Financial Services IT & AI Consulting

Proven IT Leaders with Track Records in the Financial Services & Fintech Industries

Financial Services IT Experts

The financial services sector has always been at the leading edge of technology – from mainframes and ATMs to mobile apps and fintech platforms. Today, the industry faces even greater challenges: protecting customer data, navigating ever-tightening regulations, and meeting rising expectations for seamless, digital-first services. Finance has a special place in our hearts, as our founder spent a good deal of his career working in this space, serving as CIO for two subsidiaries of money center banks.

Through our flagship Contract CIO+® tech leadership service and our foundational CIO IQ® IT & AI Advisory offering, Innovation Vista provides independent vendor-neutral IT & AI strategy to the Financial Services industry. Our consultants combine deep technical expertise with direct experience leading IT for banks, credit unions, investment firms, and fintech startups. We know where general IT best practices apply, and where financial services require specialized strategies for compliance, cybersecurity, and digital transformation.

Unlike firms that place generalists into financial roles, our experts have been CIOs, CTOs, and CISOs in the sector. With Contract CIO+®, the focus is not just on stabilizing and optimizing technology platforms, but on aligning IT with your core priorities: safeguarding trust, scaling digital channels, and creating capabilities that drive competitive advantage in a fast-moving marketplace.

Achievements for Financial Services clients from our Consulting team

Our Financial Services Scoreboard - Impact & Expertise

A.J. / Financial Data Company

Led Software Engineering team for 2 years

A.J. / Structured Data Product firm

Led the Analytics development team for 3 years

A.R. / European Wealth Advisor

As Interim CTO, transitioned company to new ownership, developed new IT strategic roadmap, integrated infrastructure and initiated an AI program which created competitive advantage and grew market-share.

A.S. / Community Bank

Vice-Chairman and head of Technology

B.A. / Business Payroll Division of Large Bank

As CIO/CISO, led technology strategy to enable a 20-fold increase in revenue for the division.

B.B. / Community Bank

As head of IT operations, led a tripling of the bank's branches over a 3 year period.

B.E. / Regional Bank

As CIO, initiated an automation program, secured rare '1' rating on FDIC IT audit, and facilitated a successful sale/merger of the bank.

B.W. / Electronic Stock Exchange

Led the acquisition & integration of 10 tech companies and smaller electronic stock exchanges

B.W. / Hedge Fund Services firm

As CTO, led a Digital transformation of their business model and a global expansion

C.C. / Loan Origination Software firm

As CIO, led the development & enhancement of custom loan underwriting software supporting hundreds of banking clients

C.V. / Proprietary Trading firm

Led an upgrade a expansion of the firm's IT platform, creating a scalable performant enterprise.

C.W. / Investment Management firm

As CIO advisor, provided strategic roadmap and interim IT leadership to several port-co's, improving system performance and stability while reducing costs 5%-9%

D.B. / Money Center Bank

Led the development of custom proprietary trading system which handles billions in transactions for the firm and its clients

D.B. / Money Center Bank

Led the Client Reporting BI function for a top 20 global bank

D.C. / Canadian Credit Union

As CIO, developed and executed a digital transformation & upgrade program for the CU.

D.F. / Mortgage company

Led Cybersecurity strategy & execution for a midsize mortgage origination company

D.N. / Consumer Finance Startup

Served as Virtual CIO/IT strategy advisor and Angel investor for a tech-forward fintech startup

D.T. / Regional Bank

As contract Head of Enterprise Architecture, developed strategic digital roadmaps for both Commercial and Consumer lines of business.

F.J. / Fintech startup

Led startup tech strategy, platform architecture, team leadership, and AI/software development

F.V. / Fintech startup

As Virtual CIO, led the IT strategy & development of a personal finance digital advice platform

F.V. / Institutional Investment Management

As Interim CIO, led a turnaround of the IT organization & platform of a major institutional investment management firm

G.B. / Large Payments processor

As Head of IT security & compliance, led network engineering, cybersecurity, and governance compliance, reducing spend by $18M over 2.5 years.

G.C. / Fintech startup

Advisory board member of a tool to evaluate traders' performance in a real-time, full-market simulation

G.C. / Lending tools software firm

Led Software Engineering on a suite of products to support consumer finance lenders through the full lending cycle

G.M. / Major Credit Bureau

Led the Enterprise Information Architecture function, which is central to the firm's credit scoring algorithms

H.T. / Moneycenter Bank

As Group CTO, upgraded and unified the data & integration architecture, established sound data governance to position for trustworthy AI.

J.B. / Digital Transactions clearinghouse

Head of Information Protection & Compliance for a digital billing & payments transactions service.

J.H. / Regional Bank

As Interim CIO, led the IT organization through acquisition by a larger competitor

J.H. / Regional Bank

Advised the C-suite and IT leadership on e-commerce strategy

J.K. / Banking Software company

Led the New Technology efforts for the leading provider of banking software in the U.S., achieving $2M in recurring savings

J.K. / European Fintech SaaS startup

Provided initial IT strategy & architecture guidance for startup until transitioning to full-time leadership

J.K. / Financial Services Software firm

As Interim CIO, led completion of strategic mobile app development before transitioning IT to full-time leadership

J.K. / Mortgage Services company

As CIO, led a digital transformation of their business model which drove 40% in costs reduction

J.K. / Retirement Plan management firm

As CIO, led major upgrade and consolidation of software systems support multi-millions of customers, over $100B in AUM

J.O. / Large Investment Advisory firm

As CIO, transitioned to cloud, agile/devops best practices and leveraged offshore resources in India & Latin America, driving 30% reduction in IT costs.

J.R. / Investment Management firm

As CTO, led a major process & IT platform upgrade to position technology as a strategic advantage for the firm

J.R. / Mortgage division of Money Center Bank

As CTO, transformed IT into a profit center via the upsale of analytics data & reporting to portfolio investors

M.B. / Fintech bill-pay startup company

Led a major infrastructure, cybersecurity, and cloud upgrade to enable 15x scaling for a SaaS startup in the fintech bill-pay space.

M.D. / European Financial Services firm

As CTO, led the upgrade of corporate infrastructure and fully revamped information security protections, achieving major improvements while holding overall spend relatively flat.

M.D. / U.K. Financial Services firm

Advised on fintech strategy to create unique capability for competitive advantage.

M.P. / Investment Management firm

Led design & development of a custom system providing strategic competitive advantage to the firm

M.R. / Financial Ratings Agency

As GRC Consultant & Fractional CISO, recommended, surveyed, and implemented Identity Access Mgmt. (IdAM), Data Loss Protection (DLP), & Cloud Access Security Broker (CASB) protections.

M.R. / Large Financial institution

As Fractional CISO, integrated secure CI/CD pipeline, upgraded data protection, identity management, and vulnerability management.

M.R. / Payment Processing Software firm

Over a decade leading the software development & tech services delivery functions for a major payment processor

M.T. / Equipment Finance company

As Virtual CTO, led the design & development of a blockchain-based custom lending platform to syndicate financing of industrial equipment

R.B. / Large Canadian Credit union

As Senior VP and Head of Innovation for 4 years, led a major upgrade of the credit union's underwriting & account processing systems, integrating them for advanced analytics.

R.B. / Nationwide Credit Unions

Spent 7 years as the top cybersecurity executive at two different credit unions with U.S. nationwide footprints

R.M. / Billing & Payment Processor

As CTO over two decades' tenure, led the development of the company's flagship e-commerce payments & billing products

R.R. / Asset Management firm

As CTO, powered expansion of firm into seven business lines including ABS, CRE, mortgages, structured Lending, PE, and a REIT.

R.U. / Lease Financing Company

Served as Virtual CIO leading IT for 6 years until the company grew to need a full-time CIO

S.A. / Global Insurance Giant

Led their IT GRC initiative & IT Finance oversight, driving 10% savings on a $250M IT budget

S.H. / Subscriptions management SaaS co

As Fractional CTO, transformed their technology strategy from B2C to B2B and streamlined their resource/project planning.

S.P. / Capital Investment subsidiary of a Global Conglomerate

Led their global Digitization process for enabling functions

T.K. / Crypto Currency Wallet Platform

Served as Head of Engineering for a major Crypto Currency Asset Management platform

T.K. / Online Brokerage

Served as Manager of Software Engineering, leading development of their custom e-brokerage platform

T.K. / Midsize Mortgage company

As CIO and CAO for over a decade, led the digital transformation of the company's underwriting and servicing systems to become a strategic advantage

Z.K. / Major Financial Ratings agency

Led infrastructure/cybersecurity upgrade which both raised stability and saved $2M/year for the organization.

State of Innovation in Financial Services

Our 2026 Summary of Innovation in the Financial Services industry

The Trust Economy & The AI Regulator

The Financial Services sector in 2026 is operating under a new mandate: innovation must be auditable. The “move fast and break things” era is over; the “move fast and prove it” era is here.

The “Black Box” Ban: Regulators are cracking down on opaque AI models. Institutions are now required to demonstrate “Explainable AI” (XAI) for credit scoring and risk modeling. If you cannot explain why the AI made a decision, you cannot deploy it.

Deepfake Defense: The fraud landscape has shifted. Cybersecurity teams are battling AI-generated deepfakes used in social engineering attacks against high-net-worth clients and internal transfer approvals. Identity verification technology is undergoing a massive overhaul.

Open Finance Maturity: We have moved beyond simple Open Banking. Data portability is now the standard. Institutions that hoard data are losing customers to those that leverage API ecosystems to offer holistic, “financial health” dashboards.

Hollowing out the Core: To compete with nimble Fintechs, incumbents are accelerating “Core Modernization” not by ripping and replacing, but by “hollowing out” legacy mainframes—moving product logic to the cloud while keeping the ledger stable.

Interested in Leveraging Some of these Tech Capabilities? An Assessment Could Be Step 1.

Is your tech platform and organization ready to scale and advance? Many of our clients choose to start with an IT & AI Assessment and Recommendations report.

This is a high-leverage first step to gain actionable insights from our Financial Services consulting team, validate your current IT and AI readiness, and discover how our expert collaboration can drive value for your organization’s future.

Financial Services Leaders First - Then tech consultants

Our Unique "Top-Line ROI" Approach to Financial Services IT & AI Strategy

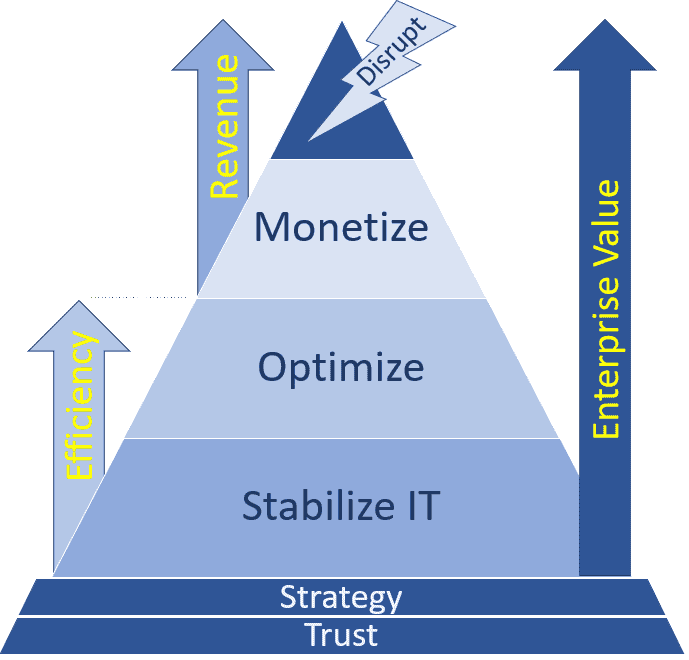

Like many consulting firms, we help financial institutions with Stabilizing IT platforms, protecting sensitive data, and Optimizing architecture, service levels, and budgets. These are critical foundations – but in financial services, they are only the starting line.

With Contract CIO+® and CIO IQ®, we begin by aligning IT strategy with your firm’s broader objectives. For a bank, that could mean preparing for regulatory exams while enabling new digital banking products. For an investment manager, it may involve modernizing data pipelines to support analytics and AI. For a fintech startup, the priority is often scalability and speed-to-market. The “right” technology strategy is always tied to your business model, regulatory environment, and growth goals.

Where we deliver the greatest impact is in Monetizing technology. We help clients Innovate Beyond Efficiency® by turning IT and data into revenue enablers — whether through digital platforms that attract new customers, analytics that drive smarter lending and investing decisions, or capabilities that command higher valuations. In financial services, technology isn’t just an enabler of compliance and security; it’s a lever for market share, enterprise value, and long-term advantage.

IT & AI Strategy for Your Financial Services Niche

Financial Services Sectors Covered

- CFPB, FINRA, SEC, FFIEC audit compliance

- Banking

- Investment banking

- Investment management

- Consumer lending

- Commercial lending

- Mortgage lending

- Mortgage servicing

- Mortgage insurance

- Financial exchanges

- Commodity & currency exchanges

- Commercial & personal insurance

- Financial services specialty software

Analytics Maturity in Financial Services · Analyzing our Mid-market Survey

Our experience in Financial Services IT & AI consulting shows us that these firms are among the most data-intensive organizations in the mid-market. From banking and lending to wealth management, insurance brokerage,

Getting Started with AI · A Guide for Financial Services Firms

Artificial intelligence (AI) is reshaping financial services at breakneck speed. From fraud prevention and underwriting to portfolio modeling and customer personalization, AI is no longer just a futuristic concept; it is already

Turning IT into a Profit Center · Client Success Story

Innovation Vista keeps our past clients and partnerships confidential. Unless you choose to publicize our joint work, the public – and specifically your competitors – will not know you are working with