Media & Entertainment IT & AI Consulting

Proven IT Leaders with Track Records in the Media & Entertainment Industries

Entertainment IT & AI Experts

The media and entertainment industry has always been shaped by technology — from the printing press to radio, film, television, and now streaming, podcasts, and digital-first content. Today, success in this space depends on meeting audiences where they are: online, on mobile, and demanding content faster and more personalized than ever before.

Through our flagship Contract CIO+® tech leadership service and our foundational CIO IQ® IT & AI Advisory offering, Innovation Vista delivers independent vendor-neutral IT & AI strategy to the Entertainment & Media industries. Our consultants pair technical depth with first-hand experience supporting IT in film, publishing, broadcasting, streaming platforms, and live entertainment. We know where standard IT practices apply — and where creative workflows, intellectual property protection, and digital distribution require industry-specific strategies.

Unlike firms that drop in generalists, our experts understand the unique pressures of entertainment: protecting digital assets, scaling platforms for massive audience spikes, and enabling new revenue models around digital content. With Contract CIO+®, the mission isn’t just stabilizing and optimizing systems — it’s ensuring your technology empowers creators, accelerates distribution, and engages audiences at scale.

State of Innovation in Media & Entertainment

Our 2026 Summary of Innovation in the Entertainment industry

The Generative Supply Chain & The Trust Battle

The Media & Entertainment sector in 2026 has fundamentally changed its production model. The linear pipeline is dead; the “Generative Supply Chain” is here. Success is now defined by how fast you can create, how effectively you can monetize, and how fiercely you can prove ownership.

GenAI moves to “Final Pixel”: Generative AI is no longer just for storyboarding. Studios and broadcasters are using AI for final-pixel visual effects, dubbing, and localization, drastically compressing production timelines and costs.

The Authenticity Mandate: As deepfakes flood the internet, “Content Credentials” (C2PA) are the new SSL. Platforms and consumers demand cryptographic proof of content origin. Media companies without robust provenance tracking are losing brand trust.

The “FAST” Monetization War: With subscription fatigue peaking, Free Ad-Supported Streaming TV (FAST) is the primary growth engine. This requires sophisticated Ad-Tech stacks capable of real-time, programmatic insertion that rivals the targeting of social media.

Cloud-Native Production: The days of on-prem render farms are ending. 2026 production workflows are entirely cloud-native, allowing globally distributed teams to edit, color, and finish high-fidelity content without a single physical drive shipping.

Interested in Leveraging Some of these Tech Capabilities? An Assessment Could Be Step 1.

Is your tech platform and organization ready to scale and advance? Many of our clients choose to start with an IT & AI Assessment and Recommendations report.

This is a high-leverage first step to gain actionable insights from our Media & Entertainment consulting team, validate your current IT and AI readiness, and discover how our expert collaboration can drive value for your organization’s future.

Media Leaders First - Then Tech Leaders

Our Unique Approach to Entertainment Technology

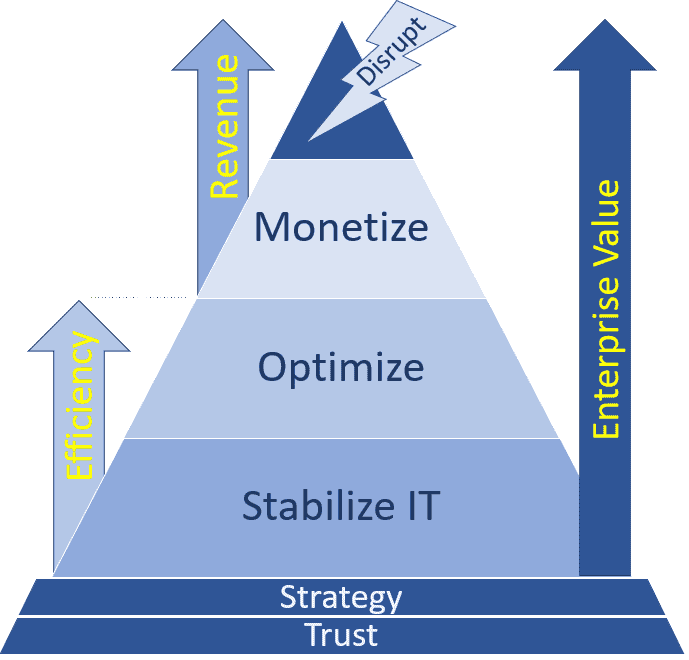

Many firms limit their focus to Stabilizing IT environments, shoring up security, and Optimizing performance and costs. While those foundations matter, media and entertainment demand much more — technology must keep pace with the speed of creativity and the expectations of global audiences.

With Contract CIO+® and CIO IQ®, we start by aligning IT strategy with your creative and business goals. For a production company, that may mean enabling secure, high-performance collaboration tools for distributed teams. For a streaming service, it might involve scaling infrastructure to handle surges in demand. For a publisher, priorities could include safeguarding intellectual property while modernizing distribution channels. Each segment of the industry has unique requirements, and the technology roadmap has to match them.

Our strongest differentiator lies in Monetizing technology. We help clients Innovate Beyond Efficiency® by turning IT and data into drivers of audience growth and revenue. That could include analytics that personalize content recommendations, platforms that open new subscription or ad-based revenue streams, or digital engagement tools that deepen loyalty. In entertainment, technology isn’t just backstage support — it’s center stage in creating impact, scale, and competitive edge.

IT Strategy for Your Entertainment Niche

Media Sectors Covered

- FCC, SOC audit compliance

- Film production

- TV production

- Radio production

- Newspaper publishing

- Book publishing

- Magazine publishing

- Podcasting, Blogging, and Vlogging

- Social media content production

- Live entertainment production

- Content streaming services

- Fine arts organizations

Latest Media & Entertainment Tech !nsights from Our Team:

Analytics Maturity in Entertainment & Media · Analyzing our Mid-market Survey

Our experience in Entertainment & Media IT & AI consulting informs us companies have been among the earliest adopters of advanced data and AI capabilities. With direct-to-consumer models, advertising-driven revenues, and massive libraries of digital content, these firms are under constant pressure to innovate. Unlike more traditional sectors, Entertainment & Media companies have long recognized that data is their product, and that insight is shaping what content is created, how it’s distributed, and how it’s monetized. The recent update to our Mid-market Analytics Maturity Survey provides a three-year view (2023–2025) of how Entertainment & Media firms have progressed across Data, Business Intelligence (BI), and Artificial Intelligence (AI). The results show the sector consistently leading the mid-market in optimization and monetization,