresh, initial instrumentation.

- Optimized: governed semantic layer, KPI catalog with owners, data literacy programs.

- Monetized: predictive analytics, scenario planning, automated responses embedded in workflows.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 86 / 55 / 24 | 99 / 89 / 43 | 100 / 100 / 60 | 100 / 100 / 70 | 100 / 100 / 80 |

| 2024 | 89 / 58 / 25 | 100 / 92 / 45 | 100 / 100 / 63 | 100 / 100 / 74 | 100 / 100 / 84 |

| 2025 | 91 / 61 / 27 | 100 / 94 / 47 | 100 / 100 / 65 | 100 / 100 / 76 | 100 / 100 / 86 |

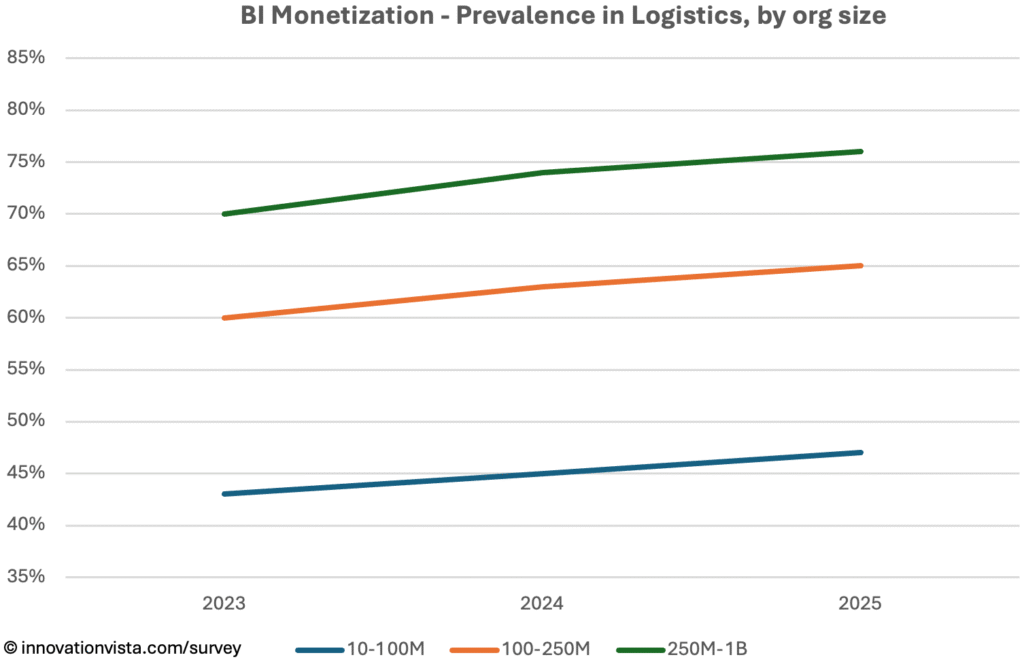

!nsights: BI has become a core differentiator in Logistics. By 2025, monetization exceeds 45% in $10–$100M firms and reaches 76% in $250M–$1B companies. Predictive dashboards for on-time delivery, fuel efficiency, and warehouse productivity are common, and customers increasingly expect access to these insights as part of the service.

AI Maturity in Logistics & Transportation

Criteria

- Stabilized: pilots and early deployments, prompt libraries, basic guardrails.

- Optimized: MLOps practices, model registries, evaluation frameworks, monitoring.

- Monetized: production AI delivering ROI – fine-tuned models, measurable revenue &/or cost impact.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 42 / 20 / 6 | 50 / 26 / 9 | 64 / 35 / 15 | 82 / 55 / 24 | 96 / 78 / 38 |

| 2024 | 49 / 27 / 8 | 59 / 34 / 12 | 72 / 46 / 20 | 86 / 66 / 30 | 97 / 88 / 44 |

| 2025 | 57 / 33 / 11 | 68 / 42 / 16 | 80 / 56 / 23 | 93 / 76 / 35 | 99 / 94 / 52 |

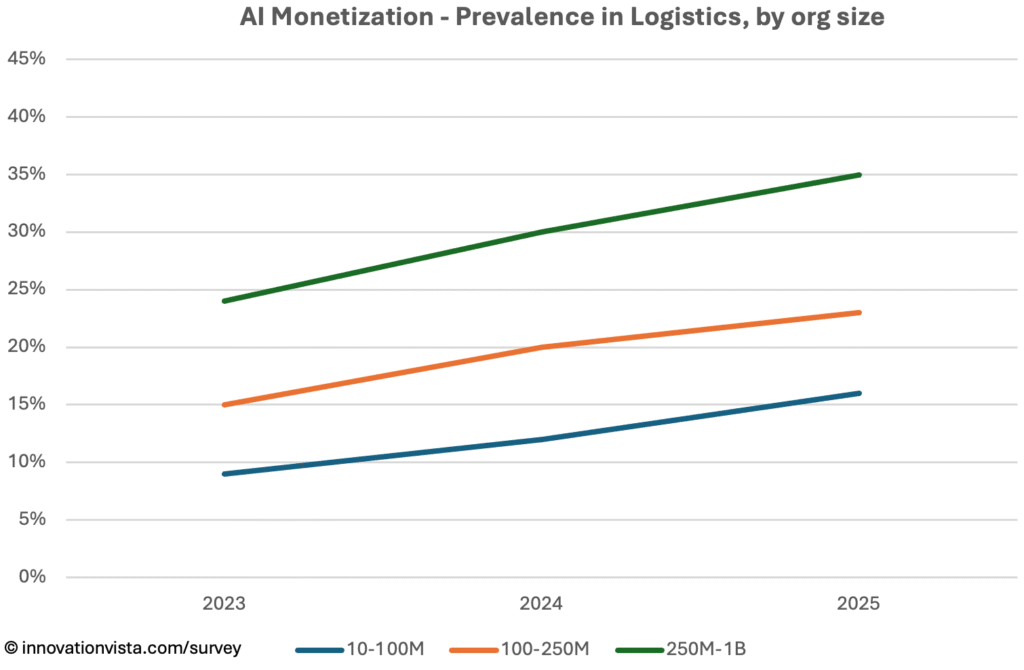

!nsights: AI adoption is accelerating rapidly. By 2025, 68% of $10–$100M firms have stabilized pilots, with 16% monetizing AI. Larger firms are further ahead: 35% of $250M–$1B companies monetize AI, often through predictive routing, autonomous warehouse operations, and dynamic fleet optimization. The sector is quickly moving toward monetizing AI directly in client contracts, where guarantees on speed and efficiency become a differentiator.

Logistics & Transportation Compared to Other Industries

- Ahead of the average: Logistics firms exceed the mid-market in BI and AI monetization by 3–5 points across size bands.

- Benchmark in data transparency: Many firms now monetize by selling visibility dashboards back to clients – a trend others are watching.

- Fastest growth in AI monetization: From 2023 to 2025, monetization more than triples in the mid-market, highlighting the sector’s appetite for predictive tools.

Company Spotlight: Monetizing Predictive Logistics

One mid-market logistics provider illustrates how the sector is moving beyond efficiency into monetization. Originally focused on traditional 3PL services such as warehousing and regional trucking, the company began by stabilizing its operations data – centralizing telematics from vehicles, route histories, driver logs, and delivery performance metrics into a single warehouse.

With this stabilized foundation, the firm optimized through advanced BI dashboards. Fleet managers could now track utilization in real time, monitor driver performance, and benchmark on-time delivery against client SLAs. Predictive alerts for potential delays allowed dispatchers to re-route shipments proactively, improving reliability across the network.

The monetization breakthrough came when these predictive capabilities were embedded into customer contracts. The company began offering premium service tiers that guaranteed faster delivery windows and higher uptime, backed by AI-driven routing and predictive maintenance models. Clients pay more for certainty, while the provider creates recurring revenue streams directly tied to its intelligence capabilities.

By turning stabilized and optimized data into a customer-facing differentiator, the company transformed its role from a commodity transport provider into a partner selling reliability and insight. It is a clear example of how Logistics & Transportation firms can move from optimization to monetization, redefining their value proposition in the process.

Strategic Implications for Logistics & Transportation CXOs

For Logistics & Transportation leaders, the survey confirms what customers already demand: visibility, predictability, and efficiency. Stabilization and optimization are givens; the competitive advantage is monetization.

Opportunities include:

- Predictive routing and scheduling to reduce delivery times and costs.

- AI-driven maintenance to minimize downtime and extend asset life.

- Client-facing analytics portals that turn data transparency into a paid service.

- Dynamic pricing models powered by demand forecasting.

Companies that treat intelligence as part of the customer product – not just an internal tool – will lead the next era of Logistics & Transportation.