Our experience in Financial Services IT & AI consulting shows us that these firms are among the most data-intensive organizations in the mid-market. From banking and lending to wealth management, insurance brokerage, and payments, the sector’s competitive edge has always rested on information. Regulatory scrutiny drives discipline, while customer expectations for personalized, digital-first experiences fuel investment.

The recent update to our Mid-market Analytics Maturity Survey provides a three-year lens (2023–2025) on how Financial Services companies are progressing across Data, Business Intelligence (BI), and Artificial Intelligence (AI). The findings confirm that this sector is one of the leaders in stabilization, optimization, and monetization, setting benchmarks that many other industries aspire to reach.

Data Maturity in Financial Services

Criteria

- Stabilized: central warehouse/lake with scheduled ETL and a starter data dictionary.

- Optimized: daily refresh, catalog + glossary, and first MDM domain.

- Monetized: enterprise-wide MDM, data products shared across functions, measurable ROI.

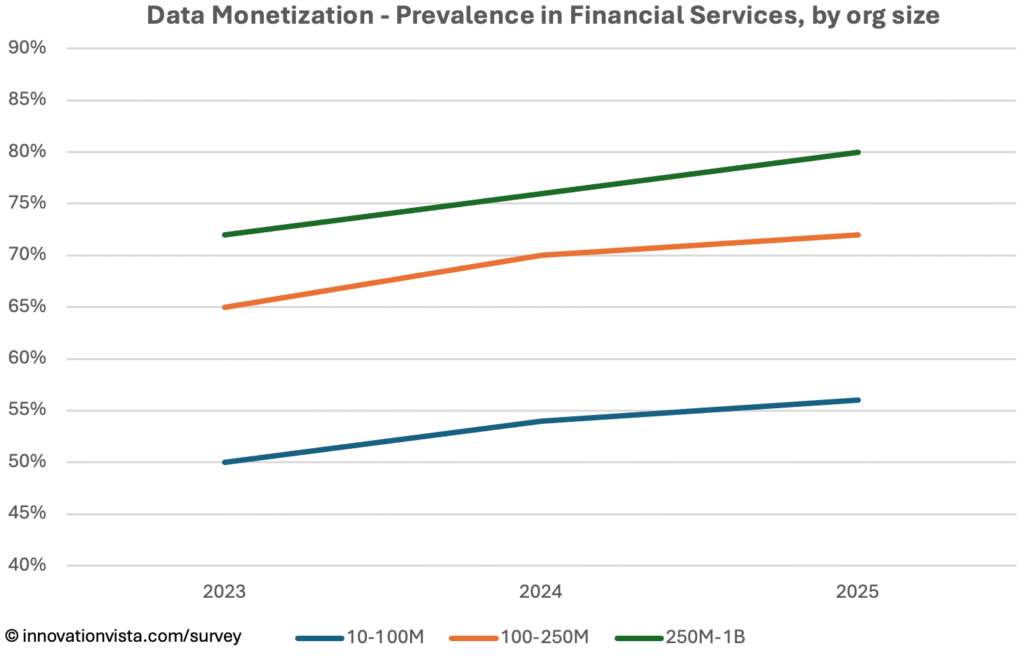

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 90 / 63 / 30 | 100 / 92 / 50 | 100 / 100 / 65 | 100 / 100 / 72 | 100 / 100 / 80 |

| 2024 | 92 / 66 / 32 | 100 / 94 / 54 | 100 / 100 / 70 | 100 / 100 / 76 | 100 / 100 / 85 |

| 2025 | 94 / 69 / 34 | 100 / 96 / 56 | 100 / 100 / 72 | 100 / 100 / 80 | 100 / 100 / 88 |

!nsights: Stabilization and optimization are virtually universal across Financial Services by 2025. Monetization rates lead the mid-market, exceeding 55% in $10–$100M firms and climbing past 80% in $250M–$1B companies. This reflects how data is directly embedded in revenue streams through risk models, customer segmentation, and regulatory technology.

BI Maturity in Financial Services

Criteria

- Stabilized: dashboards in place, weekly refresh, initial instrumentation.

- Optimized: governed semantic layer, KPI catalog with owners, data literacy programs.

- Monetized: predictive analytics, scenario planning, automated responses embedded in workflows.

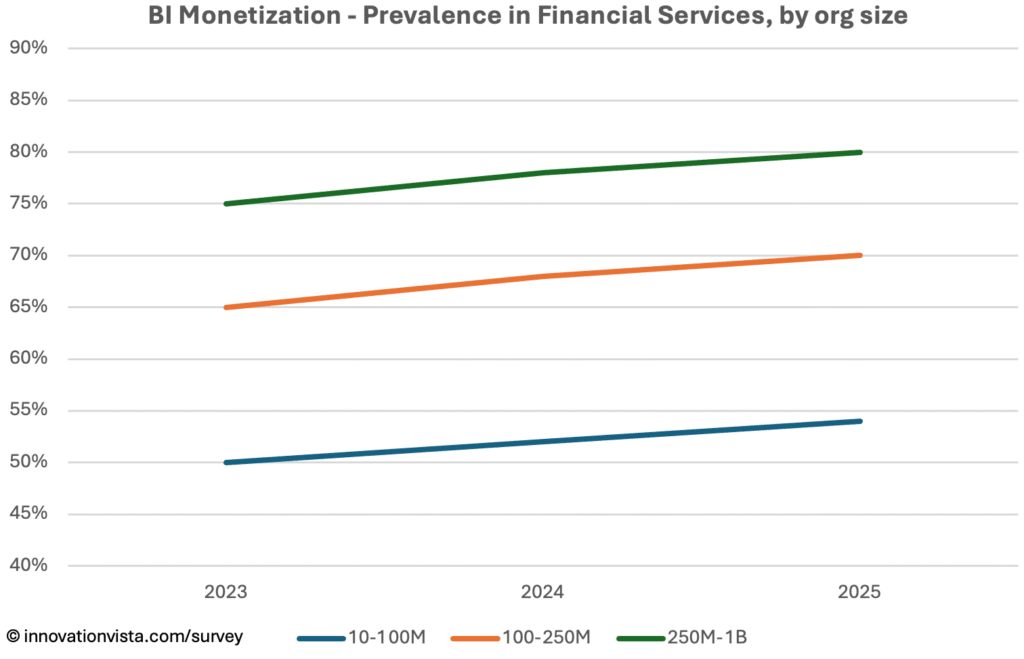

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 89 / 62 / 28 | 100 / 92 / 50 | 100 / 100 / 65 | 100 / 100 / 75 | 100 / 100 / 85 |

| 2024 | 92 / 64 / 30 | 100 / 94 / 52 | 100 / 100 / 68 | 100 / 100 / 78 | 100 / 100 / 88 |

| 2025 | 93 / 67 / 31 | 100 / 96 / 54 | 100 / 100 / 70 | 100 / 100 / 80 | 100 / 100 / 90 |

!nsights: BI is a core differentiator in Financial Services. By 2025, monetization sits at 54% in $10–$100M firms and reaches 80–90% in larger companies. Predictive analytics for credit risk, fraud detection, portfolio modeling, and scenario planning are embedded directly in client-facing offerings, making monetized BI not just an efficiency play but a competitive weapon.

AI Maturity in Financial Services

Criteria

- Stabilized: pilots and early deployments, prompt libraries, basic guardrails.

- Optimized: MLOps practices, model registries, evaluation frameworks, monitoring.

- Monetized: production AI delivering ROI – fine-tuned models, measurable revenue &/or cost impact.

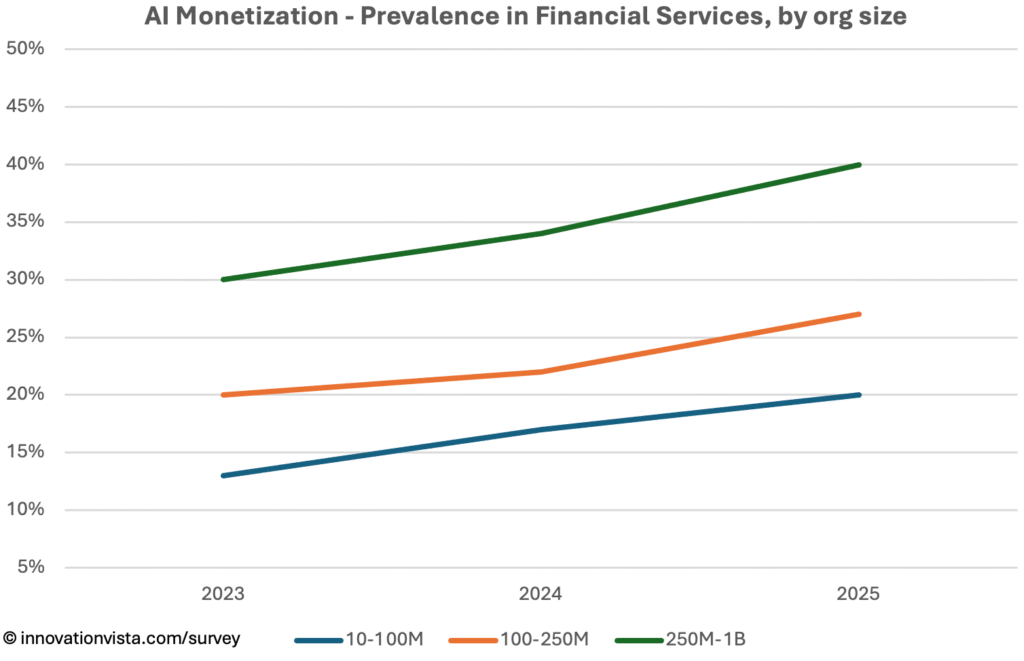

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 49 / 26 / 9 | 59 / 33 / 13 | 71 / 47 / 20 | 88 / 66 / 30 | 98 / 85 / 45 |

| 2024 | 54 / 31 / 11 | 64 / 39 / 17 | 76 / 52 / 22 | 90 / 70 / 34 | 98 / 91 / 50 |

| 2025 | 62 / 38 / 14 | 73 / 47 / 20 | 84 / 61 / 27 | 95 / 80 / 40 | 100 / 96 / 60 |

!nsights: Financial Services continues to lead the mid-market in AI adoption. By 2025, 73% of $10–$100M firms have stabilized AI pilots and nearly half have optimized. Monetization is visible across tiers: 20% in smaller mid-market firms, 40% in $250M–$1B companies, and 60% in large enterprises. Use cases include AI for underwriting, fraud prevention, customer service chatbots, algorithmic trading, and portfolio optimization – each delivering direct revenue or cost savings.

Financial Services Compared to Other Industries

- Clear leader across categories: Financial Services ranks in the top tier in Data, BI, and AI.

- Monetization ahead of average: Both BI and AI monetization are consistently 10–15 points higher than mid-market norms.

- Benchmark sector: For CXOs, Financial Services offers a model of how to move from stabilized and optimized to monetized, with customer-facing and revenue-driving use cases leading the way.

Company Spotlight: Turning Fraud Detection into a Product

One mid-sized Financial Services provider in the payments space demonstrates how firms can move from optimization into full monetization. Originally, the company built its data backbone by stabilizing transaction streams from merchants and partners, consolidating billions of payment records across regions and currencies into a unified warehouse.

With this stabilized infrastructure, the firm optimized by deploying BI dashboards and predictive models to monitor high-risk geographies, merchant categories, and transaction anomalies in near real time. These insights helped internal teams reduce fraud exposure and sharpen operational decision-making.

The breakthrough came when the firm began selling its intelligence externally. Leveraging AI-driven fraud detection models, it now offers merchants a premium service tier that reduces chargebacks and false positives. For merchants, the value is clear: fewer declined legitimate transactions, better customer experience, and lower fraud losses. For the provider, it transforms an internal control function into a revenue-generating product.

By embedding AI into its service offering, the company redefined its competitive position – no longer just processing payments, but actively protecting and enhancing merchant revenue. This example illustrates how Financial Services firms can turn compliance and risk management from cost centers into growth engines through monetization of IT and AI.

Strategic Implications for Financial Services CXOs

For Financial Services leaders, the opportunity is no longer to stabilize or optimize Data, BI, and AI – those are table stakes in this industry. Without that level of competence, it will be hard to stay a going concern. The challenge is to continue embedding monetization into products and services. Firms that tie AI to ROI in fraud prevention, customer personalization, and predictive financial modeling will continue to outpace peers. Those that hesitate risk losing clients to competitors who are already compounding the benefits of monetized technology.