We know well from our Education and EdTech IT & AI consulting that these organizations span a wide spectrum, from traditional schools and universities to emerging technology-driven learning platforms. The sector’s maturity is highly uneven: large institutions and EdTech innovators are adopting AI-driven personalization and predictive analytics, while many smaller schools and service providers struggle to even stabilize their data and BI environments.

The recent update to our Mid-market Analytics Maturity Survey provides a three-year view (2023–2025) of how Education & EdTech firms are progressing across Data, Business Intelligence (BI), and Artificial Intelligence (AI). The results reveal strong improvement in stabilization, moderate progress in optimization, and very limited monetization – leaving the sector at greater risk of disruption than most mid-market peers.

Data Maturity in Education & EdTech

Criteria

- Stabilized: central warehouse/lake with scheduled ETL and a starter data dictionary.

- Optimized: daily refresh, catalog + glossary, and first MDM domain.

- Monetized: enterprise-wide MDM, data products shared across functions, measurable ROI.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 66 / 27 / 11 | 94 / 65 / 28 | 99 / 92 / 44 | 100 / 99 / 52 | 100 / 100 / 60 |

| 2024 | 69 / 29 / 12 | 96 / 68 / 32 | 100 / 95 / 49 | 100 / 100 / 56 | 100 / 100 / 66 |

| 2025 | 72 / 31 / 13 | 97 / 72 / 34 | 99 / 97 / 50 | 100 / 100 / 58 | 100 / 100 / 68 |

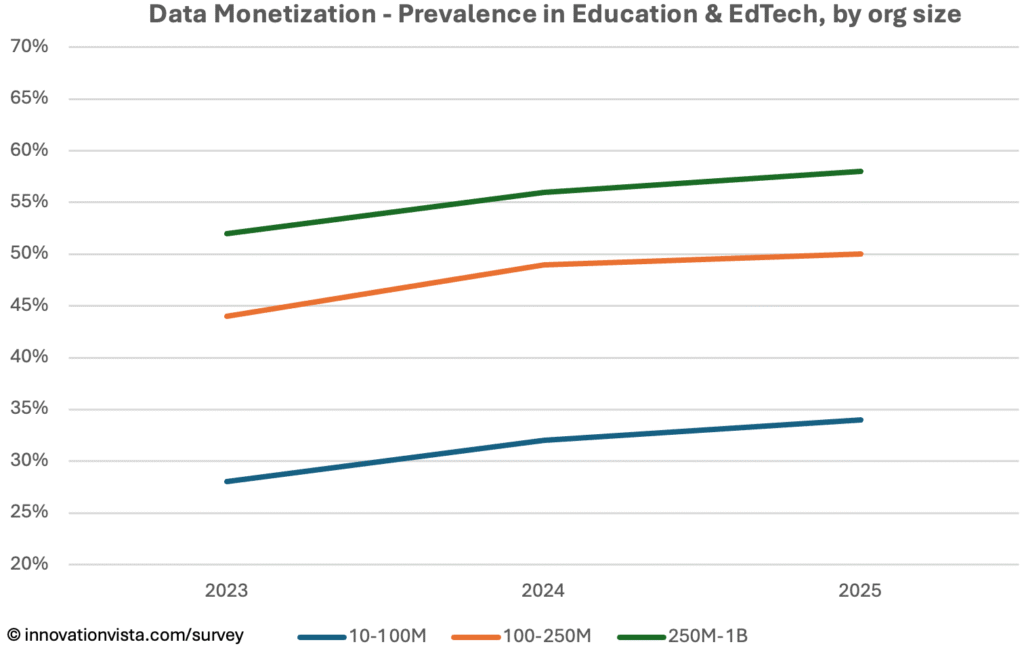

!nsights: By 2025, Education & EdTech organizations have caught up in stabilization, with optimization improving significantly. Monetization, however, remains muted – just 34% in $10–$100M firms, compared to 44–50% in the mid-market average. This shows that while systems are in place, few institutions are turning data into ROI, such as improving student outcomes, creating unique data-powered products, or driving operational savings.

BI Maturity in Education & EdTech

Criteria

- Stabilized: dashboards in place, weekly refresh, initial instrumentation.

- Optimized: governed semantic layer, KPI catalog with owners, data literacy programs.

- Monetized: predictive analytics, scenario planning, automated responses embedded in workflows.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 55 / 18 / 8 | 89 / 56 / 25 | 98 / 85 / 42 | 100 / 97 / 52 | 100 / 100 / 62 |

| 2024 | 58 / 20 / 9 | 92 / 60 / 27 | 100 / 87 / 44 | 100 / 99 / 55 | 100 / 100 / 65 |

| 2025 | 61 / 22 / 9 | 94 / 63 / 29 | 100 / 90 / 46 | 100 / 99 / 57 | 100 / 100 / 67 |

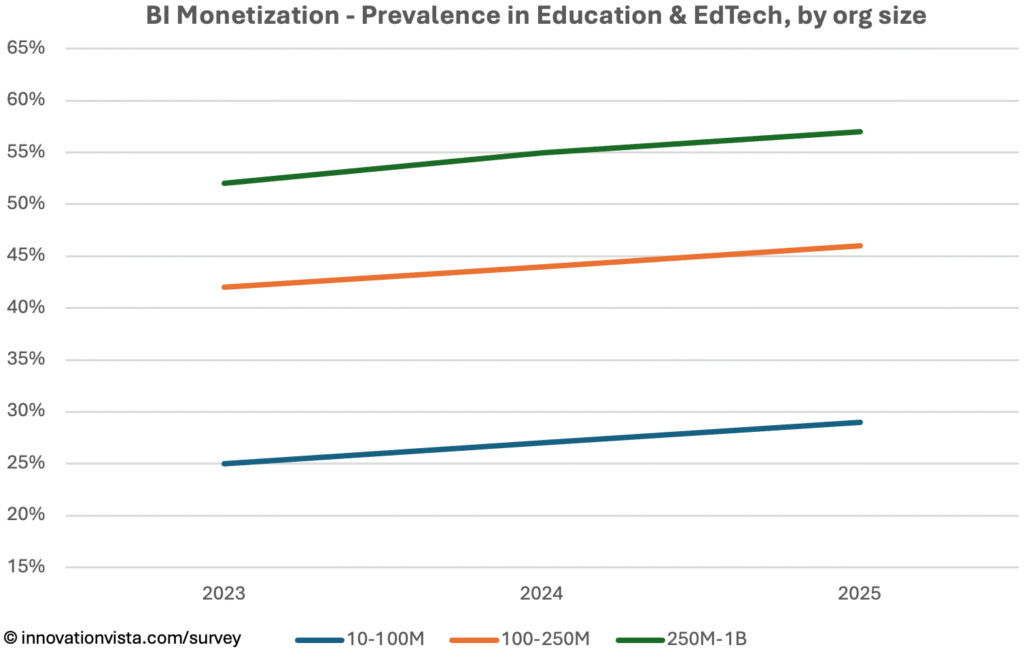

!nsights: BI is nearly universal in stabilization and increasingly optimized. But monetization is still limited, especially in smaller organizations: only 29% of $10–$100M firms monetize BI by 2025, compared to ~40–50% in other industries. Larger institutions and EdTech companies are leading the charge, embedding predictive analytics into student success dashboards and financial planning, but the long tail of smaller organizations is dragging down the sector average.

AI Maturity in Education & EdTech

Criteria

- Stabilized: pilots and early deployments, prompt libraries, basic guardrails.

- Optimized: MLOps practices, model registries, evaluation frameworks, monitoring.

- Monetized: production AI delivering ROI—fine-tuned models, measurable revenue or cost impact.

| Year | < $10M | $10–$100M | $100–$250M | $250M–$1B | $1B+ |

|---|---|---|---|---|---|

| 2023 | 30 / 13 / 4 | 34 / 15 / 5 | 45 / 21 / 8 | 65 / 36 / 15 | 85 / 60 / 28 |

| 2024 | 34 / 15 / 5 | 38 / 17 / 6 | 48 / 24 / 8 | 68 / 40 / 16 | 90 / 70 / 32 |

| 2025 | 35 / 16 / 6 | 45 / 21 / 8 | 58 / 31 / 12 | 78 / 50 / 20 | 95 / 80 / 38 |

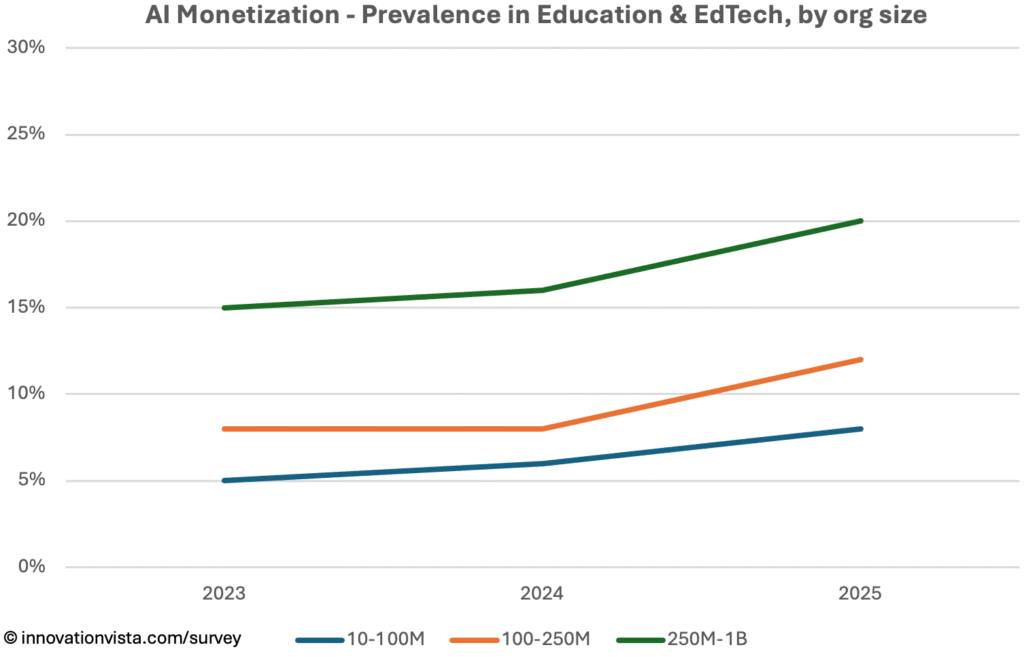

!nsights: AI is the weakest category in Education & EdTech. While pilots are growing — stabilization reached 45% in $10–$100M firms by 2025 — optimization is rare and monetization remains minimal. Even in $250M–$1B institutions, monetization is only 20%, far below the mid-market average of 35%. EdTech startups are the outliers driving progress, using AI for adaptive learning and content personalization, while most traditional institutions are still experimenting.

Education & EdTech Compared to Other Industries

- Significantly behind in monetization: Across Data, BI, and AI, Education & EdTech monetization rates lag the mid-market by 10–15 points.

- Closer to laggards than leaders: Education aligns more closely with Real Estate and Commercial Real Estate than with Retail or Financial Services.

- Bright spots in EdTech: Digital-native platforms are exceptions, often monetizing AI through subscription models, adaptive content, and personalized learning journeys.

Company Spotlight: Personalization as a Monetization Engine

One mid-sized EdTech provider has built its entire model around monetizing data and AI. Starting as a digital learning platform, the company stabilized its foundation by centralizing vast libraries of educational content alongside detailed learner interaction data – every click, quiz score, and engagement signal captured and stored.

The next step was optimization. Advanced analytics and AI models were applied to measure retention, engagement, and progression, giving both instructors and the platform itself visibility into where learners succeed or struggle. Algorithms began to recommend exercises, pacing, and difficulty adjustments in real time, improving learning outcomes and boosting student satisfaction.

Monetization came as the final leap. Personalization became the product: learners and institutions now pay for access to adaptive pathways that guarantee better results. Subscription revenue grows because learners stay longer, upgrade to premium tiers, and renew more frequently. Institutions license the platform for classrooms because data shows improved exam performance and reduced dropout rates. In each case, AI isn’t just an internal efficiency tool; it is the central value proposition that drives growth and revenue.

This example illustrates how an Education & EdTech provider can move fully through the maturity spectrum: stabilized infrastructure, optimized insights, and monetized AI capabilities that transform teaching and learning into a scalable business model.

Strategic Implications for Education & EdTech CXOs

For Education & EdTech leaders, the message is stark: stabilization and optimization are no longer competitive advantages — they are catch-up requirements. The battleground is monetization, and here the sector is far behind.

Opportunities include:

- Adaptive learning platforms that personalize content delivery and measure ROI through student success outcomes.

- Predictive analytics for enrollment and retention, improving financial stability.

- Operational AI to optimize scheduling, staffing, and facilities.

Laggards who fail to monetize risk losing students, funding, and market share to more agile EdTech entrants and data-driven institutions. Leaders who embed intelligence into their offerings can transform from education providers into innovation hubs, setting the pace for the sector.