Tech Strategy for Family Offices

Sovereign Technology Governance

IT & AI Leadership for Your Legacy

For the ultra-high-net-worth enterprise, technology has evolved from a back-office utility into the central nervous system of wealth preservation. In an era defined by rapid AI advancement and sophisticated threats, a reactive posture is insufficient. The modern Family Office requires a Sovereign Technology Strategy – one that enforces governance and ensures absolute privacy within the office, while simultaneously deploying deep technical diligence and AI-driven transformation to unlock EBITDA growth across the investment portfolio.

Standard enterprise IT focuses on efficiency and uptime. The Private Office requires something far more critical: alignment with legacy. At Innovation Vista, we believe your technology architecture should be as resilient as your trust structures. We do not sell hardware, accept kickbacks, or resell software. We sit on your side of the table as the un-conflicted architect of your digital estate.

“You have a Fiduciary for your finances. We are the Fiduciary for your technology.”

State of Innovation in Family Office and MFO investments

Our 2026 Summary of Innovation in the Family Office sector

The modern Family Office has quietly undergone a radical shift: it is no longer just a passive wealth management vehicle, but has evolved into a sophisticated, operating enterprise. We treat this sector as a distinct category because its innovation drivers are unique: unlike public corporations driven by quarterly earnings, Family Offices prioritize sovereignty, privacy, and multi-generational continuity. In 2026, the primary trend is the professionalization of the “Digital Estate”, moving away from ad-hoc support models toward institutional-grade technology governance that rivals the capabilities of top-tier private equity firms.

The most significant shift we observe is the “Direct Investing” revolution. As more families bypass traditional funds to acquire operating companies directly, they are adopting a Private Equity-style “Operating Partner” model for technology. Innovation is no longer just about securing the family’s email; it now involves deploying technical due diligence teams to audit potential acquisitions and parachuting fractional CIOs into portfolio companies to drive digital transformation. Research indicates that family offices are increasingly using their “patient capital” advantage to fund longer-term R&D and AI initiatives in their holdings that traditional PE funds, with their 3-7 year exits, might avoid.

Simultaneously, the “Sovereign Tech Stack” has emerged as a critical governance requirement. We are seeing a mass migration away from monolithic, bank-provided platforms (which often create vendor lock-in and data commingling) toward “Best-of-Breed” ecosystems. Families are leveraging API-driven architectures to knit together specialized general ledger, tax, and investment reporting systems into a “Single Source of Truth.” This decoupling allows families to own their data independently of their custodians or advisors, ensuring that their historical records remain intact regardless of changes in their service provider network.

Finally, Privacy and AI have become inextricably linked. While families are eager to deploy AI to analyze investment performance and automate back-office operations, they are deeply wary of public LLMs absorbing their private data. The innovation frontier for 2026 is “Private AI” – deploying local, sovereign AI models that can query the family’s unstructured data (trust documents, historical correspondence, investment memos) without that data ever leaving the family’s secure private cloud.

In conclusion, the innovation agenda for Family Offices in 2026 is defined by control. It is a move away from convenience-based outsourcing toward intentional, sovereign architecture that protects the family’s privacy while aggressively leveraging technology to grow the value of their direct investments.

Interested in Leveraging Some of these Tech Capabilities? An Assessment Could Be Step 1.

Is your tech platform and organization ready to scale and advance? Many of our clients choose to start with an IT & AI Assessment and Recommendations report.

This is a high-leverage first step to gain actionable insights from our Family Office consulting team, validate your current IT and AI readiness, and discover how our expert collaboration can drive value for your organization’s future.

Moving Beyond "Protection" to Value Creation

Our Unique "Top-line ROI" Approach to Family Office Innovation

Most IT consultancies view the Family Office through a single lens: Risk. Their entire value proposition is defensive – protecting the family from hackers, keeping the email servers running, and minimizing helpdesk tickets. While stability and security are non-negotiable prerequisites, treating technology solely as an insurance policy leaves massive value on the table.

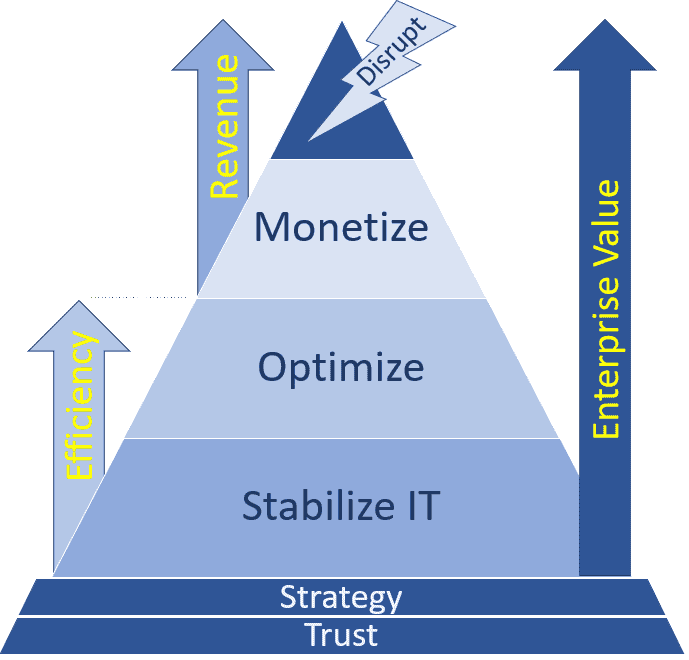

At Innovation Vista, we apply our proprietary Innovate Beyond Efficiency® framework to the Family Office sector, shifting the mandate from “Cost Center” to “Investment Lever.” We recognize that for modern families – especially those engaged in direct investing – technology is a primary driver of Enterprise Value.

Our approach delivers Top-Line ROI in three distinct ways:

1. The “Operating Partner” Impact (Direct Investing): For families that acquire operating companies directly, we act as your fractional Chief Technology Officer. We don’t just “fix the IT” of a portfolio company; we deploy AI and digital strategies to aggressively grow their EBITDA. By digitizing customer experiences, automating labor-heavy workflows, and unlocking data assets, we directly increase the valuation multiple of your holdings at exit.

2. Sovereign Architecture as Wealth Preservation: Standard “ecosystem” platforms often bleed value through hidden fees, data commingling, and forced obsolescence. We design Sovereign Tech Stacks – bespoke, vendor-neutral architectures that you own completely. This stops the “rent-seeking” of legacy vendors and ensures that your technology spend builds a permanent asset for the family, rather than a perpetual liability.

3. Information Advantage (The “Alpha”): In a world awash in data, the family with the best synthesis wins. We build private, secure AI models that sit on top of your historical investment data, correspondence, and market research. This turns your family’s decades of institutional knowledge into a queryable “Brain,” surfacing insights and connections that drive smarter investment decisions and generational alpha.

The Bottom Line: We believe your technology strategy should pay for itself – not by saving a few dollars on software licenses, but by adding millions to the value of your digital estate and investment portfolio.

IT & AI Strategy for Your Family Office Strategy

Family Office Sub-Sectors Covered

- Single Family Office (SFO) Modernization

- Direct Investment / Private Equity Technology

- Multi-Family Office (MFO) Integration

- Private Trust Company (PTC) Systems

- Sovereign Privacy & Reputation Defense

- Intergenerational Wealth Transfer & Data Continuity

- Real Estate Holdings & PropTech

- Family Foundation & Philanthropy Operations

- Concierge "Lifestyle" Management

- Virtual Boardroom & Governance

Latest Family Office Tech !nsights from Our Team:

Analytics Maturity in Private Equity · Analyzing our Mid-market Survey

Our experience providing Private Equity (PE) IT & AI strategy consulting confirms for us that these firms live and die by portfolio company performance. Increasingly, analytics maturity at the portfolio level determines not just operational efficiency but also valuation multiples at exit. PE owners are uniquely positioned to accelerate stabilization and optimization by pushing playbooks across their holdings. In truth, PE firms can be considered a significant uplift engine for Analytics in the mid-market as a whole. They would score higher on this survey, but they frequently sell or IPO high-maturity organizations, and acquire new companies at the lower end of the spectrum. Climbing the Analytics maturity curve is where a good portion of Private Equity’s gains in recent years