Our experience delivering Energy IT & AI consulting confirms for us that Oil & Gas firms operate some of the most complex and capital-intensive systems in the world. From exploration and drilling to refining, distribution, and trading, the sector has long been data-driven. SCADA systems, IoT sensors, and seismic data create enormous volumes of information, yet integrating and monetizing it has been uneven. Mid-market players, in particular, face the dual pressures of high volatility in commodity prices and increasing sustainability demands.

The recent update to our Mid-market Analytics Maturity Survey (2023–2025) shows that while stabilization and optimization are nearly universal across the sector, monetization is where the competitive divide emerges. Data, BI, and AI maturity has never been more critical, or led to larger performance differences. Leaders are embedding analytics into asset performance, predictive maintenance, and trading strategies, while laggards remain stuck at the optimized stage.

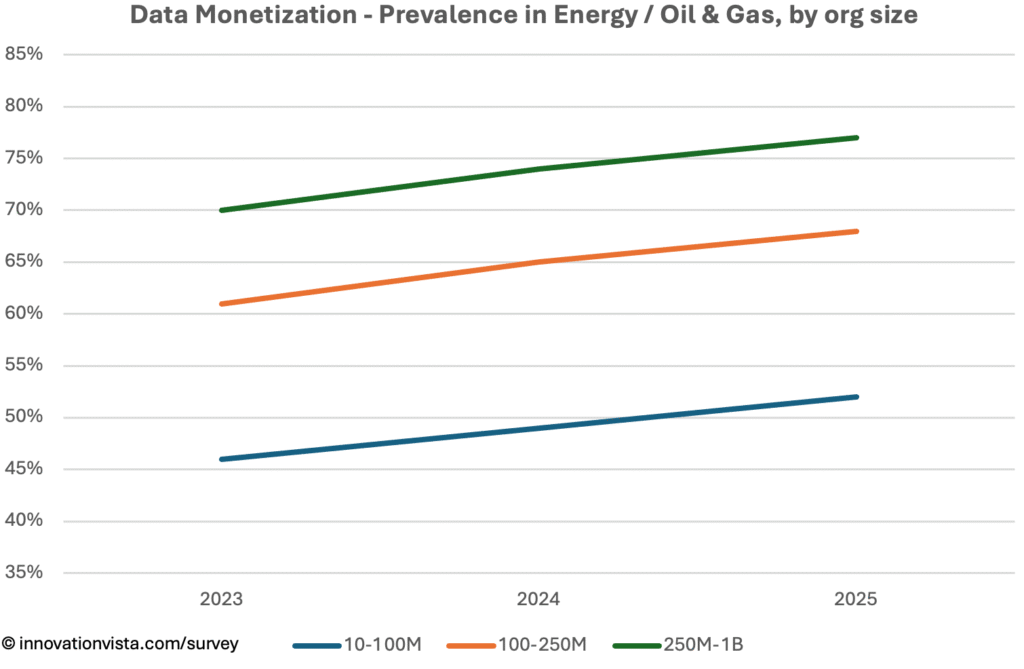

Data Maturity in Energy / Oil & Gas

Criteria

- Stabilized: central warehouse/lake with scheduled ETL and a starter data dictionary.

- Optimized: daily refresh, catalog + glossary, and first MDM domain.

- Monetized: enterprise-wide MDM, data products shared across functions, measurable ROI.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 86 / 55 / 26 | 100 / 89 / 46 | 100 / 99 / 61 | 100 / 100 / 70 | 100 / 100 / 78 |

| 2024 | 89 / 58 / 26 | 100 / 91 / 49 | 100 / 100 / 65 | 100 / 100 / 74 | 100 / 100 / 83 |

| 2025 | 91 / 61 / 27 | 100 / 93 / 52 | 100 / 100 / 68 | 100 / 100 / 77 | 100 / 100 / 86 |

!nsights: By 2025, stabilization and optimization are complete across the mid-market. Monetization climbs into the 50–70% range in mid-market firms, with the strongest progress in $250M–$1B companies. Leaders are turning operational and trading data into profit drivers, while laggards risk being commoditized.

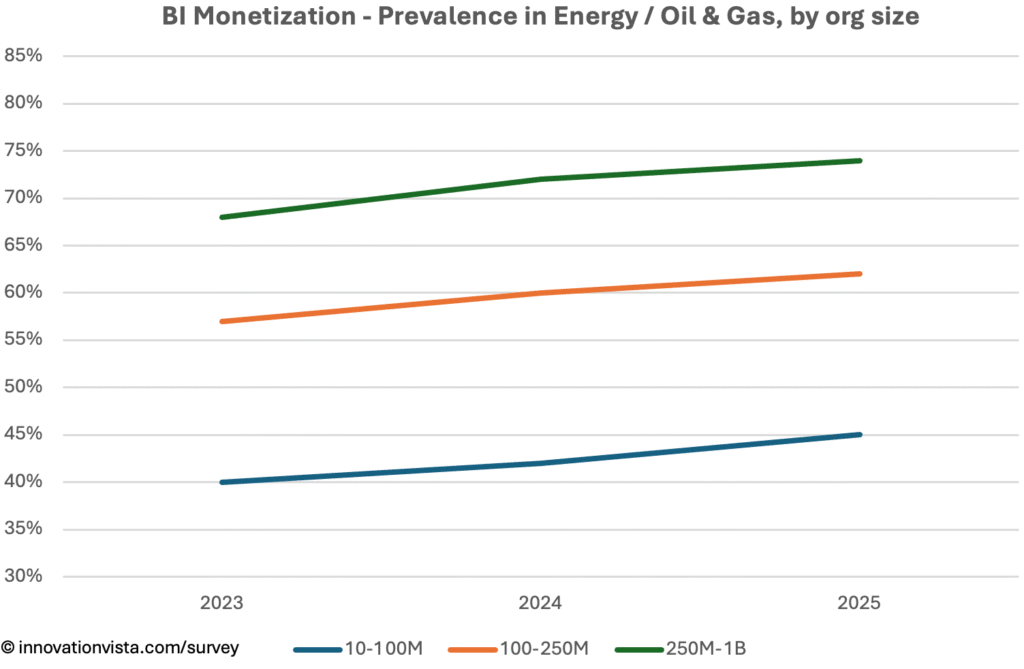

BI Maturity in Energy / Oil & Gas

Criteria

- Stabilized: dashboards in place, weekly refresh, initial instrumentation.

- Optimized: governed semantic layer, KPI catalog with owners, data literacy programs.

- Monetized: predictive analytics, scenario planning, automated responses embedded in workflows.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 82 / 48 / 21 | 99 / 86 / 40 | 100 / 99 / 57 | 100 / 100 / 68 | 100 / 100 / 78 |

| 2024 | 84 / 48 / 21 | 99 / 86 / 42 | 100 / 99 / 60 | 100 / 100 / 72 | 100 / 100 / 82 |

| 2025 | 86 / 50 / 22 | 99 / 89 / 45 | 100 / 99 / 62 | 100 / 100 / 74 | 100 / 100 / 84 |

!nsights: BI is a well-established capability in Oil & Gas. By 2025, 45% of $10–$100M firms monetize BI, while larger firms exceed 70%. Monetization often comes through scenario modeling (e.g., price swings, production shocks), operational dashboards tied to performance KPIs, and simulation platforms for investment and safety planning.

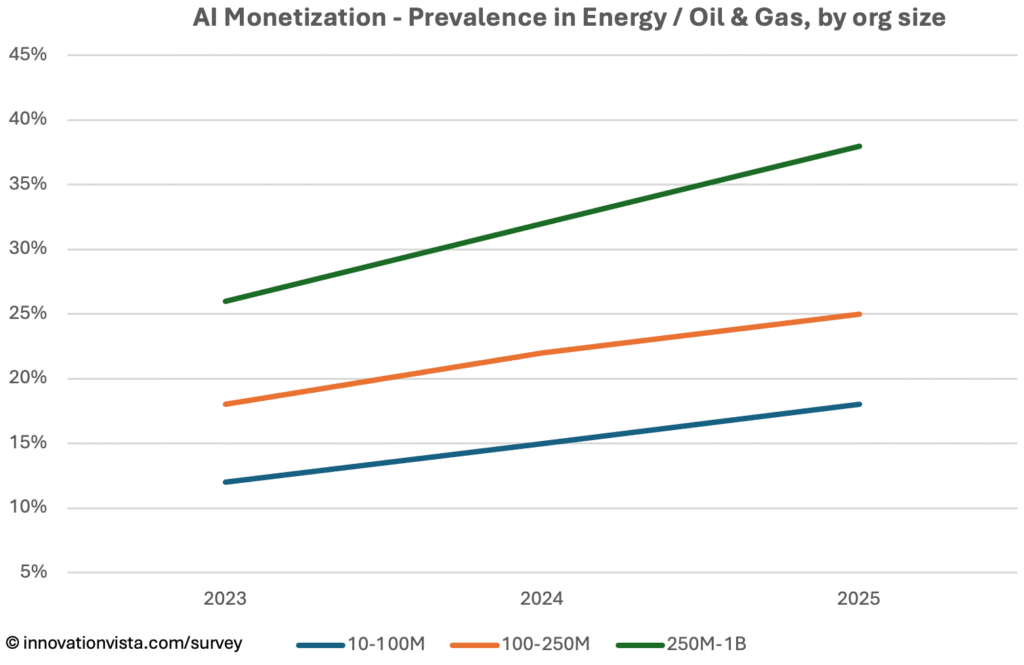

AI Maturity in Energy / Oil & Gas

Criteria

- Stabilized: pilots and early deployments, prompt libraries, basic guardrails.

- Optimized: MLOps practices, model registries, evaluation frameworks, monitoring.

- Monetized: production AI delivering ROI—fine-tuned models, measurable revenue or cost impact.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 44 / 21 / 7 | 52 / 28 / 12 | 66 / 37 / 18 | 82 / 57 / 26 | 96 / 80 / 40 |

| 2024 | 52 / 28 / 9 | 61 / 37 / 15 | 74 / 48 / 22 | 88 / 68 / 32 | 98 / 90 / 48 |

| 2025 | 60 / 35 / 12 | 70 / 45 / 18 | 82 / 58 / 25 | 94 / 78 / 38 | 99 / 95 / 55 |

!nsights: AI is advancing quickly in Oil & Gas. By 2025, 45% of $10–$100M firms are optimized, and monetization rates are rising — 18% in smaller mid-market firms and 38% in $250M–$1B companies. Larger firms show over 50% monetization, particularly in predictive maintenance, drilling optimization, and trading strategy enhancement.

Energy / Oil & Gas Compared to Other Industries

- Advanced in AI monetization: Oil & Gas monetization rates in AI (25–38% by 2025) put the sector ahead of Manufacturing and Education, though still behind leaders like Retail and Financial Services.

- Consistent in BI: Monetization is steady but not sector-leading; BI is treated as essential infrastructure rather than a differentiator.

- Capital-intensive advantages: Heavy use of IoT and sensor data gives the sector a unique edge in predictive analytics, particularly for maintenance and asset optimization.

Company Spotlight: Monetizing Reliability

One mid-market pipeline operator demonstrates how Energy & Oil & Gas firms can transform analytics into a revenue product. The company manages a regional network of crude and natural gas pipelines, where uptime and safety are paramount.

The journey began with stabilization. The firm centralized supervisory control and data acquisition (SCADA) feeds, IoT sensor outputs, and maintenance logs into a unified data warehouse. This gave engineers and managers a consistent, real-time view of pressure levels, throughput, and asset condition across hundreds of miles of pipe.

Optimization followed. BI dashboards allowed leaders to monitor flow efficiency, identify bottlenecks, and track maintenance intervals more accurately. Predictive analytics highlighted potential risks before they caused downtime, improving planning and reducing operating costs.

The breakthrough came when the operator embedded these predictive capabilities into its customer contracts. Rather than simply charging for capacity, the company introduced premium “assured capacity” agreements. Shippers pay more for guaranteed uptime, backed by AI models that predict leaks, failures, or maintenance needs days in advance. For customers, this means fewer disruptions and better planning. For the operator, it converts reliability — traditionally a cost of doing business — into a monetized service.

By moving from stabilized systems to optimized insights and then monetizing reliability, this firm turned operational excellence into a differentiator. It shows how Energy & Oil & Gas companies can expand margins and strengthen customer relationships by selling intelligence, not just infrastructure.

Strategic Implications for Energy / Oil & Gas CXOs

For Energy & Oil & Gas leaders, the survey shows stabilization and optimization are table stakes — nearly every firm has achieved them. The opportunity is in monetization.

Key priorities include:

- Predictive maintenance on wells, rigs, and pipelines to reduce downtime.

- AI-driven trading strategies to capture margins in volatile markets.

- Sustainability analytics to monitor emissions and compliance, creating new value in carbon-conscious markets.

- Data-as-a-service models, selling visibility and predictive insights to partners in the energy ecosystem.

Firms that monetize data and AI will drive efficiency, reduce risk, and unlock new revenue streams. Those that remain optimized-only risk being squeezed by commodity price pressures and more agile competitors.