Our experience in Retail IT & AI consulting has been at the forefront of technology adoption for decades, leveraging point-of-sale data, e-commerce platforms, loyalty programs, and increasingly AI-driven personalization. Competition is fierce, with razor-thin margins and constant disruption from digital-native entrants. For mid-market retailers, the challenge is not just stabilizing and optimizing technology but monetizing it — embedding intelligence into every interaction with customers.

The recent update to our Mid-market Analytics Maturity Survey provides a three-year lens (2023–2025) on how Retail firms are progressing across Data, Business Intelligence (BI), and Artificial Intelligence (AI). The results show that Retail consistently leads the mid-market in AI adoption and monetization, while still facing gaps between smaller and larger players.

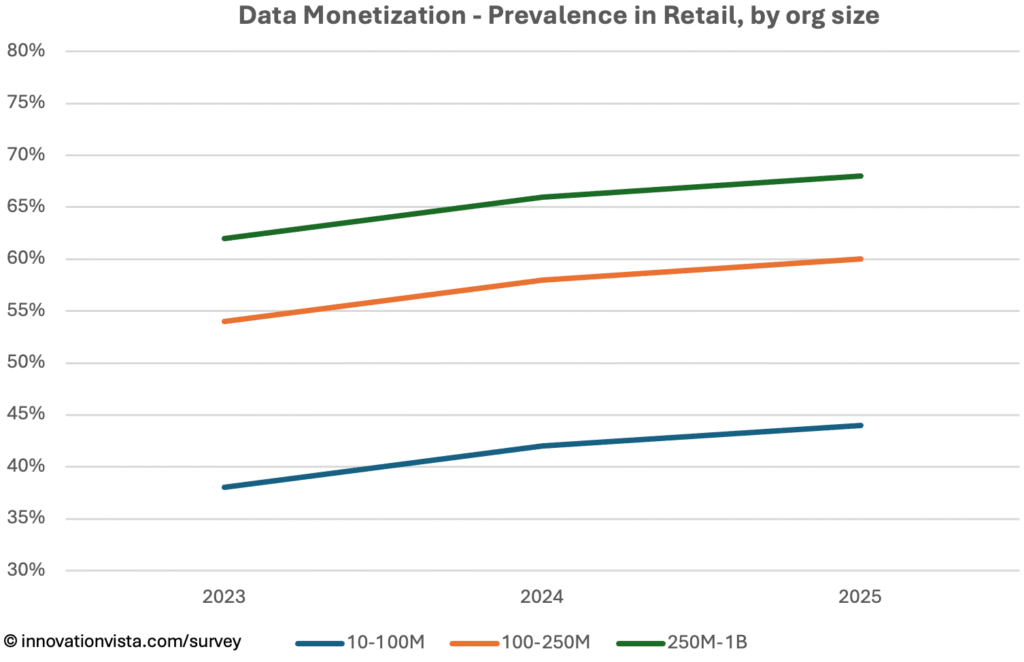

Data Maturity in Retail

Criteria

- Stabilized: central warehouse/lake with scheduled ETL and a starter data dictionary.

- Optimized: daily refresh, catalog + glossary, and first MDM domain.

- Monetized: enterprise-wide MDM, data products shared across functions, measurable ROI.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 80 / 42 / 19 | 97 / 80 / 38 | 100 / 96 / 54 | 100 / 100 / 62 | 100 / 100 / 72 |

| 2024 | 82 / 44 / 20 | 98 / 83 / 42 | 100 / 98 / 58 | 100 / 100 / 66 | 100 / 100 / 76 |

| 2025 | 84 / 47 / 21 | 99 / 86 / 44 | 100 / 99 / 60 | 100 / 100 / 68 | 100 / 100 / 78 |

!nsights: Retail firms are universally stabilized and optimized by 2025, and monetization is strong: 44% of $10–$100M firms monetize data, while larger firms are above 60–70%. Data monetization is often tied to loyalty programs, customer insights, and supplier-funded analytics.

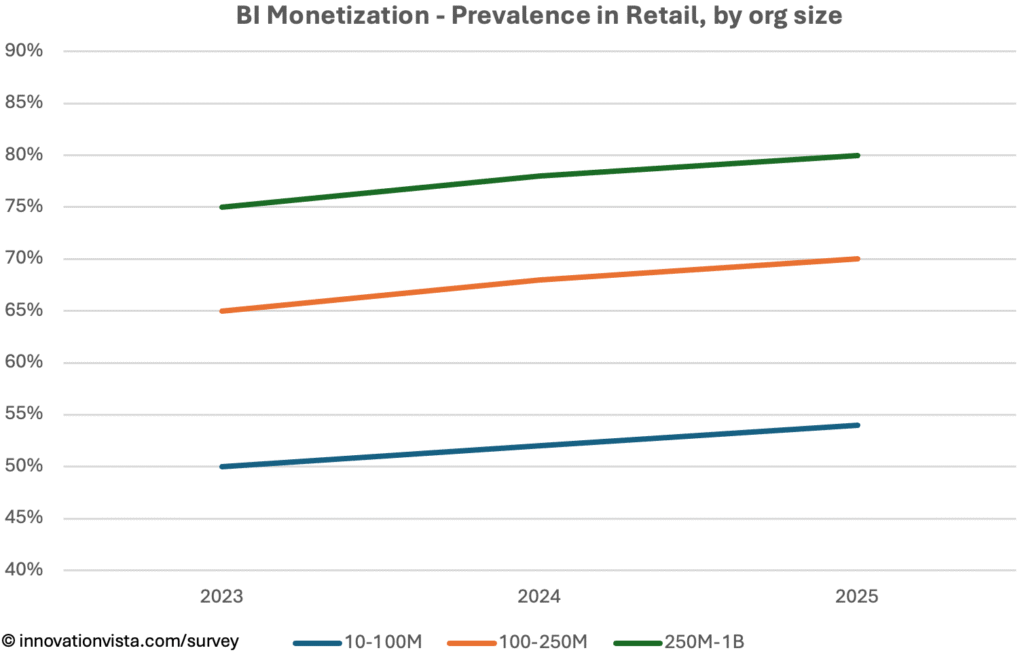

BI Maturity in Retail

Criteria

- Stabilized: dashboards in place, weekly refresh, initial instrumentation.

- Optimized: governed semantic layer, KPI catalog with owners, data literacy programs.

- Monetized: predictive analytics, scenario planning, automated responses embedded in workflows.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 89 / 62 / 28 | 100 / 92 / 50 | 100 / 100 / 65 | 100 / 100 / 75 | 100 / 100 / 85 |

| 2024 | 92 / 64 / 30 | 100 / 94 / 52 | 100 / 100 / 68 | 100 / 100 / 78 | 100 / 100 / 88 |

| 2025 | 93 / 67 / 31 | 100 / 96 / 54 | 100 / 100 / 70 | 100 / 100 / 80 | 100 / 100 / 90 |

!nsights: BI in Retail is nearly flawless by 2025. Monetization reaches 54% in $10–$100M firms and up to 90% in $1B+ companies. Customer-facing analytics, dynamic assortment planning, and predictive demand modeling are widely monetized, making BI not just a management tool but a competitive weapon.

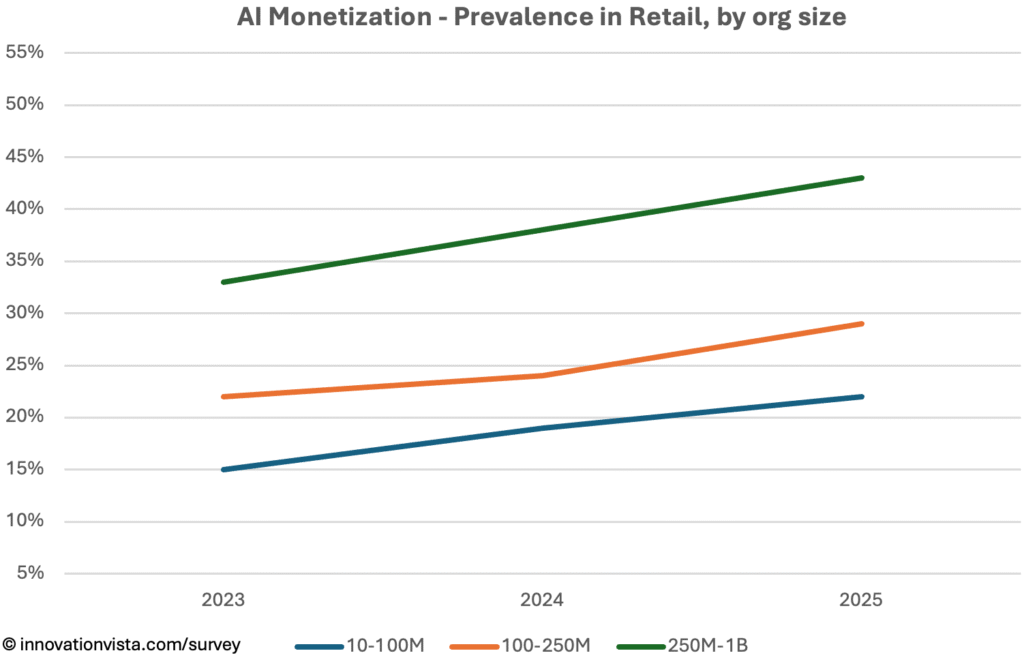

AI Maturity in Retail

Criteria

- Stabilized: pilots and early deployments, prompt libraries, basic guardrails.

- Optimized: MLOps practices, model registries, evaluation frameworks, monitoring.

- Monetized: production AI delivering ROI—fine-tuned models, measurable revenue or cost impact.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 53 / 29 / 10 | 63 / 36 / 15 | 75 / 50 / 22 | 92 / 70 / 33 | 99 / 90 / 50 |

| 2024 | 58 / 36 / 12 | 68 / 44 / 19 | 80 / 57 / 24 | 92 / 76 / 38 | 100 / 93 / 52 |

| 2025 | 67 / 43 / 16 | 77 / 53 / 22 | 87 / 67 / 29 | 96 / 84 / 43 | 100 / 97 / 63 |

!nsights: AI is Retail’s clear differentiator. By 2025, 53% of $10–$100M firms have optimized AI and 22% monetize it, often through recommendation engines, personalized marketing, and dynamic pricing. Larger firms monetize heavily: 43% of $250M–$1B companies and 63% of $1B+ enterprises. Retail leads most other industries in AI monetization, proving that customer-facing personalization translates directly into ROI.

Retail Compared to Other Industries

- At the front of AI monetization: Retail consistently outruns the mid-market average, often doubling monetization rates of laggards like Education and Real Estate.

- Close to Financial Services: In Data and BI, Retail is comparable to Financial Services and Insurance — near-universal optimization and very high monetization.

- Consumer-facing edge: Retail’s ability to embed analytics and AI into the customer experience puts it among the industries most transformed by technology maturity.

Company Spotlight: Monetizing Assortment Intelligence

One mid-market specialty retailer illustrates how analytics maturity can become a direct driver of margin and loyalty. Focused on fashion and home goods, the company historically managed product mix through intuition, seasonal trends, and post-sale markdowns.

The journey began with stabilization. The retailer consolidated point-of-sale, e-commerce, and returns data into a centralized warehouse, creating a consistent foundation for inventory and demand analysis across its store network and digital channels.

Optimization followed with BI dashboards that monitored sell-through rates, markdown performance, and customer lifetime value. These tools gave merchants the ability to identify underperforming products earlier, adjust purchasing in real time, and improve store-level assortment.

The monetization breakthrough came when AI-driven demand forecasting and assortment planning were embedded into both internal operations and customer-facing programs. Predictive models now guide buying decisions and automatically adjust allocation to stores and warehouses, reducing excess inventory and boosting margins. Customers experience the benefits through curated loyalty tiers and subscription-like services that promise exclusive access to in-demand items with fewer stockouts.

For the retailer, monetization comes in two forms: higher profitability from reduced markdowns and incremental revenue from premium loyalty programs. By embedding analytics into both the back office and the customer experience, the company transformed optimization into a monetized differentiator.

Strategic Implications for Retail CXOs

For Retail leaders, stabilization and optimization are assumed. The frontier is monetization — turning data, BI, and AI into direct drivers of revenue and margin.

Opportunities include:

- AI-driven personalization that lifts conversion and basket size.

- Dynamic pricing and promotion engines tied to demand signals.

- Supplier-funded analytics that monetize retail media networks.

- Inventory and supply chain optimization that reduces costs while improving customer experience.

Retail firms that monetize intelligence as part of the product experience will capture outsized share. Those that don’t risk being commoditized in an industry where customer expectations rise faster than margins.