Our experiences in Real Estate IT & AI consulting have shown us that these firms, from brokerages to home-builders, are under intense pressure to modernize. Digital-first platforms have reset consumer expectations, offering transparency, personalization, and AI-driven recommendations. Mid-market players face a dual challenge: stabilizing their fragmented legacy systems while trying to compete with tech-forward disruptors.

The recent update to our Mid-market Analytics Maturity Survey provides a three-year view (2023–2025) of how Residential Real Estate firms are progressing across Data, Business Intelligence (BI), and Artificial Intelligence (AI). The data shows incremental gains in stabilization and optimization but consistently low monetization rates, leaving the sector at heightened risk of disruption from digital-native competitors.

Data Maturity in Residential Real Estate

Criteria

- Stabilized: central warehouse/lake with scheduled ETL and a starter data dictionary.

- Optimized: daily refresh, catalog + glossary, and first MDM domain.

- Monetized: enterprise-wide MDM, data products shared across functions, measurable ROI.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 68 / 29 / 12 | 94 / 68 / 30 | 99 / 93 / 47 | 100 / 100 / 54 | 100 / 100 / 64 |

| 2024 | 71 / 32 / 13 | 96 / 72 / 33 | 100 / 96 / 50 | 100 / 100 / 57 | 100 / 100 / 67 |

| 2025 | 74 / 33 / 14 | 97 / 75 / 36 | 100 / 97 / 51 | 100 / 100 / 60 | 100 / 100 / 70 |

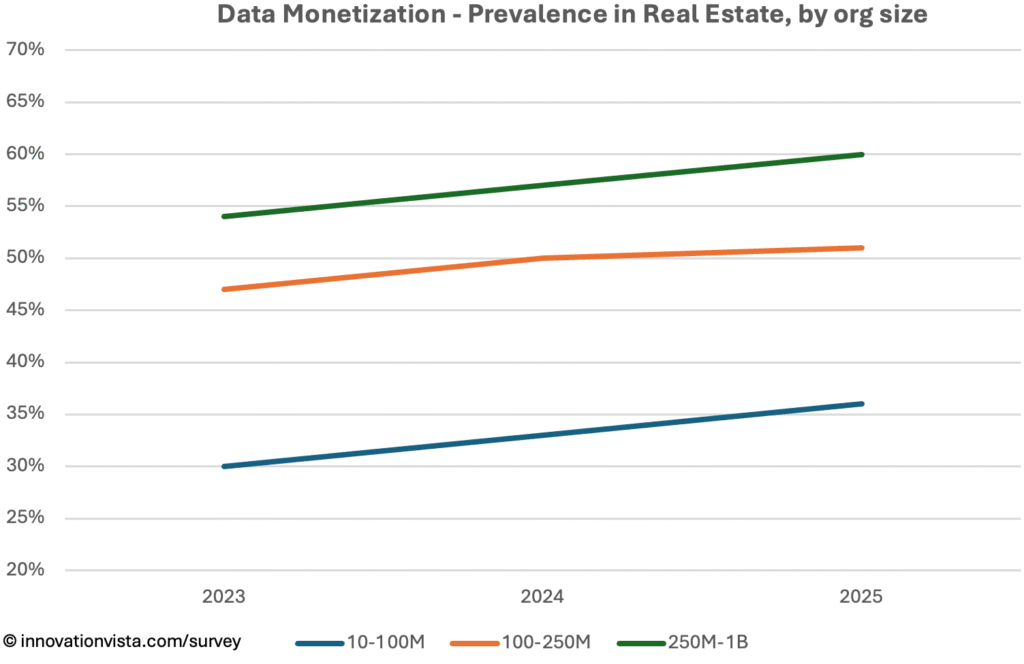

!nsights: By 2025, stabilization is complete in mid-market Residential Real Estate firms, but monetization is lagging — just 36% in $10–$100M companies, compared to ~44% in the mid-market average. Larger firms are more competitive, monetizing at 60–70%, often through investor dashboards and market intelligence services.

BI Maturity in Residential Real Estate

Criteria

- Stabilized: dashboards in place, weekly refresh, initial instrumentation.

- Optimized: governed semantic layer, KPI catalog with owners, data literacy programs.

- Monetized: predictive analytics, scenario planning, automated responses embedded in workflows.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 59 / 20 / 8 | 91 / 60 / 26 | 98 / 86 / 44 | 100 / 97 / 55 | 100 / 100 / 65 |

| 2024 | 61 / 22 / 9 | 94 / 62 / 28 | 100 / 91 / 46 | 100 / 99 / 57 | 100 / 100 / 67 |

| 2025 | 64 / 24 / 10 | 95 / 66 / 30 | 100 / 91 / 47 | 100 / 99 / 58 | 100 / 100 / 68 |

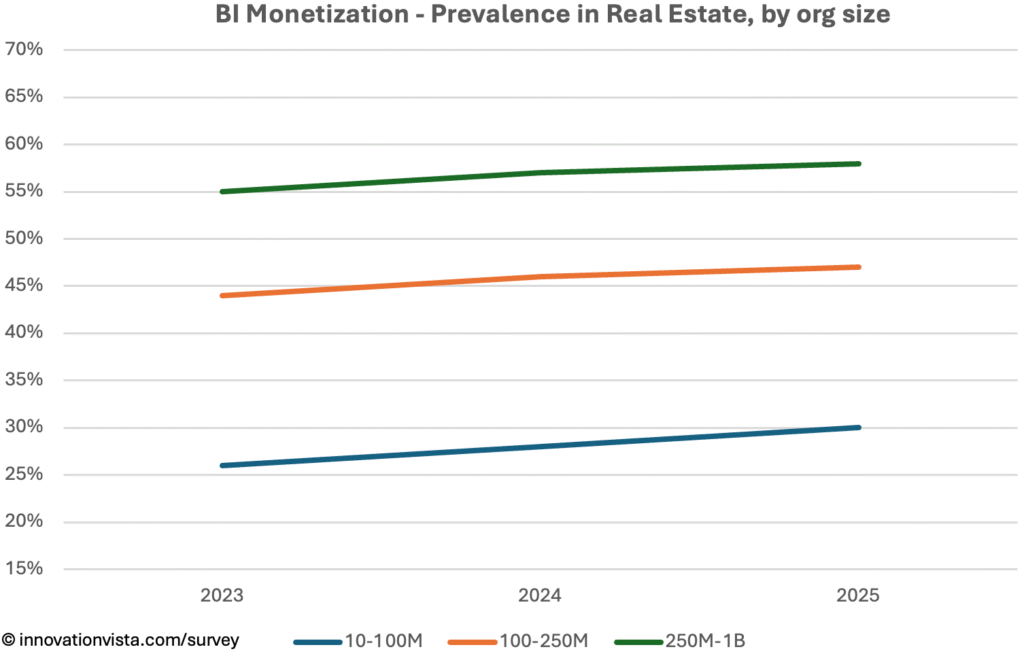

!nsights: BI adoption is high, but monetization remains limited. By 2025, just 30% of $10–$100M firms monetize BI, compared to nearly 60% in larger mid-market peers. Leaders monetize by providing clients with real-time property insights, valuation forecasts, and market trend dashboards. Smaller firms are slower, leaving them less competitive against data-forward disruptors.

AI Maturity in Residential Real Estate

Criteria

- Stabilized: pilots and early deployments, prompt libraries, basic guardrails.

- Optimized: MLOps practices, model registries, evaluation frameworks, monitoring.

- Monetized: production AI delivering ROI – fine-tuned models, measurable revenue &/or cost impact.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 28 / 12 / 3 | 30 / 13 / 4 | 37 / 15 / 5 | 56 / 28 / 9 | 78 / 52 / 20 |

| 2024 | 32 / 14 / 4 | 32 / 14 / 5 | 38 / 17 / 6 | 58 / 30 / 11 | 84 / 58 / 26 |

| 2025 | 31 / 13 / 5 | 34 / 14 / 6 | 47 / 22 / 9 | 68 / 38 / 15 | 91 / 69 / 30 |

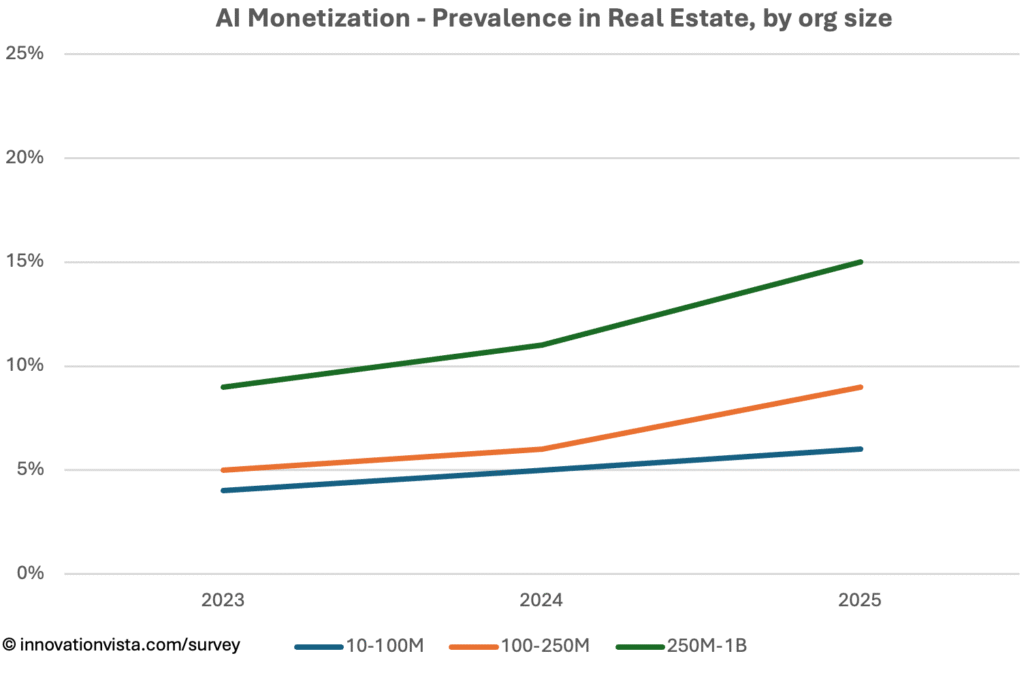

!nsights: AI maturity remains very low in Residential Real Estate compared to the mid-market. Even by 2025, just 6% of $10–$100M firms monetize AI, compared to 20%+ in the average mid-market. Larger firms are more advanced, with monetization at 15–30%, often through AI-driven valuation models, property recommendation engines, and smart pricing. The lag among smaller firms makes this one of the most disruption-prone sectors.

Residential Real Estate Compared to Other Industries

- Behind in monetization: Across Data, BI, and AI, Residential Real Estate lags mid-market averages by 5–15 points.

- Similar to Commercial Real Estate: Both sectors struggle with monetization, though Residential is slightly further along in BI.

- High disruption risk: Tech-driven entrants and digital platforms already monetize BI and AI far beyond traditional firms, putting incumbents under increasing pressure.

Company Spotlight: Monetizing Market Intelligence

One mid-sized residential brokerage demonstrates how firms in the sector can move beyond optimization into monetization. With dozens of agents operating across multiple markets, the company initially struggled with fragmented MLS feeds, inconsistent client records, and siloed transaction data.

The first step was stabilization. Leadership invested in consolidating MLS feeds, agent CRM data, and transaction histories into a centralized warehouse. For the first time, the firm had a single source of truth for listings, pricing, and client activity across the network.

Optimization followed as BI dashboards were deployed. Agents gained visibility into their pipelines, forecasting tools highlighted transaction risks, and managers tracked productivity and commissions in real time. Market-trend dashboards helped leadership plan more effectively for cyclical demand shifts.

The monetization breakthrough came when the firm extended these insights to clients. It launched premium client-facing dashboards that provided real-time property alerts, neighborhood comps, and predictive pricing forecasts. Sellers were able to list with greater confidence, and buyers were guided to competitive bids without overpaying. Clients paid for this transparency through premium listing packages and higher service tiers.

By embedding analytics directly into the customer experience, the brokerage transformed BI from an internal tool into a product. This move not only boosted fee revenue but also created differentiation in a market increasingly threatened by digital-first disruptors.

Strategic Implications for Residential Real Estate CXOs

For Residential Real Estate leaders, stabilization and optimization are already expected by investors and customers. The real question is monetization: can firms turn their data and AI into insights that clients, investors, and tenants will pay for?

Opportunities include:

- Client-facing BI portals offering market trends, real-time valuation updates, and predictive analytics.

- AI-driven pricing and recommendation engines to match buyers and renters more effectively.

- Operational optimization for portfolio owners, improving yields and reducing vacancy.

Without monetization, Residential Real Estate firms risk losing ground to digital-first competitors who are already offering predictive valuation and customer-centric AI at scale.