As we know well from our Healthcare IT & AI consulting experiences, healthcare organizations balance two immense pressures: the demand for innovation to improve patient outcomes, and the regulatory and compliance frameworks that slow down experimentation. Hospitals, clinics, payers, and healthcare service providers all sit in the mid-market with varied levels of sophistication. Data is abundant – electronic health records, imaging, clinical trials, IoT devices – but turning that into reliable analytics and monetized AI remains a challenge.

The recent update to our Mid-market Analytics Maturity Survey gives us a three-year lens (2023–2025) on how Healthcare firms are maturing across Data, Business Intelligence (BI), and Artificial Intelligence (AI). The findings show strong stabilization, steady optimization, and a cautious but accelerating move into monetization, with leaders pulling ahead on predictive analytics and AI-enabled care.

Data Maturity in Healthcare

Criteria

- Stabilized: central warehouse/lake with scheduled ETL and a starter data dictionary.

- Optimized: daily refresh, catalog + glossary, and first MDM domain.

- Monetized: enterprise-wide MDM, data products shared across functions, measurable ROI.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 85 / 53 / 24 | 99 / 88 / 43 | 100 / 99 / 58 | 100 / 100 / 65 | 100 / 100 / 75 |

| 2024 | 88 / 56 / 26 | 100 / 90 / 46 | 100 / 100 / 62 | 100 / 100 / 70 | 100 / 100 / 80 |

| 2025 | 90 / 58 / 27 | 100 / 92 / 48 | 100 / 100 / 64 | 100 / 100 / 72 | 100 / 100 / 82 |

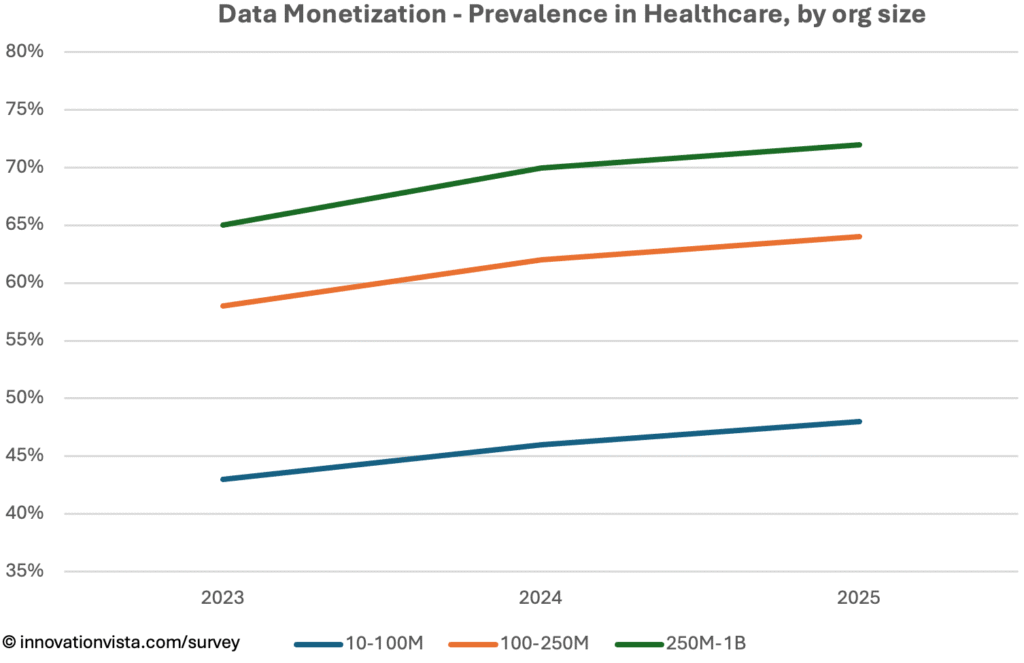

!nsights: Healthcare organizations are strong in data stabilization and optimization, which reached ubiquity across the mid-market by 2024. Monetization remains more modest, though progress is visible: in $250M–$1B firms, monetization climbed from 65% in 2023 to 72% in 2025. Smaller providers lag, with monetization below 30% even in 2025, reflecting barriers to investment and complexity of regulatory compliance.

BI Maturity in Healthcare

Criteria

- Stabilized: dashboards in place, weekly refresh, initial instrumentation.

- Optimized: governed semantic layer, KPI catalog with owners, data literacy programs.

- Monetized: predictive analytics, scenario planning, automated responses embedded in workflows.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 79 / 42 / 18 | 97 / 82 / 38 | 100 / 98 / 55 | 100 / 100 / 65 | 100 / 100 / 75 |

| 2024 | 82 / 44 / 19 | 98 / 85 / 41 | 100 / 99 / 58 | 100 / 100 / 70 | 100 / 100 / 80 |

| 2025 | 84 / 47 / 20 | 99 / 88 / 43 | 100 / 99 / 60 | 100 / 100 / 72 | 100 / 100 / 82 |

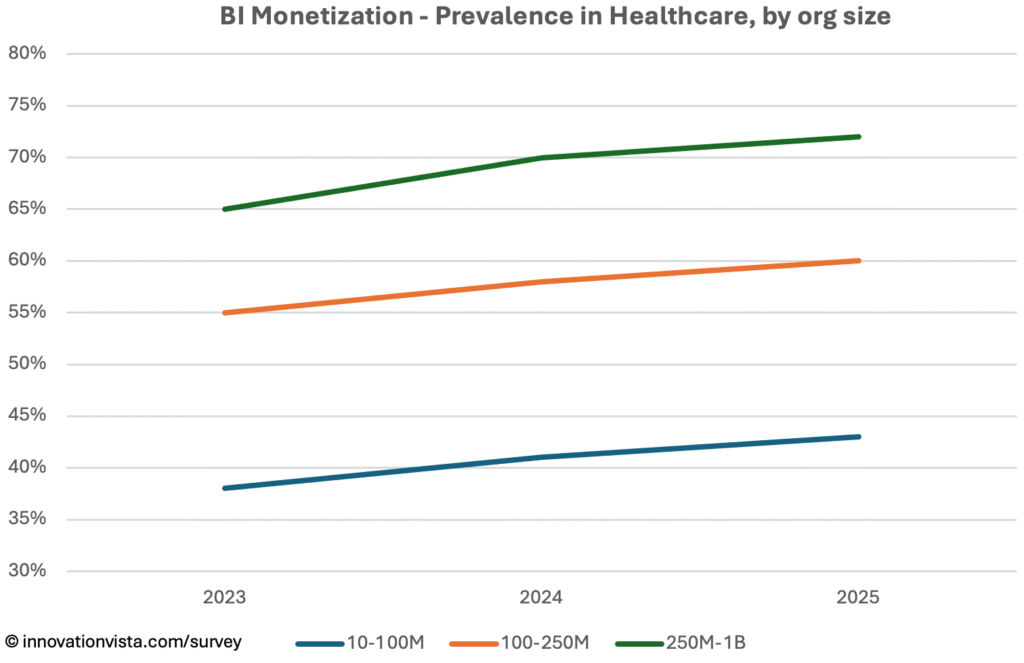

!nsights: BI is firmly established across Healthcare by 2025. Smaller organizations remain weaker at monetization – just 20% in <$10M firms – while large mid-market and enterprise players monetize BI heavily, with 70%+ adoption. Leading use cases include clinical quality dashboards, hospital throughput optimization, and predictive modeling of admissions and staffing needs.

AI Maturity in Healthcare

Criteria

- Stabilized: pilots and early deployments, prompt libraries, basic guardrails.

- Optimized: MLOps practices, model registries, evaluation frameworks, monitoring.

- Monetized: production AI delivering ROI – fine-tuned models, measurable revenue &/or cost impact.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 39 / 19 / 6 | 47 / 23 / 8 | 61 / 33 / 13 | 80 / 54 / 24 | 95 / 75 / 38 |

| 2024 | 44 / 23 / 7 | 54 / 30 / 10 | 67 / 41 / 18 | 83 / 60 / 28 | 96 / 85 / 42 |

| 2025 | 52 / 29 / 10 | 63 / 37 / 14 | 76 / 50 / 22 | 90 / 70 / 33 | 99 / 92 / 50 |

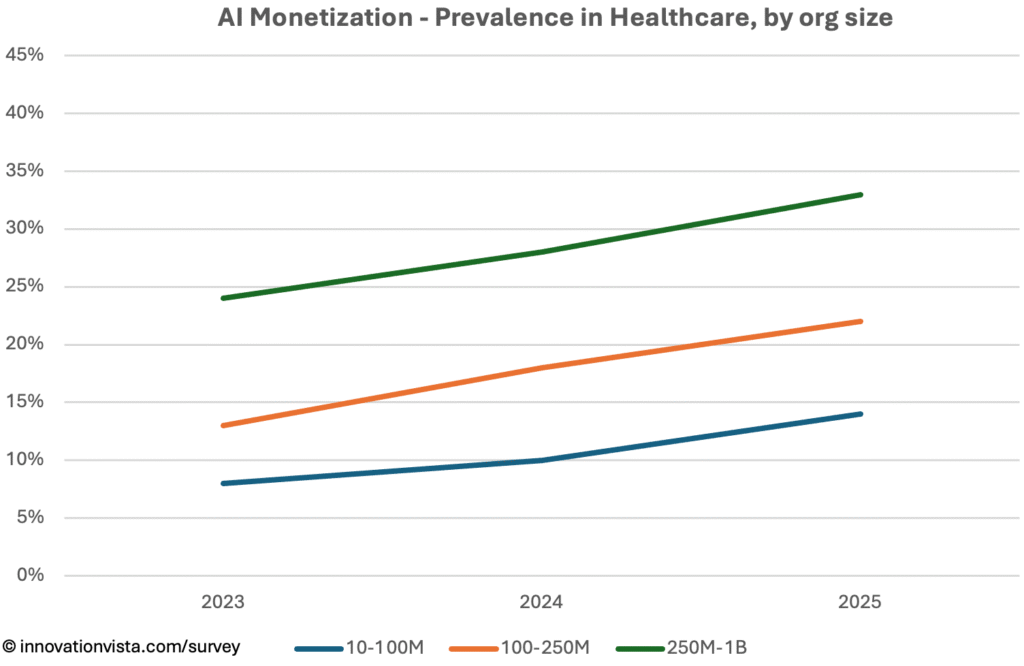

!nsights: AI is advancing, but with caution. Stabilization rates have climbed rapidly – over 60% of $10–$100M firms piloted AI by 2025 – but monetization is still rare at smaller scales. Larger organizations show more progress, with 33% monetizing AI in $250M–$1B firms and 50% in $1B+ enterprises. Common monetized use cases include imaging diagnostics, patient risk scoring, and AI-driven scheduling.

Healthcare Compared to Other Industries

- Strong in Data & BI: Healthcare matches or exceeds the mid-market average in stabilization and optimization, particularly due to regulatory rigor.

- Behind in AI monetization: Healthcare’s 2025 monetization rates lag leaders like Financial Services and Retail by 10–15 points, leaving headroom for growth.

- Regulatory pressures create dual effect: compliance drives optimization but slows innovation, explaining the sector’s cautious advance into monetization.

Company Spotlight: Monetizing Predictive Care

One regional hospital system illustrates how Healthcare organizations can move through the full maturity spectrum from stabilization to monetization. With multiple facilities and specialty clinics, the system began by stabilizing its data environment – integrating electronic medical records, billing systems, lab data, and imaging repositories into a centralized warehouse. This foundation enabled a reliable, single source of truth for patient and operational data.

The next step was optimization. The hospital system deployed BI dashboards that tracked throughput, average length of stay, and readmission rates. Clinical leaders used these insights to allocate staff, improve discharge planning, and monitor compliance with quality standards. Administrators gained new visibility into financial performance and resource utilization.

The monetization leap came when predictive analytics were applied to patient data. AI models now score patient risk in real time, flagging individuals most likely to be readmitted within 30 days. Care managers can intervene proactively, reducing costly readmissions. The financial benefit is twofold: avoiding regulatory penalties tied to readmissions, and increasing reimbursement by meeting value-based care benchmarks.

In this case, monetization doesn’t mean selling a product externally; it means translating stabilized and optimized analytics into measurable ROI. By aligning predictive insights with financial incentives, the hospital system demonstrates how Healthcare organizations can both improve patient outcomes and strengthen economic sustainability.

Strategic Implications for Healthcare CXOs

For Healthcare leaders, stabilization and optimization are already expected. The real challenge is monetization: turning insights into outcomes that improve patient care while delivering financial ROI.

Opportunities include:

- Predictive patient risk modeling to reduce readmissions.

- AI-driven imaging diagnostics to improve efficiency and accuracy.

- Operational analytics for staffing, scheduling, and capacity optimization.

- Population health management to proactively manage chronic conditions.

Healthcare firms that push through regulatory complexity and succeed in monetizing technology will improve both patient outcomes and financial sustainability. Those that hesitate risk falling behind not just competitors, but also new entrants from tech and retail that are moving into the health ecosystem.