Food Service IT & AI Consulting

Proven IT Leaders with Track Records in the Agriculture & Food Service Industries

Food Service IT Experts

From farms and fisheries to restaurants and grocery chains, the food service industry operates on thin margins and high expectations. Success depends on speed, safety, and reliability — with technology now driving everything from farm management and supply chain logistics to online ordering and customer engagement.

Through our flagship Contract CIO+® tech leadership service and our foundational CIO IQ® IT & AI Advisory offering, Innovation Vista delivers independent vendor-neutral IT & AI strategy to the Agriculture & Food Service industry. Our consultants pair deep technical expertise with real-world experience in agriculture, food production, distribution, and hospitality. We understand where broad IT practices apply — and where food service requires unique strategies, such as IoT systems to monitor freshness, compliance with FDA and FSIS standards, and platforms that balance operational efficiency with superior customer experience.

Unlike firms that send in generalists, our experts know the realities of this sector: delays and breakdowns affect not only profitability but also food safety and customer trust. With Contract CIO+®, the mission goes beyond stabilizing and optimizing systems — it’s about ensuring technology supports growth, streamlines delivery, and builds competitive advantage in one of the world’s most fast-paced industries.

State of Innovation in Food Service & Agriculture

Our 2026 Summary of Innovation in the Food Services industry

The Algorithmic Menu & The Labor Pivot

The Food Service industry in 2026 has fully embraced the “Digital Front Door.” With labor costs permanently higher, technology is the primary lever for protecting margins and ensuring consistency across multi-unit operations.

Dynamic Pricing & Digital Menus: Static pricing is dead. Leading brands are utilizing AI-driven digital menu boards and apps to adjust pricing and featured items in real-time based on inventory levels, weather, and peak demand, protecting margins during surges.

Reclaiming the Customer: Brands are fighting back against third-party delivery apps. By enhancing first-party loyalty apps with exclusive AI-personalized offers, restaurants are converting “anonymous delivery orders” into “loyal direct customers,” saving the 20-30% commission fees.

Voice AI at the Drive-Thru: To combat labor shortages, conversational AI handles order taking at the drive-thru and phone lines. This isn’t replacing staff; it’s reallocating them to the window and kitchen to improve speed-of-service and order accuracy.

Back-of-House Predictive Prep: AI is now the “Kitchen Manager.” Systems predict exact prep quantities based on historical data and local events, drastically reducing food waste (COGS) and ensuring freshness without relying on guesswork.

Interested in Leveraging Some of these Tech Capabilities? An Assessment Could Be Step 1.

Is your tech platform and organization ready to scale and advance? Many of our clients choose to start with an IT & AI Assessment and Recommendations report.

This is a high-leverage first step to gain actionable insights from our Food Services tech consulting team, validate your current IT and AI readiness, and discover how our expert collaboration can drive value for your organization’s future.

AgriculturE and Food Service Leaders First - Then Tech Leaders

Our Unique Approach to Food Service Technology

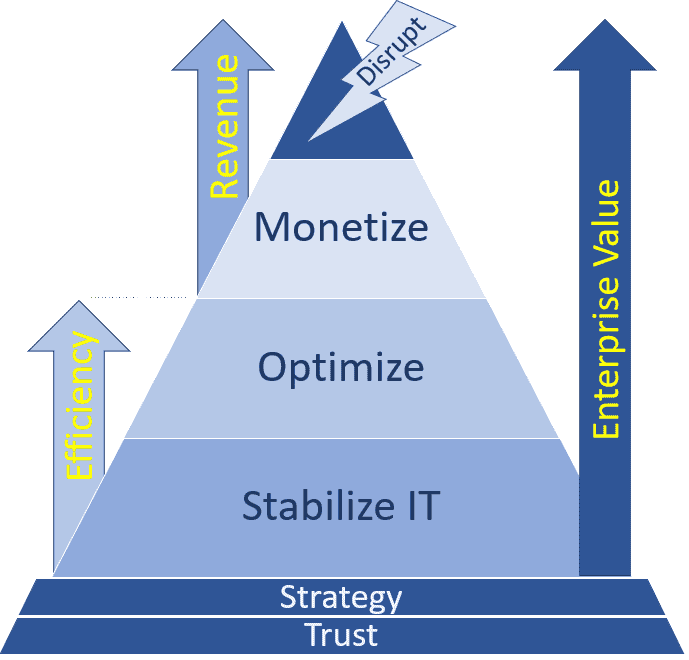

Most consulting firms stop at Stabilizing core IT platforms, improving cybersecurity, and Optimizing infrastructure and costs. While essential, those steps aren’t enough in food and agriculture, where supply chains are perishable, customer expectations are immediate, and compliance is non-negotiable.

With Contract CIO+® and CIO IQ®, we align IT strategy with your specific business drivers. For a food distributor, this may mean automating warehouse and delivery logistics. For a restaurant chain, the focus might be on mobile ordering and loyalty platforms. For a processor or producer, priorities could include IoT monitoring, traceability, and compliance reporting. Every organization in the food service ecosystem faces different challenges, and the roadmap must reflect those realities.

Where we create the biggest impact is in Monetizing technology. We help clients Innovate Beyond Efficiency® by turning IT and data into engines for growth — whether by enabling predictive analytics to optimize supply and demand, creating consumer-facing apps that drive repeat business, or leveraging digital platforms that differentiate your brand in a crowded marketplace. In food service, technology isn’t just back-office support; it’s a core ingredient of profitability, safety, and customer loyalty.

IT Strategy for Your Food Service Niche

Agricultural Sectors Covered

- FDA, FSIS, SOC audit compliance

- Farming

- Ranching

- Farm & Ranch treatment & optimization

- Fishing & marine harvesting

- Packaged food processing

- Beverages

- Grocery stores

- Bars & Restaurants

- Food distribution

- Horticulture

- Renewables

- Animal products

- Custom software & model development

Latest Agriculture & Food Service Tech !nsights from Our Team:

Analytics Maturity in Food Services · Analyzing our Mid-market Survey

As we know well from our Agriculture & Food Service IT & AI consulting, this industry sits at the crossroads of tradition and innovation. Many companies in this sector are still rooted in manual operations and seasonal rhythms, while others are racing ahead with IoT sensors, supply chain visibility, and AI-driven demand forecasting. The diversity in maturity is striking. The recent update to our Mid-market Analytics Maturity Survey provides a three-year lens (2023–2025) on how Agriculture & Food Service companies are evolving across Data, Business Intelligence (BI), and Artificial Intelligence (AI). The results highlight steady improvement in stabilization and optimization, but also underscore how far many firms still have to go in monetizing these capabilities. Data Maturity in Agriculture