Insurance IT & AI Consulting

Proven IT Leaders with Track Records in the Insurance Industry

Insurance IT Experts

The insurance industry has long been built on data, risk modeling, and trust — and today it is being reshaped by digital expectations, automation, and the rise of AI. For carriers, brokers, and reinsurers, technology is no longer just about efficiency; it is central to growth, customer experience, and competitiveness.

Through our flagship Contract CIO+® tech leadership service and our foundational CIO IQ® IT & AI Advisory offering, Innovation Vista delivers independent vendor-neutral IT & AI strategy to the Insurance industry. Our consultants bring both technical depth and direct experience guiding IT in the insurance sector. We know where general best practices apply — and where the unique nuances of insurance demand specialized strategies, such as regulatory compliance, customer data protection, and deploying AI to streamline underwriting, claims, and service delivery.

Unlike firms that assign consultants without industry context, our experts have led IT across health, property & casualty, life, and specialty insurance. With Contract CIO+®, the focus goes beyond stabilizing and optimizing IT: it’s about aligning technology with your underwriting, distribution, and service models to drive measurable business impact.

State of Innovation in Insurance & InsurTech

Our 2026 Summary of Innovation in the Insurance industry

The Era of “Predict & Prevent”

The insurance sector has shifted from merely repairing loss to predicting and preventing it. In 2026, data maturity is the single biggest predictor of combined ratio performance.

Touchless Claims & AI: We are seeing “Zero-Touch” claims processing move from pilot to production for simple property and auto lines. AI is now handling FNOL (First Notice of Loss) through settlement in minutes, not days, drastically reducing LAE (Loss Adjustment Expense).

Hyper-Personalization at Scale: Static renewal pricing is obsolete. Carriers are leveraging real-time telemetry (IoT, telematics) to offer dynamic, behavioral-based pricing that rewards risk mitigation instantly.

Legacy Modernization as Survival: The “Technical Debt” bill has come due. Carriers are aggressively retiring mainframes in favor of API-first, cloud-native cores that allow for “Embedded Insurance”—selling policies directly at the point of sale (e.g., inside a car buying app).

Climate & Cyber Risk Modeling: With traditional historical data failing to predict new climate extremes, insurers are adopting AI-driven geospatial modeling to price risk accurately in volatile markets.

Interested in Leveraging Some of these Tech Capabilities? An Assessment Could Be Step 1.

Is your tech platform and organization ready to scale and advance? Many of our clients choose to start with an IT & AI Assessment and Recommendations report.

This is a high-leverage first step to gain actionable insights from our Insurance tech consulting team, validate your current IT and AI readiness, and discover how our expert collaboration can drive value for your organization’s future.

BUsiness Leaders First - Then Tech Leaders

Our Unique Approach to Insurance Technology

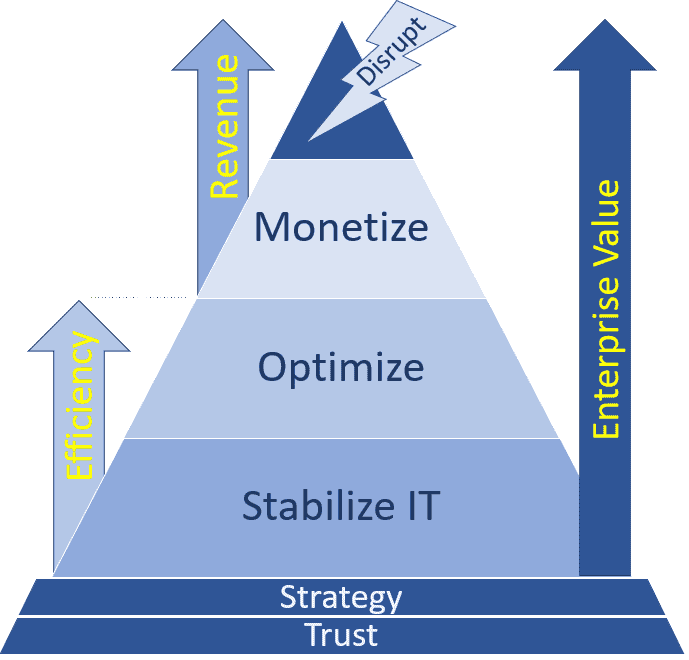

Like many consulting firms, we help insurance organizations with Stabilizing IT platforms, securing sensitive data, and Optimizing architecture, service performance, and budgets. These are foundational steps — but in insurance, they are only the starting point.

Through Contract CIO+® and CIO IQ®, we align IT strategy directly with your business model. For an insurer or broker, the “right” technology approach depends on your goals: lowering claims cycle times, enhancing customer engagement, or expanding distribution channels. Our consultants bring insurance-specific expertise to ensure technology supports not only operations but also compliance, risk management, and profitability.

Where we make the biggest difference is in Monetizing technology. We help clients Innovate Beyond Efficiency® by turning IT and data into tools for top-line growth. That can mean enabling predictive analytics to refine underwriting, digitizing claims for faster settlement and higher satisfaction, or creating customer-facing platforms that win market share from competitors. For insurance leaders, the result is more than cost control — it’s stronger loyalty, higher sales velocity, and sustainable growth.

IT & AI Strategy for Your Insurance Niche

Insurance Sectors Covered

- InsurTech products

- Cyberinsurance consulting

- Health insurance carriers

- Health insurance brokers

- Property & Casualty carriers

- Personal insurance brokers

- Re-insurance carriers

- Home insurance

- Auto insurance

- Commercial insurance brokers

- Commercial insurance carriers

- Liability insurance

- Errors & Omissions insurance

- Life insurance

- Disability insurance

- Annuities, Financial planning

- Travel insurance

- Custom software

Latest Insurance Tech !nsights from Our Team:

Analytics Maturity in Insurance · Analyzing our Mid-market Survey

Our experience in Insurance IT & AI consulting informs us that these companies have always been data-driven at their core, from underwriting and risk assessment to claims processing and fraud detection. The rise of digital-first insurers, usage-based products, and AI-driven risk models has only intensified the need to modernize data and analytics capabilities. At the same time, regulatory oversight creates pressure for rigorous optimization and transparency. The recent update to our Mid-market Analytics Maturity Survey provides a three-year view (2023–2025) of how Insurance firms are progressing across Data, Business Intelligence (BI), and Artificial Intelligence (AI). The results confirm that Insurance sits alongside Financial Services as one of the most advanced sectors in the mid-market, particularly in monetizing AI through underwriting