Retail IT & AI Consulting

Proven Tech Leaders with Track Records in Retail

Retail IT & AI Experts

Retail may be the sector most transformed — and disrupted — by technology. From the rise of e-commerce to mobile shopping apps, curbside delivery, and AI-driven personalization, consumer expectations evolve faster here than almost anywhere else. Stores are no longer just physical locations; they are digital experiences, logistics hubs, and customer service platforms all rolled into one.

Through our flagship Contract CIO+® tech leadership service and our foundational CIO IQ® IT & AI Advisory offering, Innovation Vista delivers independent vendor-neutral IT & AI strategy to the Retail industry. Our consultants bring both deep technical expertise and hands-on experience leading IT for grocery chains, department stores, specialty retailers, auto dealers, and e-commerce brands. We understand where standard IT practices apply — and where retail requires unique strategies, such as unifying online and in-store experiences, ensuring supply chain agility, and protecting vast amounts of customer data.

Unlike firms that assign generalists, our experts have served as CIOs and technology leaders inside retail organizations. With Contract CIO+®, the mission goes beyond stabilizing and optimizing IT platforms — it’s about enabling technology that attracts shoppers, accelerates sales, and creates loyalty in one of the most competitive and fast-changing industries in the world.

Achievements for Retail & e-commerce clients from our Consulting team

Our Retail Scoreboard - Impact & Expertise

B.H. / Large Global Retailer

As Head of Store IT, led e-commerce upgrade of .com transacting $10B+/year, implemented onsite pickup tech in 2 months during Covid.

B.H. / Midsize Apparel Store chain

As Interim CIO, developed and led strategic roadmap for transforming IT into a nimble organization, modernizing infrastructure, supply chain automation & optimization initiatives.

B.M. / Large Discount store chain

As an expert consultant, designed AI project for "worker's next step" on key processes, reducing training time requirements 50%. Also developed vision AI system to identify & document clearance of OSHA violations in stores, enabling 99% same-day clearance.

B.M. / Pet Supply company

As CTO, developed & evolved the company's digital & tech strategy. Modernization efforts enabled a doubling of the company's rate of revenue growth.

D.E. / Midsize Consumer Goods co

As Head of IT for PE-owned group, led NetSuite ERP & WMS implementations, which transformed operations & analytics on portfolio of 15k+ SKUs.

K.W. / Large Hardware store chain

As CIO for the largest franchise-model home improvement store in the world, with over 8,000 locations, developed strategic tech vision and led huge expansion of e-commerce sales over 500%.

M.H. / Large Sporting Goods chain

As Head of IT, implemented strategic IT reorganization for e-commerce and mobile app platform, involving 37 significant projects in one year, driving a 3x growth of online sales the following year.

R.G. / Large e-commerce firm

As Head of Engineering, led a major back-office technology transformation involving data lake & warehousing, and Agile methodologies, nearly doubling the throughput on the flagship product.

S.W. / Large discount chain

As Head of IT Strategy, led installation of self-service kiosks, biometrics, mobile applications, KPI analytics executive dashboards which enabled platform integration of $17B acquisition. Generated $2M annually in tech-driven incremental revenue.

T.K. / Large international retail co

Over 12 year in charge of software development, leading DevOps, design & worldwide rollout of omni channel systems for 1100+ stores Pick, Pack, and Ship.

T.K. / Midsize Online Retailer

As Fractional CIO, completed IT turnaround including re-organized department & workload, migration of on-prem infrastructure to cloud services, saving $4.5M per year with improved performance.

State of Innovation in Retail and e-Commerce

Our 2026 Summary of Innovation in the Retail industry

The “Phygital” Store & The Media Pivot

Retail in 2026 has moved beyond simple “Omnichannel.” We are in the era of “Unified Commerce,” where the digital and physical carts are one and the same.

Retail Media Networks (RMNs) as Profit Centers: Retailers are becoming ad platforms. With margins on goods tightening, brands are using their first-party customer data to sell targeted advertising. IT teams are building sophisticated ad-tech stacks that rival traditional media companies to capture this high-margin revenue.

The War on Shrink (Computer Vision): The “honesty policy” is over. To combat organized retail crime without adding friction for paying customers, retailers are deploying Computer Vision and AI at the checkout and exit. These systems detect “misscanned” items in real-time without the need for aggressive security guards.

Hyper-Personalization 2.0: Generic segmentation is obsolete. Generative AI is now the “Personal Shopper” for every customer, analyzing purchase history and browsing behavior to generate unique product descriptions, bundles, and pricing offers dynamically for each individual.

RFID & Inventory Precision: “Click-and-Collect” breaks if inventory is wrong. RFID adoption has reached maturity, providing 99% inventory accuracy. Retailers without item-level tagging are struggling to fulfill omnichannel orders profitably due to high pick-failure rates.

Interested in Leveraging Some of these Tech Capabilities? An Assessment Could Be Step 1.

Is your tech platform and organization ready to scale and advance? Many of our clients choose to start with an IT & AI Assessment and Recommendations report.

This is a high-leverage first step to gain actionable insights from our Retail tech consulting team, validate your current IT and AI readiness, and discover how our expert collaboration can drive value for your organization’s future.

Retail Leaders First - Then Tech Leaders

Our Unique "Top-line ROI" Approach to Retail Technology

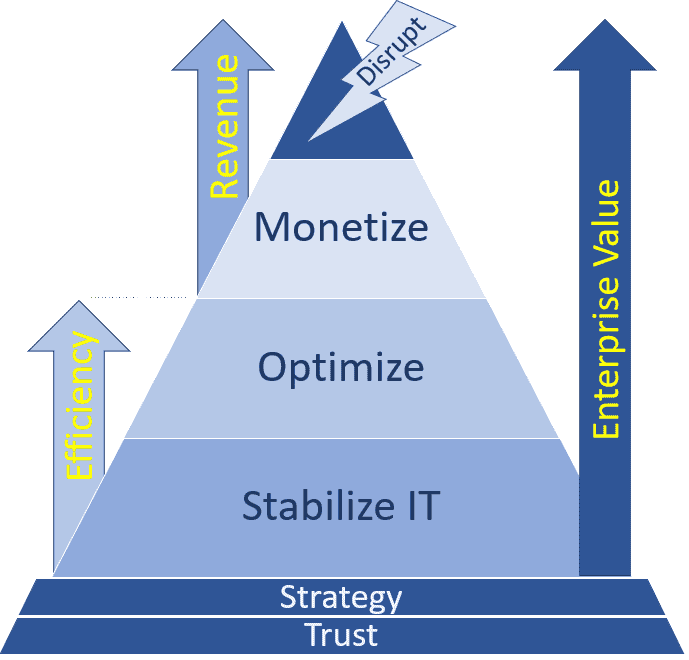

For many consulting firms, retail IT work stops at Stabilizing store systems, securing networks, and Optimizing POS and inventory platforms. Those foundations are important, but they don’t address the real challenge in retail: keeping up with consumers whose expectations shift faster than any other industry.

With Contract CIO+® and CIO IQ®, we anchor technology strategy in your customer and brand goals. For grocers, this could mean frictionless checkout and real-time supply tracking. For clothing or specialty retailers, the focus may be omnichannel platforms that unify online and in-store experiences. For auto dealers or e-commerce brands, it might involve mobile-first customer journeys, AI-driven personalization, or digital financing workflows. Each retail model has different needs, and the roadmap has to reflect them.

Where we differentiate most is in Monetizing IT. We help retailers Innovate Beyond Efficiency® by using technology and data to directly increase sales and loyalty. That might mean predictive analytics that anticipate demand, personalized promotions that boost conversion, or digital platforms that shorten the buying cycle. In retail, technology isn’t just back-office support — it’s often the storefront itself, the deciding factor in whether customers stay, shop, and return.

IT & AI Strategy for Your Retail Niche

Retail Sectors Covered

- Convenience stores

- Grocery Stores

- Shopping malls

- Specialty retailers

- Clothing stores

- Auto dealerships

- Home furnishing retailers

- Drug stores

- Department stores

- Super markets

- Consumer services

- Funeral homes & cemeteries

- Direct sales mail order companies

- e-Commerce

Latest Retail & e-commerce !nsights from Our Team:

Analytics Maturity in Retail · Analyzing our Mid-market Survey

Our experience in Retail IT & AI consulting has been at the forefront of technology adoption for decades, leveraging point-of-sale data, e-commerce platforms, loyalty programs, and increasingly AI-driven personalization. Competition is fierce, with razor-thin margins and constant disruption from digital-native entrants. For mid-market retailers, the challenge is not just stabilizing and optimizing technology but monetizing it — embedding intelligence into every interaction with customers. The recent update to our Mid-market Analytics Maturity Survey provides a three-year lens (2023–2025) on how Retail firms are progressing across Data, Business Intelligence (BI), and Artificial Intelligence (AI). The results show that Retail consistently leads the mid-market in AI adoption and monetization, while still facing gaps between smaller and larger players. Data Maturity in