As a result of our deep experience in Commercial Real Estate (CRE) IT & AI consulting, we know well that CRE firms face unique challenges in adopting modern data and technology practices. Many are built on traditional asset management models, with long transaction cycles, high reliance on manual processes, and fragmented technology environments. While CRE companies generate substantial market and portfolio data, the recent update to our Mid-market Analytics Maturity Survey shows that their adoption of advanced analytics and AI has continued to lag other sectors. This underscores the opportunity for tech-forward CRE companies to grab market-share with unique technology capabilities and maturity in data, BI analytics, and AI models.

The past three years of our survey (2023–2025) highlight slow but steady improvement. They also underscore how far behind CRE remains compared to leading industries such as Financial Services and Retail.

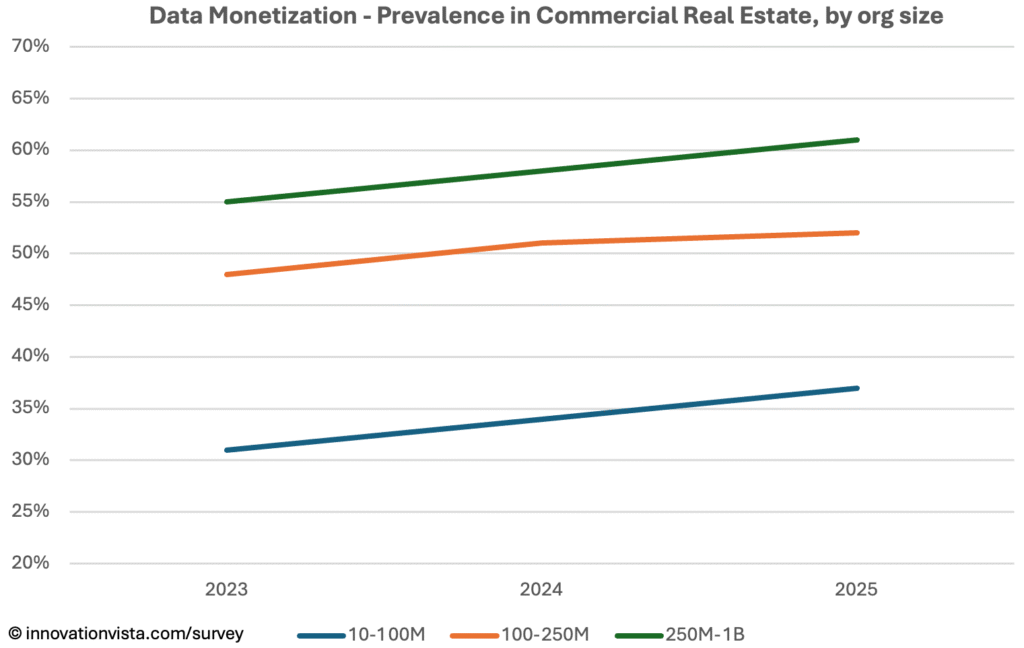

Data Maturity in Commercial Real Estate

Criteria

- Stabilized: central warehouse/lake with scheduled ETL and a starter data dictionary.

- Optimized: daily refresh, catalog + glossary, and first MDM domain.

- Monetized: enterprise-wide MDM, data products shared across functions, measurable ROI.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 70 / 32 / 12 | 95 / 70 / 31 | 99 / 94 / 48 | 100 / 100 / 55 | 100 / 100 / 65 |

| 2024 | 73 / 34 / 14 | 96 / 74 / 34 | 100 / 96 / 51 | 100 / 100 / 58 | 100 / 100 / 68 |

| 2025 | 76 / 36 / 15 | 98 / 77 / 37 | 100 / 98 / 52 | 100 / 100 / 61 | 100 / 100 / 71 |

!nsights: CRE data maturity shows modest improvement year-over-year. Stabilization is widespread by 2024, and optimization is catching up, but monetization still lags well behind most industries. Even by 2025, monetization sits below 40% in the $10–$100M band, versus 50–60% in the mid-market overall. This suggests many CRE firms have integrated data but have yet to use it as a direct source of ROI. The sector is notorious for poor data quality – even from data vendors, especially relating to properties; this is a hurdle but should not be the kind of blocker it seems to be, crossing over 50% monetization only in firms $250M and larger.

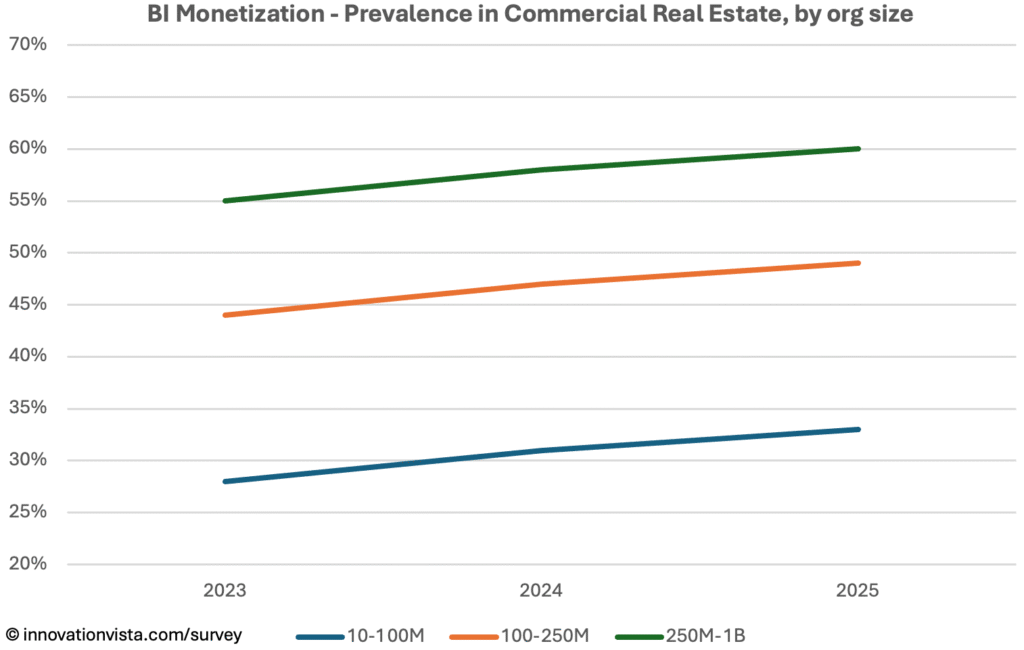

BI Maturity in Commercial Real Estate

Criteria

- Stabilized: dashboards in place, weekly refresh, initial instrumentation.

- Optimized: governed semantic layer, KPI catalog with owners, data literacy programs.

- Monetized: predictive analytics, scenario planning, automated responses embedded in workflows.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 61 / 22 / 9 | 92 / 62 / 28 | 99 / 88 / 44 | 100 / 99 / 55 | 100 / 100 / 65 |

| 2024 | 64 / 24 / 10 | 94 / 66 / 31 | 100 / 90 / 47 | 100 / 100 / 58 | 100 / 100 / 68 |

| 2025 | 67 / 26 / 11 | 96 / 69 / 33 | 100 / 93 / 49 | 100 / 100 / 60 | 100 / 100 / 70 |

!nsights: BI stabilization has become standard in CRE, but optimization and monetization trail mid-market averages. By 2025, only one-third of $10–$100M firms monetize BI, compared to 50%+ in Retail and Financial Services. The spread between small and large firms is particularly stark, indicating that many smaller CRE firms are still operating at a “dashboard-only” level. For business models which generate significant data, and which value the understanding of that data, there remains a shocking absense of impactful BI in the sector – over half of companies $100M and larger still draw zero savings or revenue from their BI analytics.

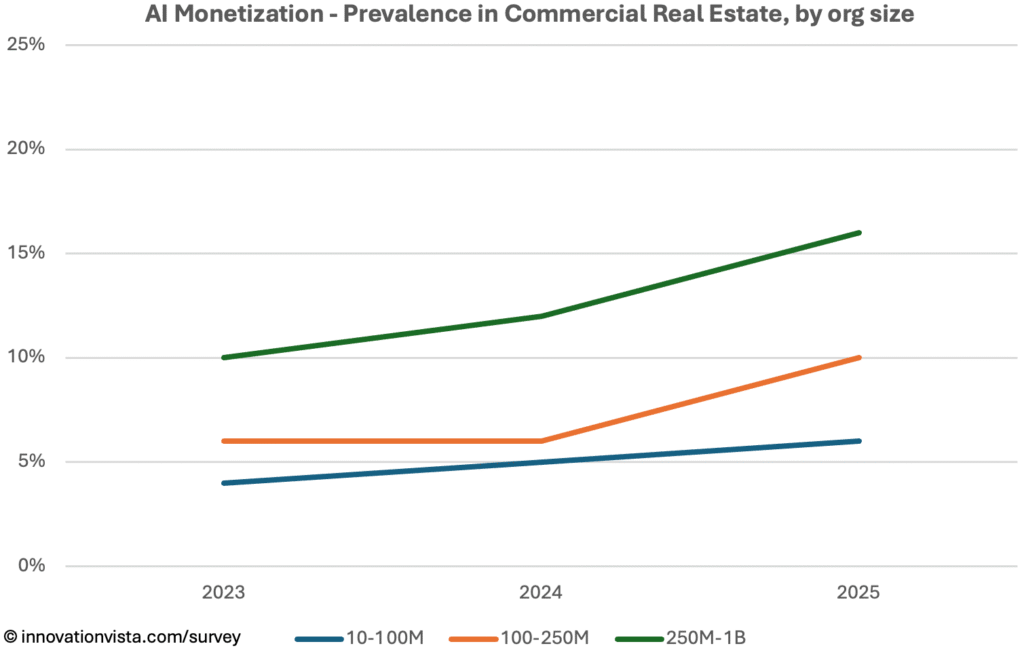

AI Maturity in Commercial Real Estate

Criteria

- Stabilized: pilots and early deployments, prompt libraries, basic guardrails.

- Optimized: MLOps practices, model registries, evaluation frameworks, monitoring.

- Monetized: production AI delivering ROI – fine-tuned models, measurable revenue &/or cost impact.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 28 / 12 / 3 | 32 / 13 / 4 | 39 / 16 / 6 | 58 / 30 / 10 | 80 / 55 / 22 |

| 2024 | 32 / 14 / 4 | 34 / 14 / 5 | 41 / 18 / 6 | 60 / 32 / 12 | 85 / 61 / 28 |

| 2025 | 31 / 13 / 5 | 37 / 16 / 6 | 50 / 24 / 10 | 70 / 41 / 16 | 92 / 72 / 32 |

!nsights: CRE is among the weakest industries in AI adoption. Stabilization is low compared to the mid-market, optimization is minimal, and monetization remains in single digits through 2025 in the $10–$100M and $100–$250M tiers. Larger firms show some progress, reaching 16–32% monetization, but CRE lags well behind leaders like Retail and Financial Services. In many ways this is a predictable situation, given the data challenges in CRE, but on the reverse side, this represents one of the most exciting opportunities for tech-forward players in CRE who grasp the strengthening connection between AI capabilities and market-share.

CRE Compared to Other Industries

- Well behind leaders: Financial Services and Retail monetize both BI and AI at double or triple the rate of CRE.

- Below average in the mid-market: CRE trails the average in every category, and especially in AI.

- Closer to laggards: CRE aligns more closely with Education and Residential Real Estate, the slowest-moving sectors in our survey.

Company Spotlight: Monetizing Tenant Experience

One Commercial Real Estate technology firm exemplifies how the industry is beginning to move beyond stabilized and optimized systems into true monetization. Originally focused on tenant-experience software, the company built a platform that aggregates data from building systems, service requests, occupancy sensors, and tenant engagement tools.

With this stabilized foundation in place, the firm optimized by creating a unified record of tenant experience — connecting operational data with financial outcomes. Analytics dashboards now give landlords and asset managers predictive insight into tenant satisfaction, building performance, and the drivers of net operating income.

The monetization breakthrough came when these insights became a product in their own right. Building owners now use the platform not only to streamline operations but also to justify premium services, reduce vacancy, and improve asset valuations. By directly tying data and AI to financial outcomes, the firm redefined what tenants and landlords see as valuable — shifting from “technology as an efficiency tool” to “intelligence as a revenue stream.”

This model demonstrates how CRE companies can turn data exhaust into monetized insight, embedding technology into the lease value proposition itself. It is a clear example of how innovation is moving the industry beyond efficiency into growth.

Strategic Implications for CRE CXOs

For CRE executives, the imperative is clear: stabilization and optimization are no longer differentiators—they are table stakes. The battleground is monetization of analytics capabilities

CRE has a rich opportunity set – automated underwriting, digital property management, tenant experience platforms, counterparty prediction, and predictive valuation models. Yet most firms are still at pilot stage or stuck with dashboards that describe rather than predict.

The industry is weak enough on this front generally that it is one of the few still ripe for innovation to make a significant difference, to help forwarding-thinking firms create unique capabilities their competitors can’t match, and digital disruption of the sector remains a potential for the firms who can solve the key data & analytics challenges involved.