As a consulting firm and experts in Business & Professional Services IT & AI consulting, we know this sector – spanning consulting, legal support, staffing, accounting, marketing, and related disciplines – very well. We understand that these sectors are all information-rich yet personnel-dependent by nature. Their most strategic assets walk out the door every evening in the form of people and expertise, so competitive advantage often hinges on how effectively those people leverage data and technology.

The recent update to our Mid-market Analytics Maturity Survey provides a three-year view (2023–2025) of how Business & Professional Services firms are maturing in their use of Data, Business Intelligence (BI), and Artificial Intelligence (AI). The data shows strong stabilization and optimization across the sector, with monetization starting to emerge, especially in BI, where firms are packaging insights into client-facing services.

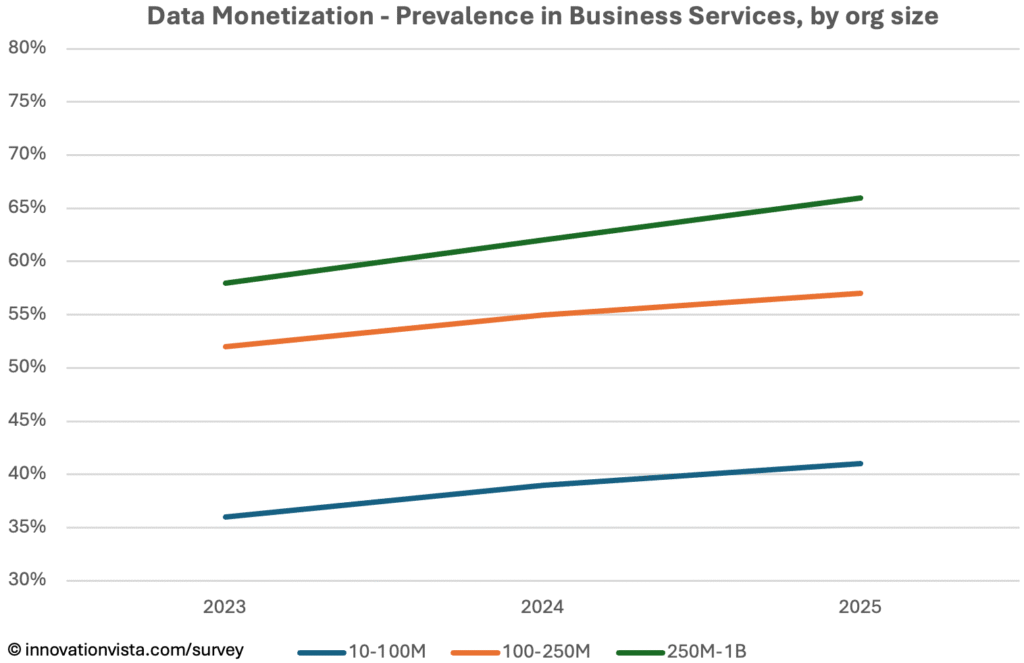

Data Maturity in Business & Professional Services

Criteria

- Stabilized: central warehouse/lake with scheduled ETL and a starter data dictionary.

- Optimized: daily refresh, catalog + glossary, and first MDM domain.

- Monetized: enterprise-wide MDM, data products shared across functions, measurable ROI.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 76 / 37 / 16 | 97 / 76 / 36 | 100 / 97 / 52 | 100 / 100 / 58 | 100 / 100 / 68 |

| 2024 | 78 / 40 / 17 | 98 / 79 / 39 | 100 / 98 / 55 | 100 / 100 / 62 | 100 / 100 / 72 |

| 2025 | 80 / 42 / 18 | 98 / 82 / 41 | 100 / 99 / 57 | 100 / 100 / 66 | 100 / 100 / 76 |

!nsights: Stabilization and optimization are effectively complete in this sector by 2025. Monetization, however, remains modest in the lower mid-market – just 41% in $10–$100M firms – though larger firms are above 65%. The spread shows many firms still treat data as an internal efficiency tool, while leaders are using it as a client-facing differentiator.

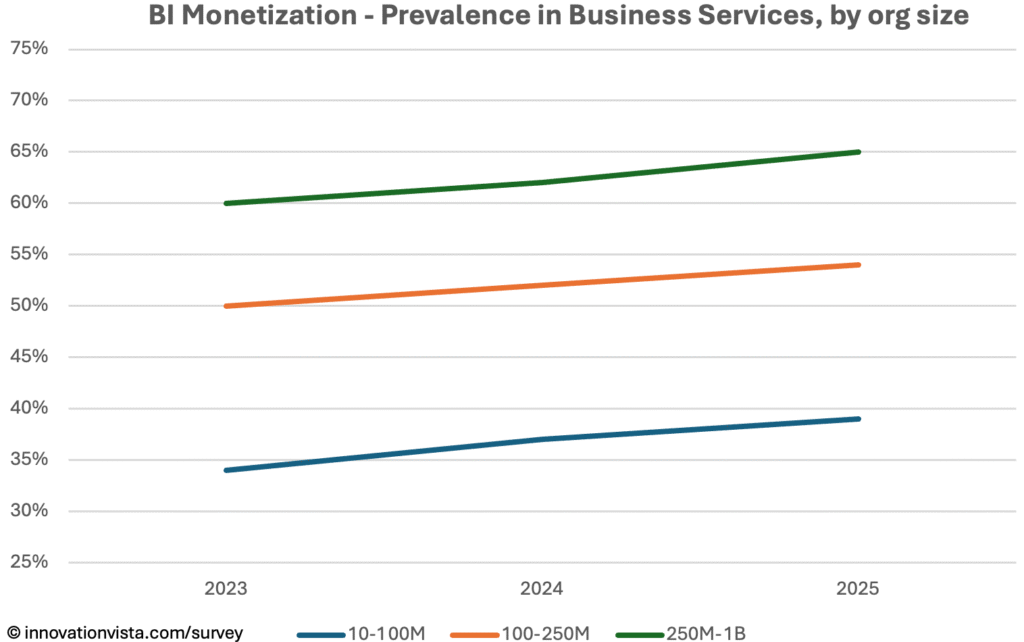

BI Maturity in Business & Professional Services

Criteria

- Stabilized: dashboards in place, weekly refresh, initial instrumentation.

- Optimized: governed semantic layer, KPI catalog with owners, data literacy programs.

- Monetized: predictive analytics, scenario planning, automated responses embedded in workflows.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 73 / 34 / 14 | 97 / 74 / 34 | 100 / 96 / 50 | 100 / 100 / 60 | 100 / 100 / 70 |

| 2024 | 76 / 36 / 15 | 98 / 79 / 37 | 100 / 96 / 52 | 100 / 100 / 62 | 100 / 100 / 72 |

| 2025 | 78 / 39 / 16 | 99 / 82 / 39 | 100 / 97 / 54 | 100 / 100 / 65 | 100 / 100 / 75 |

!nsights: BI is a strong point for Business & Professional Services. Stabilization and Optimization are nearly universal, and Monetization is becoming more common particularly in larger firms, where more than 60% monetize BI in 2025. In practice, this often means embedding dashboards, scenario modeling, or predictive analytics into client deliverables, enabling firms to command higher fees. Smaller firms are slower, with monetization below 40%, showing a significant gap that creates competitive risk.

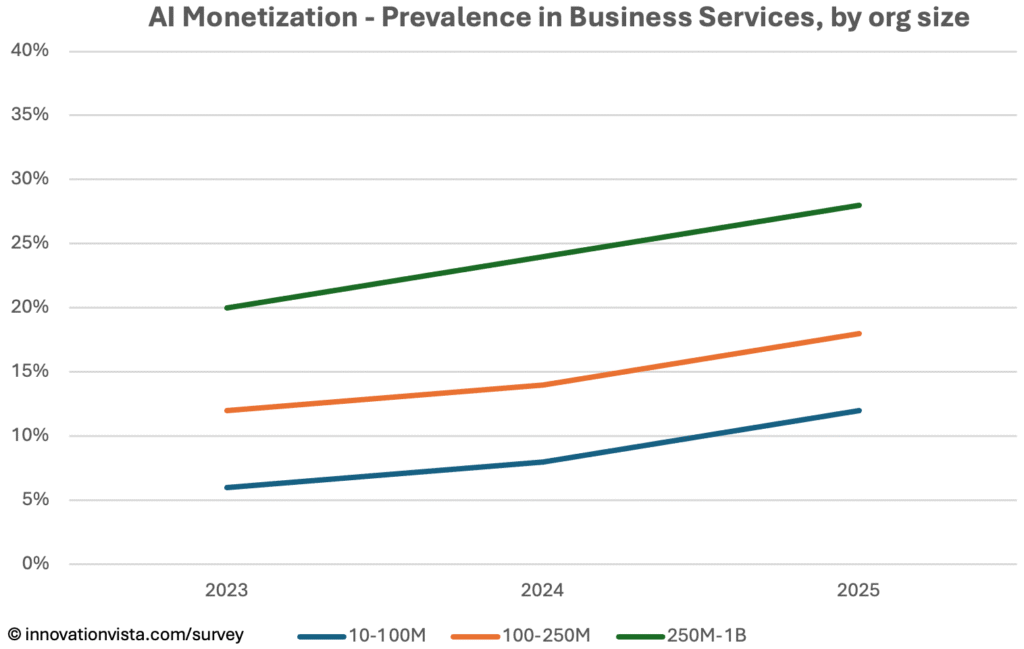

AI Maturity in Business & Professional Services

Criteria

- Stabilized: pilots and early deployments, prompt libraries, basic guardrails.

- Optimized: MLOps practices, model registries, evaluation frameworks, monitoring.

- Monetized: production AI delivering ROI – fine-tuned models, measurable revenue &/or cost impact.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 30 / 13 / 4 | 38 / 18 / 6 | 52 / 28 / 12 | 70 / 46 / 20 | 88 / 70 / 34 |

| 2024 | 38 / 18 / 6 | 46 / 24 / 8 | 60 / 34 / 14 | 78 / 52 / 24 | 94 / 79 / 40 |

| 2025 | 45 / 23 / 8 | 55 / 30 / 12 | 69 / 42 / 18 | 86 / 62 / 28 | 98 / 88 / 45 |

!nsights: AI adoption is rising quickly but remains uneven. By 2025, 55% of $10–$100M firms have stabilized AI pilots, but only 12% monetize them. Larger firms are moving faster: in $250M–$1B companies, monetization reaches 28%, often through AI-powered knowledge management, contract analysis, or staffing optimization. The gap between stabilized and monetized is the widest of all three categories, underscoring that while pilots are common, ROI is still elusive for most.

Business & Professional Services Compared to Other Industries

- Ahead of laggards: CRE, Real Estate, and Education remain slower in all categories, making Business & Professional Services relatively strong by comparison.

- Close to the average: Data and BI maturity align closely with the mid-market average, though monetization lags leaders like Financial Services.

- Middle tier in AI: Ahead of Education and Real Estate, but trailing sectors like Retail and Entertainment, where AI monetization is much further advanced.

Company Spotlight: Turning Talent Data into Revenue

One mid-sized professional services firm in the recruiting and staffing sector shows how Business & Professional Services companies can move from optimization into monetization. For years, the firm operated like most staffing providers, relying on recruiters’ intuition and networks to match candidates with open roles.

The turning point came when the company stabilized its data. It centralized decades of placement history, candidate resumes, and client performance feedback into a unified data backbone. With this stabilized foundation, the firm then optimized by applying analytics dashboards for recruiters and managers. These tools improved visibility into pipeline health, recruiter productivity, and client satisfaction metrics.

The monetization breakthrough came when the firm embedded AI into its client-facing offerings. Using machine learning models trained on historic placements and success outcomes, the platform now predicts candidate fit, expected tenure, and even projected performance in given roles. Clients can opt into a premium service tier that guarantees faster fills and higher retention, with fees tied directly to outcomes.

By shifting from “staffing as a service” to “intelligence as a product,” the company captured new revenue streams, improved margins, and deepened client loyalty. This example illustrates how a Business & Professional Services firm can move from stabilized and optimized systems into monetization, turning IT and AI into the very product clients are paying for.

Strategic Implications for Business & Professional Services CXOs

For Business & Professional Services leaders, stabilization and optimization are table stakes; they’re already nearly universal. The opportunity now is in monetization: embedding intelligence into client offerings, turning BI dashboards into advisory products, and deploying AI tools that create measurable ROI.

The firms that make this leap will command premium fees, deepen client relationships, and protect margins. Those that remain at optimized-only risk being commoditized in a market where clients increasingly expect data-driven insights as part of the service.