Our CIOs with experience supporting Legal Services know that the legal sector sits at an inflection point. Traditional firms still rely heavily on manual processes and billable-hour models, while alternative legal service providers (ALSPs) and tech-driven entrants are reshaping expectations with data-driven efficiencies. From contract analysis and e-discovery to risk management and compliance monitoring, Legal Services organizations are under pressure to modernize their technology stack.

The recent update to our Mid-market Analytics Maturity Survey provides a three-year view (2023–2025) of how Legal Services firms are progressing across Data, Business Intelligence (BI), and Artificial Intelligence (AI). The results reveal modest progress in Data and BI monetization and rapid gains in AI — where adoption is starting to transform workflows and business models.

Data Maturity in Legal Services

Criteria

- Stabilized: central warehouse/lake with scheduled ETL and a starter data dictionary.

- Optimized: daily refresh, catalog + glossary, and first MDM domain.

- Monetized: enterprise-wide MDM, data products shared across functions, measurable ROI.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 74 / 35 / 15 | 96 / 74 / 34 | 100 / 96 / 50 | 100 / 100 / 57 | 100 / 100 / 67 |

| 2024 | 76 / 36 / 15 | 97 / 76 / 36 | 100 / 97 / 53 | 100 / 100 / 60 | 100 / 100 / 70 |

| 2025 | 78 / 39 / 16 | 98 / 80 / 38 | 100 / 98 / 54 | 100 / 100 / 63 | 100 / 100 / 73 |

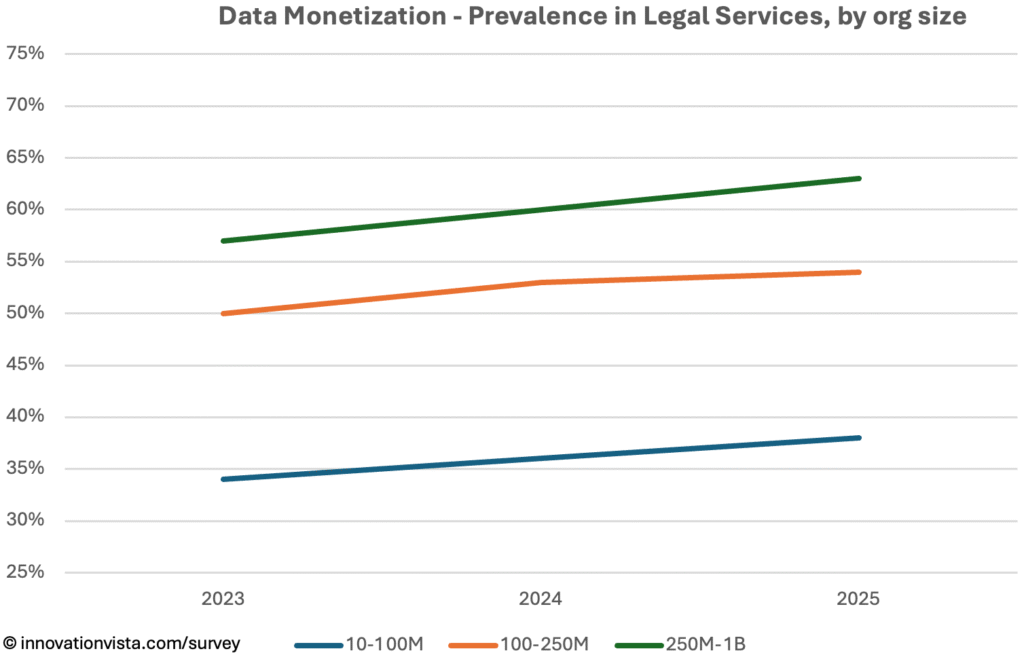

!nsights: Stabilization and optimization are strong in Legal Services by 2025, but monetization remains limited — just 38% in $10–$100M firms, compared to ~45% in the mid-market average. Larger firms are closing in on 65–70% monetization, with gains tied to document automation and compliance services.

BI Maturity in Legal Services

Criteria

- Stabilized: dashboards in place, weekly refresh, initial instrumentation.

- Optimized: governed semantic layer, KPI catalog with owners, data literacy programs.

- Monetized: predictive analytics, scenario planning, automated responses embedded in workflows.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 64 / 24 / 10 | 94 / 66 / 30 | 99 / 91 / 46 | 100 / 100 / 58 | 100 / 100 / 68 |

| 2024 | 66 / 26 / 11 | 96 / 68 / 32 | 100 / 92 / 48 | 100 / 100 / 60 | 100 / 100 / 70 |

| 2025 | 69 / 28 / 12 | 97 / 72 / 35 | 100 / 94 / 51 | 100 / 100 / 62 | 100 / 100 / 72 |

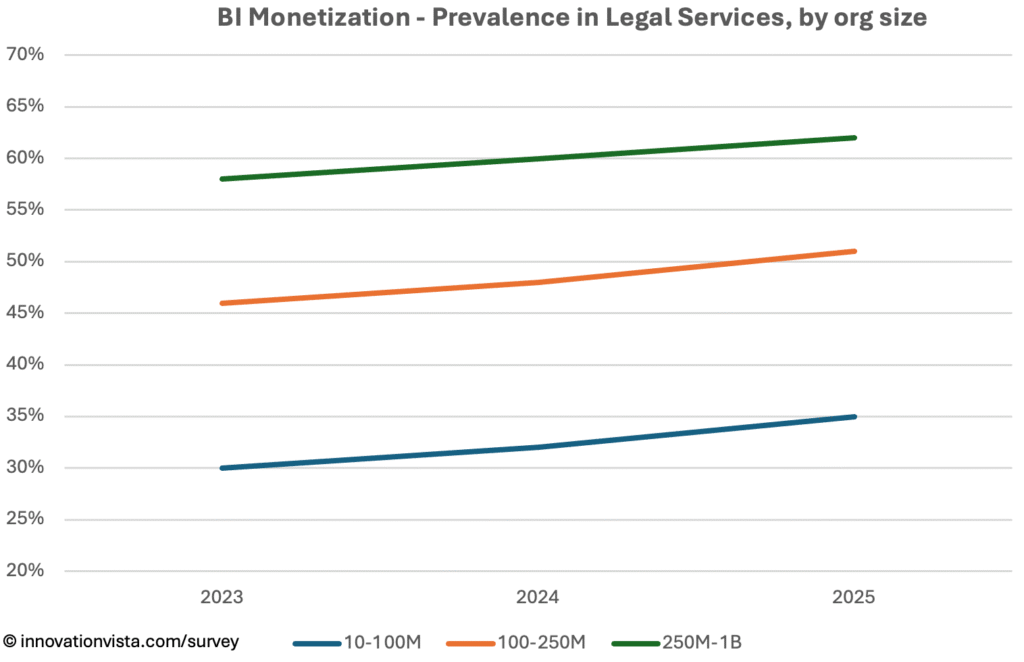

!nsights: By 2025, stabilization and optimization are nearly universal in Legal Services, but monetization is lagging. Just 35% of $10–$100M firms monetize BI, compared to 42% mid-market average. Larger firms are beginning to monetize BI through client-facing dashboards for case status, billing transparency, and predictive litigation outcomes, but the long tail of small firms still treats BI as an internal reporting tool.

AI Maturity in Legal Services

Criteria

- Stabilized: pilots and early deployments, prompt libraries, basic guardrails.

- Optimized: MLOps practices, model registries, evaluation frameworks, monitoring.

- Monetized: production AI delivering ROI – fine-tuned models, measurable revenue &/or cost impact.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 42 / 20 / 6 | 50 / 26 / 9 | 64 / 35 / 15 | 82 / 55 / 24 | 96 / 78 / 38 |

| 2024 | 49 / 27 / 8 | 59 / 34 / 12 | 72 / 46 / 20 | 86 / 66 / 30 | 97 / 88 / 44 |

| 2025 | 57 / 33 / 11 | 68 / 42 / 16 | 80 / 56 / 23 | 93 / 76 / 35 | 99 / 94 / 52 |

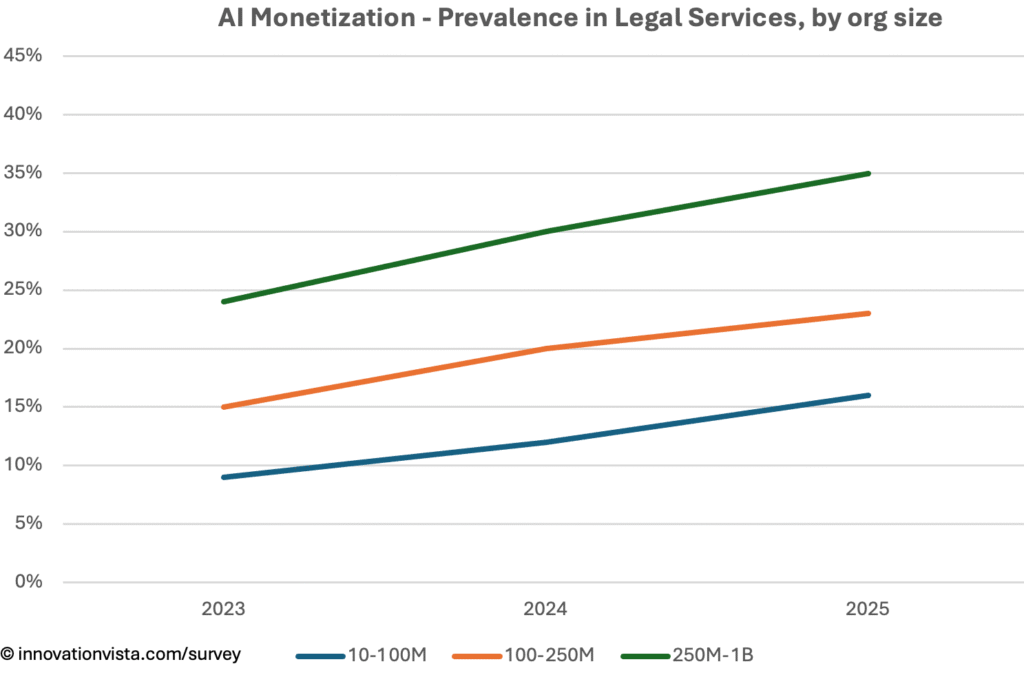

!nsights: AI is where Legal Services is making its boldest moves. Stabilization and optimization climbed quickly, with 42% of $10–$100M firms optimized by 2025. Monetization is also visible: 16% of $10–$100M firms and 35% of $250M–$1B firms now monetize AI. Use cases include AI-driven contract analysis, e-discovery, and document review, often offered as managed services. This makes Legal one of the fastest-improving sectors for AI monetization.

Legal Services Compared to Other Industries

- Data & BI laggards: Monetization trails the mid-market average by 5–10 points.

- AI acceleration: One of the strongest growth curves in AI adoption, though still behind leaders like Financial Services and Retail.

- Clear disruption risk: ALSPs and tech entrants are already monetizing AI, while many traditional firms remain optimized-only.

Company Spotlight: Turning Transparency into a Premium Service

One mid-sized corporate law firm shows how Legal Services organizations can progress beyond optimization into monetization. Like many firms, it began by stabilizing its data — integrating billing systems, matter management tools, and internal knowledge bases into a single, consistent platform. This created reliable visibility into work in progress, hours billed, and client account histories.

The optimization stage came with BI dashboards for partners and practice leaders. These tools provided real-time insights into case timelines, attorney utilization, and profitability across matters. For the first time, firm leadership could benchmark performance consistently across offices and practice areas.

The monetization breakthrough came when the firm extended these insights to its clients. By offering premium dashboards, clients could see the status of active matters, receive predictive litigation outcomes based on historic case data, and track budgets against forecasts in real time. For clients, this transparency reduced surprises and improved planning. For the firm, it translated into stickier relationships, higher client satisfaction, and the ability to charge premium rates for data-driven legal services.

This example illustrates how even a traditional law firm can move through the full maturity curve: stabilizing systems, optimizing internal insights, and monetizing analytics by embedding them directly into the client experience. By doing so, the firm transformed BI from an internal management tool into a differentiator in the market.

Strategic Implications for Legal CXOs & Managing Partners

For Legal Services leaders, the message is clear: stabilization and optimization are not differentiators, they are catch-up requirements. The frontier is monetization, and the fastest path is through AI.

Opportunities include:

- Contract review and drafting powered by AI, packaged as managed services.

- E-discovery automation that monetizes efficiency gains for clients.

- Client-facing dashboards for case progress and billing transparency.

- Risk and compliance monitoring that becomes a premium product.

Firms that continue to treat analytics and AI as internal tools risk commoditization. Those that embed them into client offerings will define the new competitive landscape in legal services.